Dish Network 2013 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2013 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-39

12. Income Taxes and Accounting for Uncertainty in Income Taxes

Income Taxes

Our income tax policy is to record the estimated future tax effects of temporary differences between the tax bases of

assets and liabilities and amounts reported on our Consolidated Balance Sheets, as well as probable operating loss, tax

credit and other carryforwards. Deferred tax assets are offset by valuation allowances when we believe it is more

likely than not that net deferred tax assets will not be realized. We periodically evaluate our need for a valuation

allowance. Determining necessary valuation allowances requires us to make assessments about historical financial

information as well as the timing of future events, including the probability of expected future taxable income and

available tax planning opportunities.

We file consolidated tax returns in the U.S. The income taxes of domestic and foreign subsidiaries not included in the

U.S. tax group are presented in our consolidated financial statements based on a separate return basis for each tax

paying entity.

As of December 31, 2013, we had no net operating loss carryforwards (“NOLs”) for federal income tax purposes and

$24 million of NOL benefit for state income tax purposes. The state NOLs begin to expire in the year 2020. In

addition, there are $13 million of tax benefits related to credit carryforwards which are partially offset by a valuation

allowance. The credit carryforwards began to expire in 2013.

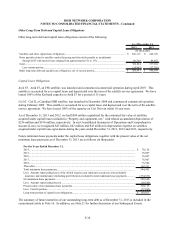

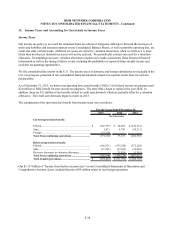

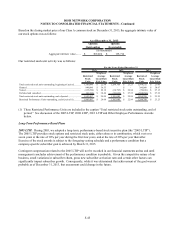

The components of the (provision for) benefit from income taxes were as follows:

2013 2012 2011

Current

(p

rovision

)

benefit:

Federal........................................................................ $ (162,737) $ 28,503 $ (252,741)

State............................................................................ 2,421 8,730 (30,211)

Foreign........................................................................ (13,316) - -

Total from continuing operations............................ (173,632) 37,233 (282,952)

Deferred

(p

rovision

)

benefit:

Federal........................................................................ (102,971) (355,220) (572,202)

State............................................................................ (23,223) (47,843) (32,430)

Decrease (increase) in valuation allowance................ - 33,839 (3,181)

Total from continuing operations............................ (126,194) (369,224) (607,813)

Total benefit (provision)........................................... (299,826)$ (331,991)$ (890,765)$

For the Years Ended December 31,

(In thousands)

Our $1.137 billion of “Income (loss) before income taxes” on our Consolidated Statements of Operations and

Comprehensive Income (Loss), included income of $9 million relates to our foreign operations.