Dish Network 2013 Annual Report Download - page 84

Download and view the complete annual report

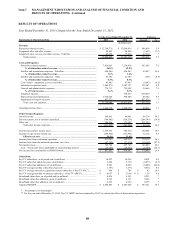

Please find page 84 of the 2013 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS - Continued

74

74

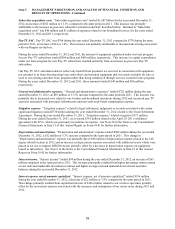

Pay-TV subscribers. DISH added approximately 89,000 net Pay-TV subscribers during the year ended December

31, 2012, compared to a loss of approximately 166,000 net Pay-TV subscribers during the same period in 2011. The

increase versus the same period in 2011 primarily resulted from a decrease in our average monthly Pay-TV churn

rate and higher gross new Pay-TV subscriber activations due primarily to increased advertising associated with our

Hopper set-top box. During the year ended December 31, 2012, DISH activated approximately 2.739 million gross

new Pay-TV subscribers compared to approximately 2.576 million gross new Pay-TV subscribers during the same

period in 2011, an increase of 6.3%.

Our gross new Pay-TV subscriber activations continued to be negatively impacted by increased competitive

pressures, including aggressive marketing and discounted promotional offers. Telecommunications companies

continued to grow their pay-TV customer bases. In addition, our gross new Pay-TV subscriber activations

continued to be adversely affected by sustained economic weakness and uncertainty.

Our average monthly Pay-TV churn rate for the year ended December 31, 2012 was 1.57% compared to 1.63% for

the same period in 2011. Our Pay-TV churn rate was positively impacted in part because we did not have a

programming package price increase in the first quarter 2012, but did during the same period in 2011. While Pay-

TV churn improved compared to the same period in 2011, churn continued to be adversely affected by the increased

competitive pressures discussed above. Our Pay-TV churn rate was also impacted by, among other things, the credit

quality of previously acquired subscribers, our ability to consistently provide outstanding customer service, the

aggressiveness of competitor subscriber acquisition efforts, and our ability to control piracy and other forms of

fraud.

Broadband subscribers. DISH added approximately 78,000 net Broadband subscribers during the year ended

December 31, 2012, compared to a loss of approximately 5,000 net Broadband subscribers during the same period in

2011. This increase versus the same period in 2011 primarily resulted from higher gross new Broadband subscriber

activations driven by increased advertising associated with the launch of dishNET branded broadband services on

September 27, 2012. During the year ended December 31, 2012, DISH activated approximately 121,000 gross new

Broadband subscribers compared to approximately 30,000 gross new Broadband subscribers during the same period

in 2011.

The pace of net broadband subscriber activations increased in the fourth quarter primarily driven by increased

advertising associated with the launch of dishNET branded broadband services. Of the 2012 net broadband

subscriber activations, 34,000 occurred during the nine months ended September 30, 2012 and 44,000 occurred

during the three months ended December 31, 2012.

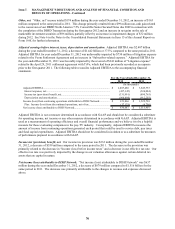

Subscriber-related revenue. “Subscriber-related revenue” totaled $13.065 billion for the year ended December 31,

2012, an increase of $93 million or 0.7% compared to the same period in 2011. The change in “Subscriber-related

revenue” from the previous year was primarily related to the increase in Pay-TV ARPU discussed below. Included

in “Subscriber-related revenue” was $95 million and $81 million of revenue related to our broadband services for the

years ended December 31, 2012 and 2011, respectively.

Pay-TV ARPU. “Pay-TV average monthly revenue per subscriber” was $76.98 during the year ended December 31,

2012 versus $76.43 during the same period in 2011. The $0.55 or 0.7% increase in Pay-TV ARPU was primarily

attributable to higher hardware related revenue.

Subscriber-related expenses. “Subscriber-related expenses” totaled $7.254 billion during the year ended December

31, 2012, an increase of $409 million or 6.0% compared to the same period in 2011. The increase in “Subscriber-

related expenses” was primarily attributable to higher programming costs. The increase in programming costs was

driven by rate increases in certain of our programming contracts, including the renewal of certain contracts at higher

rates. Included in “Subscriber-related expenses” was $51 million and $33 million of expense related to our broadband

services for the years ended December 31, 2012 and 2011, respectively. “Subscriber-related expenses” represented

55.5% and 52.8% of “Subscriber-related revenue” during the years ended December 31, 2012 and 2011, respectively.

The change in this expense to revenue ratio primarily resulted from higher programming costs, discussed above.