Dish Network 2013 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2013 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS - Continued

63

63

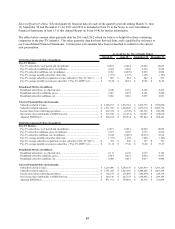

Operational Liquidity

Like many companies, we make general investments in property such as satellites, set-top boxes, information

technology and facilities that support our overall business. However, since we are primarily a subscriber-based

company, we also make subscriber-specific investments to acquire new subscribers and retain existing subscribers.

While the general investments may be deferred without impacting the business in the short-term, the subscriber-

specific investments are less discretionary. Our overall objective is to generate sufficient cash flow over the life of

each subscriber to provide an adequate return against the upfront investment. Once the upfront investment has been

made for each subscriber, the subsequent cash flow is generally positive.

There are a number of factors that impact our future cash flow compared to the cash flow we generate at a given

point in time. The first factor is how successful we are at retaining our current subscribers. As we lose subscribers

from our existing base, the positive cash flow from that base is correspondingly reduced. The second factor is how

successful we are at maintaining our subscriber-related margins. To the extent our “Subscriber-related expenses”

grow faster than our “Subscriber-related revenue,” the amount of cash flow that is generated per existing subscriber

is reduced. The third factor is the rate at which we acquire new subscribers. The faster we acquire new subscribers,

the more our positive ongoing cash flow from existing subscribers is offset by the negative upfront cash flow

associated with new subscribers. Finally, our future cash flow is impacted by the rate at which we make general

investments and any cash flow from financing activities.

Our subscriber-specific investments to acquire new subscribers have a significant impact on our cash flow. While

fewer subscribers might translate into lower ongoing cash flow in the long-term, cash flow is actually aided, in the

short-term, by the reduction in subscriber-specific investment spending. As a result, a slow down in our business

due to external or internal factors does not introduce the same level of short-term liquidity risk as it might in other

industries.

Availability of Credit and Effect on Liquidity

The ability to raise capital has generally existed for us despite the weak economic conditions. Modest fluctuations

in the cost of capital will not likely impact our current operational plans.

Future Liquidity

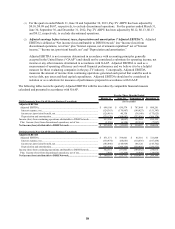

6 5/8% Senior Notes due 2014

Our 6 5/8% Senior Notes with an aggregate principal balance of $1.0 billion mature on October 1, 2014. We expect

to fund this obligation from cash generated from operations and existing cash and marketable investment securities

balances.

Wireless Spectrum

On March 2, 2012, the FCC approved the transfer of 40 MHz of AWS-4 wireless spectrum licenses held by DBSD

North America and TerreStar to us. On March 9, 2012, we completed the DBSD Transaction and the TerreStar

Transaction, pursuant to which we acquired, among other things, certain satellite assets and wireless spectrum

licenses held by DBSD North America and TerreStar. The total consideration to acquire the DBSD North America

and TerreStar assets was approximately $2.860 billion.

Our consolidated FCC applications for approval of the license transfers from DBSD North America and TerreStar

were accompanied by requests for waiver of the FCC’s MSS “integrated service” and spare satellite requirements

and various technical provisions. On March 21, 2012, the FCC released a Notice of Proposed Rule Making

proposing the elimination of the integrated service, spare satellite and various technical requirements associated with

the AWS-4 licenses. On December 11, 2012, the FCC approved rules that eliminated these requirements and gave

notice of its proposed modification of our AWS-4 authorizations to, among other things, allow us to offer single-

mode terrestrial terminals to customers who do not desire satellite functionality. On February 15, 2013, the FCC

issued an order, which became effective on March 7, 2013, modifying our AWS-4 licenses to expand our terrestrial

operating authority. That order imposed certain limitations on the use of a portion of this spectrum, including