Dish Network 2013 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2013 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-29

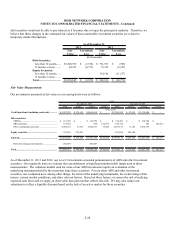

Blockbuster - Domestic

Since the Blockbuster Acquisition, we continually evaluated the impact of certain factors, including, among other

things, competitive pressures, the ability of significantly fewer company-owned domestic retail stores to continue to

support corporate administrative costs, and other issues impacting the store-level financial performance of our

company-owned domestic retail stores. These factors, among others, previously led us to close a significant number

of company-owned domestic retail stores during 2012 and 2013. On November 6, 2013, we announced that

Blockbuster would close all of its remaining company-owned domestic retail stores and discontinue the Blockbuster

by-mail DVD service. As of December 31, 2013, Blockbuster had ceased all material operations.

Blockbuster – Mexico

During the third quarter 2013, we determined that our Blockbuster operations in Mexico (“Blockbuster Mexico”)

were “held for sale.” As a result, we recorded pre-tax impairment charges of $19 million related to exiting the

business, which was recorded in “Income (loss) from discontinued operations, net of tax” on our Consolidated

Statements of Operations and Comprehensive Income (Loss) for the year ended December 31, 2013. On January

14, 2014, we completed the sale of Blockbuster Mexico.

Blockbuster UK Administration

On January 16, 2013, Blockbuster Entertainment Limited and Blockbuster GB Limited, our Blockbuster operating

subsidiaries in the United Kingdom, entered into administration proceedings in the United Kingdom (the

“Administration”). As a result of the Administration, we wrote down the assets of all our Blockbuster UK

subsidiaries to their estimated net realizable value on our Consolidated Balance Sheets as of December 31, 2012. In

total, we recorded charges of approximately $46 million on a pre-tax basis related to the Administration, which was

recorded in “Income (loss) from discontinued operations, net of tax” on our Consolidated Statements of Operations

and Comprehensive Income (Loss) for the year ended December 31, 2012.

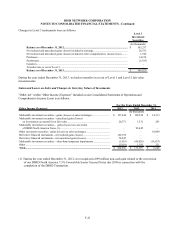

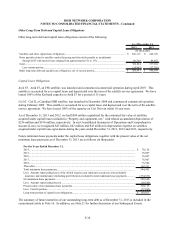

11. Long-Term Debt

7% Senior Notes due 2013

During September 2013, we repurchased $49 million of our 7% Senior Notes due 2013 in open market transactions.

On October 1, 2013, we redeemed the remaining $451 million principal balance of our 7% Senior Notes due 2013.

6 5/8% Senior Notes due 2014

The 6 5/8% Senior Notes mature October 1, 2014. Interest accrues at an annual rate of 6 5/8% and is payable semi-

annually in cash, in arrears on April 1 and October 1 of each year.

The 6 5/8% Senior Notes are redeemable, in whole or in part, at any time at a redemption price equal to 100% of their

principal amount plus a “make-whole” premium, as defined in the related indenture, together with accrued and unpaid

interest.

The 6 5/8% Senior Notes are:

x general unsecured senior obligations of DISH DBS Corporation (“DISH DBS”);

x ranked equally in right of payment with all of DISH DBS’ and the guarantors’ existing and future

unsecured senior debt; and

x ranked effectively junior to our and the guarantors’ current and future secured senior indebtedness up to

the value of the collateral securing such indebtedness.