Dish Network 2013 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2013 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS - Continued

60

60

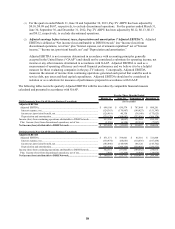

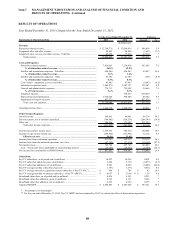

DISH added approximately 253,000 net Broadband subscribers during the year ended December 31, 2013 compared

to the addition of approximately 78,000 net Broadband subscribers during the same period in 2012. This increase

versus the same period in 2012 primarily resulted from higher gross new Broadband subscriber activations driven by

increased advertising associated with the launch of dishNET branded broadband services on September 27, 2012.

During the year ended December 31, 2013, DISH activated approximately 343,000 gross new Broadband

subscribers compared to the activation of approximately 121,000 gross new Broadband subscribers during the same

period in 2012. This increase was driven by increased advertising associated with the launch of dishNET branded

broadband services on September 27, 2012. Broadband services revenue was $221 million and $95 million for the

years ended December 31, 2013 and 2012, respectively, representing 1.6% and 0.7% of our total “Subscriber-related

revenue,” respectively.

“Net income (loss) attributable to DISH Network” for the years ended December 31, 2013 and 2012 was $807

million and $637 million, respectively. These amounts included net losses from discontinued operations of $47

million and $37 million for 2013 and 2012, respectively. During the year ended December 31, 2013, “Net income

(loss) attributable to DISH Network” increased primarily due to the programming package price increase in

February 2013 and net realized and/or unrealized gains on our marketable investment securities and derivative

financial instruments during 2013 compared to the same period in 2012 and the $102 million reversal of an

uncertain tax position that was resolved during the third quarter 2013. These increases were partially offset by the

impairment of the T2 and D1 satellites of $438 million during the second quarter 2013 and an increase in subscriber-

related expenses, subscriber acquisition costs and interest expense in 2013. In addition, the year ended December 31,

2012 was negatively impacted by $730 million of litigation expense related to the Voom Settlement Agreement. See

Note 16 in the Notes to our Consolidated Financial Statements in Item 15 of this Annual Report on Form 10-K for

further information.

Our ability to compete successfully will depend, among other things, on our ability to continue to obtain desirable

programming and deliver it to our subscribers at competitive prices. Programming costs represent a large percentage of

our “Subscriber-related expenses” and the largest component of our total expense. We expect these costs to continue to

increase, especially for local broadcast channels and sports programming. Going forward, our margins may face

pressure if we are unable to renew our long-term programming contracts on favorable pricing and other economic

terms. In addition, increases in programming costs could cause us to increase the rates that we charge our subscribers,

which could in turn cause our existing Pay-TV subscribers to disconnect our service or cause potential new Pay-TV

subscribers to choose not to subscribe to our service. Additionally, even if our subscribers do not disconnect our

services, they may purchase a certain portion of the services that they would have historically purchased from us

through these online platforms, such as pay per view movies, resulting in less revenue to us. Furthermore, our gross

new Pay-TV subscriber activations and Pay-TV churn rate may be negatively impacted if we are unable to renew our

long-term programming contracts before they expire or if we lose access to programming as a result of disputes with

programming suppliers.

As the pay-TV industry has matured, we and our competitors increasingly must seek to attract a greater proportion

of new subscribers from each other’s existing subscriber bases rather than from first-time purchasers of pay-TV

services. Some of our competitors have been especially aggressive by offering discounted programming and

services for both new and existing subscribers. In addition, programming offered over the Internet has become more

prevalent as the speed and quality of broadband networks have improved. Significant changes in consumer behavior

with regard to the means by which they obtain video entertainment and information in response to digital media

competition could materially adversely affect our business, results of operations and financial condition or otherwise

disrupt our business.

While economic factors have impacted the entire pay-TV industry, our relative performance has also been driven by

issues specific to DISH. In the past, our Pay-TV subscriber growth has been adversely affected by signal theft and

other forms of fraud and by operational inefficiencies at DISH. To combat signal theft and improve the security of

our broadcast system, we completed the replacement of our Security Access Devices to re-secure our system during

2009. We expect that additional future replacements of these devices will be necessary to keep our system secure.

To combat other forms of fraud, we continue to expect that our third party distributors and retailers will adhere to

our business rules.