Costco 1999 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 1999 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2

December 10, 1999

Dear Costco Shareholders,

Fiscal 1999 was a banner year for Costco in terms of revenues and earnings. We were able to achieve sales of $27

billion, which was a 13% increase over the prior year. More importantly, warehouses that were open for more than 12

months realized a comparable sales growth rate of 10%. We believe this is an accurate indication of the health of our

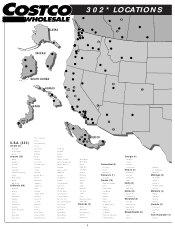

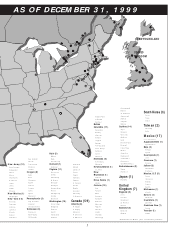

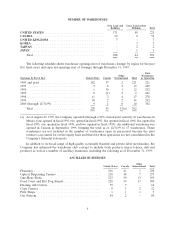

business, considering that our average sales per warehouse exceeded $94 million per unit for the 292 locations open

worldwide in 1999, including $101 million per unit for the 221 warehouses in the U.S.

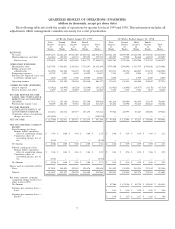

Our reported net income for fiscal 1999 was $397 million, or $1.73 per diluted share, compared to the prior year’s

reported net earnings of $460 million, or $2.03 per share. As reported to you earlier, and as described in the financial

discussion detailed further in this annual report, fiscal 1999 net income was negatively impacted by a $50 million ($30

million after-tax) fourth quarter provision for impaired assets and warehouse closing costs, as well as a $118 million

after-tax charge recorded in the first quarter related to a change in accounting for membership fees. Excluding these

two items, our fiscal 1999 net income would have been $545 million, or $2.36 per share. Similarly, if the new

accounting treatment for membership fees had been in effect in fiscal 1998, net earnings for fiscal 1998 would have

been $444 million, or $1.96 per share; and the year-over-year earnings and earnings per share increases would have

been 23% and 20%, respectively.

Equally important in the performance of our Company this past year were the operational improvements we

achieved throughout our business. We continue to show robust sales increases in the new markets of Atlanta and

Detroit, and our newly opened Chicago warehouses are exceeding our sales expectations. The results in these three

markets have encouraged us to open additional units in each of these communities. Our new units in Tennessee (one

in Nashville and two in Memphis) are brand-new and also performing very well. Additionally, we are proceeding with

plans to enter new markets in Texas, Ohio, Pennsylvania and Missouri during calendar year 2000. Depending upon

permitting and construction, these new warehouses will open in the summer or fall of next year. We expect that we will

open approximately 25 new units this fiscal year, with the bulk of these openings being in existing markets such as

California, Florida, Arizona, Washington, New York and New Jersey. Four to six additional warehouses will be

relocated this fiscal year to improved sites and facilities. This compares to fourteen new warehouses and seven

relocations in all of fiscal 1999. The majority of the fourth quarter charge for impaired assets and closing costs is a

result of these recently completed and planned relocations for 1999 and 2000. All told, we plan to spend nearly $1

billion in fiscal 2000 on capital expenditures. While the majority of these expenditures will be directed towards new

and relocation warehouse construction, approximately $200 million is planned for remodelling and ancillary business

expansion activities—activities that, we believe, allow Costco to maintain its leadership position in the marketplace.

Our gross margins continue to be strong, increasing from 10.28% of sales in fiscal 1998 to 10.40% in fiscal 1999.

Overall, our gross margins have now improved for six consecutive years, despite the fact that we have consistently

lowered the prices of our merchandise during that same period of time. This is the result of improved purchasing,

better utilization of depots and logistics, increased sales penetration of certain higher margin businesses, and record

performance in shrink control by our merchants and operators. In terms of our depot ‘‘cross docking’’ operations,

which allow us to reduce even further the freight and handling costs of the merchandise we sell, we plan to spend

nearly $200 million in fiscal 2000 to add 1.5 million additional square feet to a business operation that we believe

furthers our advantage over our competitors in bringing goods to market at the lowest possible prices.

Our operating expenses declined as a percent of sales from 8.69% in fiscal 1998 to 8.67% in the fiscal year just

ended. This represents the fourth consecutive year of overall expense improvement, which is particularly gratifying

after considering the added burden of entering four new markets; opening new regional offices in the Midwest and

Southeast; starting a complete new operating and merchandising team in Japan; incurring increased marketing and

development expenses for the Executive Membership Program and launch of the American Express Co-Branded Card

Program; and starting up our e-Commerce website—www.costco.com—which just completed its first year of operations

this November. We will touch on each of these new programs further in this letter. Notwithstanding these added costs

for growth, we clearly recognize our need to be continually improving our process of cost containment at every level of

our business. We still have alot of work to do in this area.

Before discussing our new member services and initiatives, we should highlight a few of the merchandising

successes that were, in large part, responsible for the strength in sales growth both in fiscal 1999 and into the new 2000

fiscal year.

As you all know, we are first and foremost a merchandising Company. We are confident that we understand how

to buy and sell goods as well as anyone in the world. Our merchants know how to find the right merchandise, at the

right time, and at the right price; and our operators understand how to run the businesses that profitably deliver these

values to our members. In addition to our primary merchandising focus of bringing branded goods to market at the

lowest possible price, our buyers have over the past five years developed more than 400 items in a variety of categories

under our own ‘‘Kirkland Signature’’ private label. Our private label strategy is simple and straightforward: The item

quality must be as good as, or better than, the leading national brand; and the value must be at least 20% better. Today

we estimate that approximately 12% of our nearly $30 billion in annual sales are sold under the ‘‘Kirkland Signature’’

name—a name that has become known for both high quality and great value. Private label successes in fiscal 1999

include co-branded Whirlpool appliances, co-branded chicken products with both Tyson and Foster Farms, and