Costco 1999 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 1999 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATIONS

Certain statements contained in this document constitute forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995. For these purposes, forward-looking

statements are statements that address activities, events, conditions or developments that the company

expects, or anticipates may occur in the future. Such forward-looking statements involve risks and

uncertainties that may cause actual events, results or performance to differ materially from those indicated

by such statements. These risks and uncertainties include, but are not limited to, domestic and interna-

tional economic conditions including exchange rates, the effects of competition and regulation, conditions

affecting the acquisition, development, ownership or use of real estate, actions of vendors, Year 2000

issues, and other risks identified from time to time in the Company’s public statements and reports filed

with the SEC.

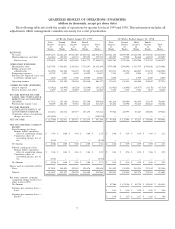

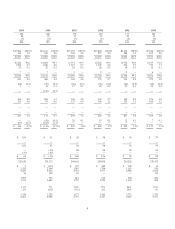

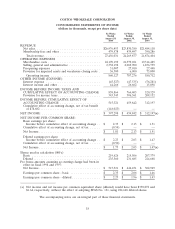

Comparison of Fiscal 1999 (52 weeks) and Fiscal 1998 (52 weeks):

(dollars in thousands, except earnings per share)

Net income for fiscal 1999 was impacted by both a $50,000 fourth quarter pre-tax provision for

impaired assets and warehouse closing costs, as well as the one-time $118,023 non-cash, after-tax charge

recorded in the first quarter of fiscal 1999, reflecting the cumulative effect of the Company’s change in

accounting for membership fees from a cash to a deferred method. The impact of these two charges

resulted in net income for fiscal 1999 of $397,298, or $1.73 per diluted share compared to last year’s

reported net income of $459,842, or $2.03 per diluted share. Excluding the impact of these two charges, net

income in fiscal 1999 would have been $545,321, or $2.36 per diluted share. Assuming the newly adopted

accounting treatment for deferring membership fees had been in effect in fiscal 1998, net income for fiscal

1998 would have been $444,451, or $1.96 per diluted share; and the year-over-year earnings per share

increase, adjusted for these items, would have been 20%.

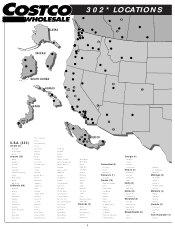

Net sales increased 13% to $26,976,453 in fiscal 1999 from $23,830,380 in fiscal 1998. This increase

was due to: (i) higher sales at existing locations opened prior to fiscal 1998; (ii) increased sales at 16

warehouses that were opened in fiscal 1998 and in operation for the entire 1999 fiscal year; and (iii) first

year sales at the 14 new warehouses opened (21 opened, 7 closed) during fiscal 1999. Changes in prices did

not materially impact sales levels.

Comparable sales, that is sales in warehouses open for at least a year, increased at a 10% annual rate

in fiscal 1999 compared to an 8% annual rate during fiscal 1998.

Membership fees and other revenue increased 9% to $479,578, or 1.78% of net sales, in fiscal 1999

from $439,497, or 1.84% of net sales, in fiscal 1998. This increase is primarily due to membership sign-ups

at the 14 new warehouses opened in fiscal 1999 and a five dollar increase in the annual membership fee for

both Business and Gold Star members effective April 1, 1998 in the United States and May 1, 1998 in

Canada.

Effective with the first quarter of fiscal 1999, the Company changed its method of accounting for

membership fee income from a ‘‘cash basis’’ to a ‘‘deferred basis’’, whereby membership fee income is

recognized ratably over the one-year life of the membership. If the deferred method had been used in

fiscal 1998, membership fees and other would have been reduced by $25,651 to $413,846, or 1.74% of net

sales, and the year-over-year increase would have been 16%.

Gross margin (defined as net sales minus merchandise costs) increased 15% to $2,806,254, or 10.40%

of net sales, in fiscal 1999 from $2,450,689, or 10.28% of net sales, in fiscal 1998. Gross margin as a

percentage of net sales increased due to increased sales penetration of certain higher gross margin

ancillary businesses, favorable inventory shrink results, and improved performance of the Company’s

international operations. The gross margin figures reflect accounting for most U.S. merchandise invento-

ries on the last-in, first-out (LIFO) method. In fiscal 1999 there was a $4 million LIFO credit, due

10