Costco 1999 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 1999 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Derivatives

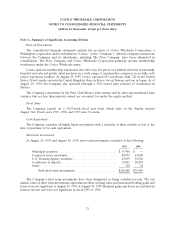

The Company has limited involvement with derivative financial instruments and uses them only to

manage well-defined interest rate and foreign exchange risks. Forward foreign exchange contracts are used

to hedge the impact of fluctuations of foreign exchange on inventory purchases. The amount of interest

rate and foreign exchange contracts outstanding at August 29, 1999 were not material to the Company’s

results of operations or its financial position.

Year 2000

The Company uses a number of computer software programs and embedded operating systems that

were not originally designed to process dates beyond the year 1999. Like most automated companies,

Costco has been addressing the Year 2000 challenge to make sure all of its systems are Year 2000

compliant and fully operational prior to the year 2000 and on into the 21st Century. As far back as the

early 1990’s, the Company began taking initial measures to ensure that its systems would function in the

year 2000 and beyond, and in 1997 began a formal review of each of its applications to determine the Year

2000 compliance of its date-sensitive systems and equipment. This included assessments of both informa-

tion technology, such as point-of-sale computer systems and financial software applications, as well as non-

information technology equipment, including critical facilities systems, such as security systems, energy

management, warehouse refrigeration, etc.

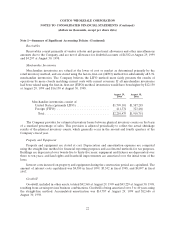

As of August 29, 1999 the Company has substantially completed the necessary remediation and testing

of virtually all key systems, and believes that the Year 2000 issues will not present any significant

operational problems. Total costs related to the Year 2000 effort are estimated to be less than $7,500, of

which the Company has incurred approximately 90% through August 29, 1999. While it is possible that the

remaining systems currently being implemented, reviewed and/or tested may produce an unexpected cost

increase, the Company does not believe it would add materially to the current estimated cost.

Additionally, Costco has contacted and will continue to contact significant vendors, suppliers, financial

institutions and other third party providers upon which its business depends. These efforts are designed to

minimize the impact to the Company should these third parties fail to remediate their Year 2000 issues.

Although the Company has not received responses from all of its suppliers, the responses received have

indicated that they are or will be Year 2000 compliant and that they are anticipating no significant

problems related to Year 2000 preparedness. However, the Company can give no assurances that such

third parties will in fact be successful in resolving all of their Year 2000 issues, and the failure of such third

parties to comply on a timely basis could have an adverse effect on the Company. The Company

anticipates minimal business disruption as a result of Year 2000 issues; however, possible consequences

include, but are not limited to, loss of local or regional electric power, delays in delivery or receipt of

merchandise, inability to process transactions, loss of communications, and similar interruptions of normal

business activities. Where needed, the Company has established contingency plans based on assessment of

its supplier base and evaluation of outside risks.

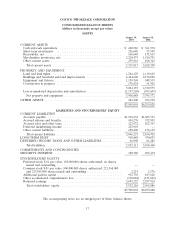

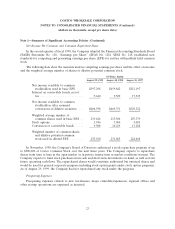

Financial Position and Cash Flows

Working capital totaled approximately $450,000 at August 29, 1999, compared to working capital of

$431,000 at August 30, 1998. The increase in net working capital was primarily due to an increase in cash

and cash equivalents and short-term investments of approximately $260,000, and an increase in other

current assets of approximately $131,000. These increases were largely offset by increases in accrued and

other current liabilities of approximately $136,000 and an increase of $226,000 due to the adoption of the

deferred membership accounting method.

Net cash provided by operating activities totaled $940,863 in fiscal 1999 compared to $737,610 in fiscal

1998. The increase in net cash from operating activities is primarily a result of increased net income,

14