Costco 1999 Annual Report Download - page 13

Download and view the complete annual report

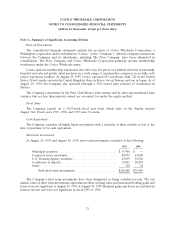

Please find page 13 of the 1999 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.primarily to deflation in most of the Company’s LIFO pools, particularly in the electronics LIFO pool,

coupled with a reduction of tobacco inventory levels resulting primarily from announced manufacturers’

price increases just prior to fiscal year end. In fiscal 1998 there was no LIFO charge due to the use of the

LIFO method compared to the first-in, first-out (FIFO) method.

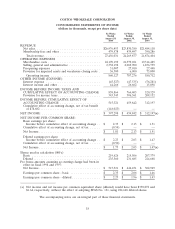

Selling, general and administrative expenses as a percent of net sales decreased to 8.67% during fiscal

1999 from 8.69% during fiscal 1998, primarily reflecting the increase in comparable warehouse sales noted

above, and a year-over-year improvement in the Company’s core warehouse operations and Central and

Regional administrative offices, which were partially offset by higher expenses associated with interna-

tional expansion and certain ancillary businesses.

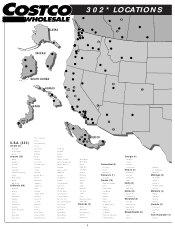

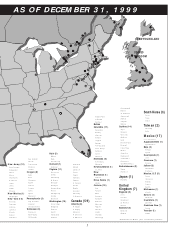

Preopening expenses totaled $31,007, or 0.11% of net sales, during fiscal 1999 and $27,010, or 0.11%

of net sales, during fiscal 1998. During fiscal 1999, the Company opened 21 new warehouses compared to

16 new warehouses during fiscal 1998. Pre-opening expenses also include costs related to remodels,

expanded fresh foods and ancillary operations at existing warehouses.

The provision for impaired assets and warehouse closing costs was $56,500 in fiscal 1999 compared to

$6,000 in fiscal 1998. The fiscal 1999 provision includes a charge of $31,080 for the impairment of long-

lived assets as required by the Financial Accounting Standards Board Statement No. 121 (SFAS 121) and

$30,865 for warehouse and other facility closing costs, which were offset by $5,445 of gains on the sale of

real property. The provision for warehouse closing costs includes $24,773 for lease obligations and $6,092

for other expenses directly related to the closedown of warehouses and other facilities. As of August 29,

1999, the Company had expended $828 for lease obligations and $3,339 for other closedown expenses. The

increase in warehouse closing costs is primarily attributable to the Company’s decision in the fourth

quarter of fiscal 1999 to relocate several warehouses (which were not otherwise impaired) to larger and

better-located facilities.

Interest expense totaled $45,527 in fiscal 1999, and $47,535 in fiscal 1998. The decrease in interest

expense is primarily due to an increase in capitalized interest related to construction projects.

Interest income and other totaled $44,266 in fiscal 1999 compared to $26,662 in fiscal 1998. The

increase was primarily due to interest earned on higher balances of cash and cash equivalents and short-

term investments during fiscal 1999 as compared to fiscal 1998.

The effective income tax rate on earnings was 40% in both fiscal 1999 and fiscal 1998.

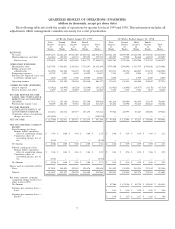

Comparison of Fiscal 1998 (52 weeks) and Fiscal 1997 (52 weeks):

(dollars in thousands, except earnings per share)

Net operating results for fiscal 1998 reflect net income of $459,842, or $2.03 per share (diluted), as

compared to a fiscal 1997 net income of $312,197, or $1.47 per share (diluted). The net income for fiscal

1997 includes a non-cash, pre-tax charge of $65,000 ($38,675 after-tax, or $.17 per share) reflecting a

provision for the impairment of long-lived assets as required by SFAS 121. In addition, fiscal 1997 net

income was impacted by one-time, pre-tax charges of approximately $13,000 ($7,800 after-tax, or $.03 per

share) related to the call and redemption of $764,000 of convertible subordinated debentures.

Net sales increased 11% to $23,830,380 in fiscal 1998 from $21,484,118 in fiscal 1997. This increase

was due to: (i) higher sales at existing locations opened prior to fiscal 1997; (ii) increased sales at 17

warehouses that were opened in fiscal 1997 and in operation for the entire 1998 fiscal year; and (iii) first

year sales at the 16 new warehouses opened during fiscal 1998, which increase was partially offset by one

warehouse closed during fiscal 1998 that was in operation during fiscal 1997. Changes in prices did not

materially impact sales levels.

11