Costco 1999 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 1999 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

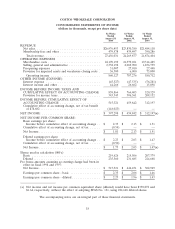

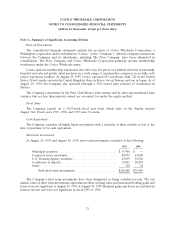

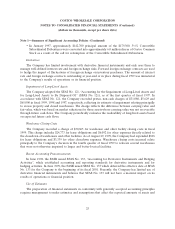

COSTCO WHOLESALE CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS

(dollars in thousands)

52 Weeks 52 Weeks 52 Weeks

Ended Ended Ended

August 29, August 30, August 31,

1999 1998 1997

CASH FLOWS FROM OPERATING ACTIVITIES

Net income ...................................... $397,298 $ 459,842 $ 312,197

Adjustments to reconcile net income to net cash provided by

operating activities:

Depreciation and amortization ....................... 224,811 196,315 181,759

Accretion of discount on zero coupon notes ............. 16,064 15,875 567

Net gain on sale of property and equipment and other ..... (10,443) (3,459) (602)

Provision for impaired assets ........................ 31,080 5,629 65,000

Change in deferred income taxes ..................... (22,666) 20,420 (4,322)

Cumulative effect of accounting change, net of tax ........ 118,023 — —

Change in receivables, other current assets, accrued and

other current liabilities ........................... 195,528 60,315 66,303

Increase in merchandise inventories ................... (286,902) (255,140) (189,323)

Increase in accounts payable ........................ 284,238 243,164 162,628

Other ......................................... (6,168) (5,351) (3,958)

Total adjustments ............................... 543,565 277,768 278,052

Net cash provided by operating activities ............... 940,863 737,610 590,249

CASH FLOWS FROM INVESTING ACTIVITIES

Additions to property and equipment .................... (787,935) (571,904) (553,374)

Proceeds from the sale of property and equipment .......... 58,670 80,698 40,946

Investment in unconsolidated joint ventures ............... (15,000) (11,595) (4,750)

Increase in short-term investments ...................... (181,103) (75,549) —

Increase in other assets and other, net ................... (28,555) (31,096) (25,995)

Net cash used in investing activities ..................... (953,923) (609,446) (543,173)

CASH FLOWS FROM FINANCING ACTIVITIES

Repayments under short-term credit facilities, net ........... — (24,404) (33,990)

Net proceeds from issuance of long-term debt ............. 10,336 9,928 461,035

Repayments of long-term debt ......................... (11,675) (9,307) (471,791)

Changes in bank overdraft ........................... 10,203 (3,321) (7,244)

Proceeds from minority interests ....................... 15,058 19,580 15,119

Exercise of stock options ............................. 61,923 74,115 62,015

Net cash provided by financing activities ................ 85,845 66,591 25,144

EFFECT OF EXCHANGE RATE CHANGES ON CASH ..... 5,827 (8,289) 1,333

Net increase in cash and cash equivalents ................ 78,612 186,466 73,553

CASH AND CASH EQUIVALENTS BEGINNING OF YEAR . . 361,974 175,508 101,955

CASH AND CASH EQUIVALENTS END OF YEAR ........ $440,586 $ 361,974 $ 175,508

SUPPLEMENTAL DISCLOSURE OF CASH FLOW

INFORMATION:

Cash paid during the year for:

Interest (excludes amounts capitalized and paid for redemption

premiums) ..................................... $ 27,107 $ 29,191 $ 76,233

Income taxes ..................................... $294,860 $ 257,352 $ 195,241

The accompanying notes are an integral part of these financial statements

20