Costco 1999 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 1999 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.adjusted for the non-cash cumulative effect of accounting change, and a positive change in net receivables,

other current assets and accrued and other current liabilities.

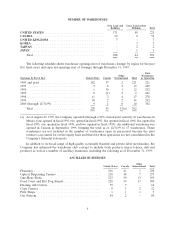

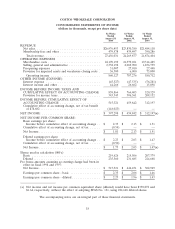

Net cash used in investing activities totaled $953,923 in fiscal 1999 compared to $609,446 in fiscal

1998. The investing activities primarily relate to additions to property and equipment for new and

remodeled warehouses of $787,935 and $571,904 in fiscal 1999 and 1998, respectively. The Company

opened 21 warehouses during fiscal 1999 compared to 16 warehouses opened during fiscal 1998. Net cash

used in investing activities also reflects an increase in short-term investments of $181,103 since the

beginning of fiscal year 1999.

Net cash provided by financing activities totaled $85,845 in fiscal 1999 compared to $66,591 in fiscal

1998. This increase is primarily due to a decline in net repayments under short-term credit facilities.

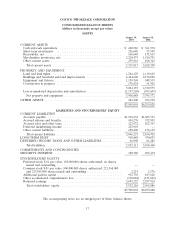

The Company’s balance sheet as of August 29, 1999 reflects a $1,245,181 or 20% increase in total

assets since August 30, 1998. The increase is primarily due to a net increase in property and equipment and

merchandise inventory related to the Company’s expansion program and an increase in cash and cash

equivalents and short-term investments.

Stock Repurchase Program

On November 5, 1998, the Company announced that its Board of Directors had authorized a stock

repurchase program of up to $500 million of Costco Common Stock over the next three years. The

Company expects to repurchase shares from time to time in the open market or in private transactions as

market conditions warrant. The Company expects to fund stock purchases from cash and short-term

investments on hand, as well as from future operating cash flows. The repurchased shares would constitute

authorized, but unissued shares and would be used for general corporate purposes including stock option

grants under stock option programs. As of August 29, 1999, the Company had not repurchased any stock

under the program.

15