Costco 1999 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 1999 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COSTCO COMPANIES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(dollars in thousands, except per share data)

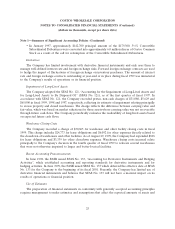

Note 4—Stock Options (Continued)

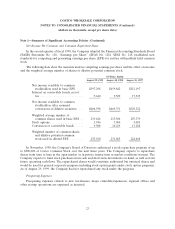

At August 30, 1998 and August 31, 1997, there were 5,926 and 7,118 options exercisable at weighted

average exercise prices of $19.65 and $18.85, respectively.

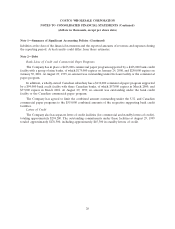

Note 5—Retirement Plans

The Company has a 401(k) Retirement Plan that is available to all U.S. employees who have one year

or more of service, except California union employees. The plan allows pre-tax deferral against which the

Company matches 50% of the first one thousand dollars of employee contributions. In addition, the

Company will provide each eligible participant a contribution based on salary and years of service. The

Company has a defined contribution plan for Canadian and United Kingdom employees and contributes a

percentage of each employee’s salary.

California union employees participate in a defined benefit plan sponsored by their union. The

Company makes contributions based upon its union agreement. In June 1995, the Company also estab-

lished a 401(k) plan for the California union employees. The plan currently allows pre-tax deferral against

which the Company matches 50% of the first four hundred dollars of employee contributions.

Amounts expensed under these plans were $85,974, $73,764, and $59,960 for fiscal 1999, 1998, and

1997, respectively. The Company has defined contribution 401(k) and retirement plans only, and thus has

no liability for post-retirement benefit obligations under the SFAS No. 106 ‘‘Employer’s Accounting for

Post-retirement Benefits Other than Pensions.’’

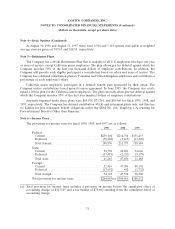

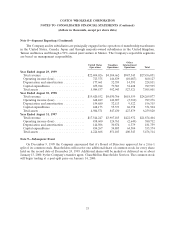

Note 6—Income Taxes

The provisions for income taxes for fiscal 1999, 1998, and 1997 are as follows:

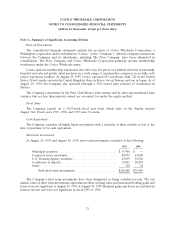

1999 1998 1997

Federal:

Current ............................. $259,104 $214,788 $151,433

Deferred ............................ (70,248) (3,415) (13,249)

Total federal .......................... 188,856 211,373 138,184

State:

Current ............................. 54,701 49,881 34,666

Deferred ............................ (13,418) (2,231) (3,178)

Total state ............................ 41,283 47,650 31,488

Foreign:

Current ............................. 52,416 47,096 40,192

Deferred ............................ (17,692) 442 (1,732)

Total foreign .......................... 34,724 47,538 38,460

Total provision for income taxes ............. $264,863(a) $306,561 $208,132

(a) Total provision for income taxes includes a provision on income before the cumulative effect of

accounting change of $343,545 and a tax benefit of $78,682 resulting from the cumulative effect of

accounting change.

31