Costco 1999 Annual Report Download - page 26

Download and view the complete annual report

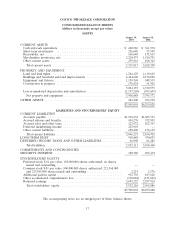

Please find page 26 of the 1999 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.COSTCO WHOLESALE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(dollars in thousands, except per share data)

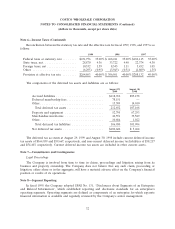

Note 1—Summary of Significant Accounting Policies (Continued)

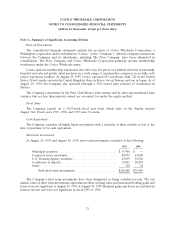

Membership Fees

Membership fee revenue represents annual membership fees paid by substantially all of the Com-

pany’s members. Effective with the first quarter of fiscal 1999, the Company changed its method of

accounting for membership fee income from a ‘‘cash basis’’ to a ‘‘deferred basis’’ whereby membership fee

income is recognized ratably over the one-year life of the membership. The change to the deferred method

of accounting for membership fees resulted in a one-time, non-cash, pre-tax charge of approximately

$196,705 ($118,023 after-tax, or $.50 per diluted share) to reflect the cumulative effect of the accounting

change as of the beginning of fiscal 1999. If the deferred method of accounting for membership fee income

had been in effect in fiscal 1998 and 1997, net income would have been $444,451, or $1.96 per diluted share

and $302,969, or $1.43 per diluted share respectively.

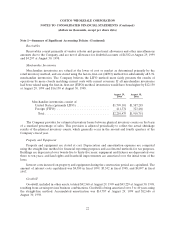

Foreign Currency Translation

The accumulated foreign currency translation relates to the Company’s consolidated foreign opera-

tions as well as its investment in the Price Club Mexico joint venture. Foreign currency translation is

determined by application of the current rate method and included in the determination of consolidated

stockholders’ equity and comprehensive income at the respective balance sheet dates.

Cumulative inflation in Mexico exceeded 100% in the three-year calendar period 1994-1996, requiring

a hyper-inflationary accounting treatment for the Company’s Mexico joint venture operations in calendar

year 1997. Foreign currency translation gains or losses were reflected in the Statement of Income rather

than as an adjustment to stockholders’ equity during this period.

Income Taxes

The Company accounts for income taxes under the provisions of Statement of Financial Accounting

Standards (SFAS) No. 109, ‘‘Accounting for Income Taxes.’’ That standard requires companies to account

for deferred income taxes using the asset and liability method.

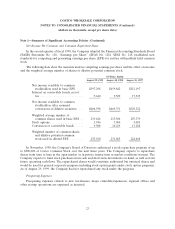

Supplemental Disclosure of Non-Cash Activities

Fiscal 1999 Non-Cash Activities

• In March 1999, approximately $48,000 principal amount of the $900,000, 31⁄2% Zero Coupon

Convertible Subordinated Notes were converted into approximately 545 thousand shares of Costco

Common Stock.

Fiscal 1998 Non-Cash Activities

• None.

24

Fiscal 1997 Non-Cash Activities

• In December 1996, approximately $159,400 principal amount of the $285,100, 63⁄4% Convertible

Subordinated Debentures were converted into approximately 7.1 million shares of Costco Common

Stock as a result of a call for redemption of the Convertible Subordinated Debentures.