Costco 1999 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 1999 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COSTCO WHOLESALE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(dollars in thousands, except per share data)

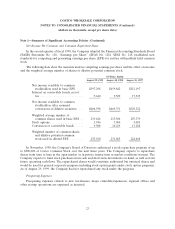

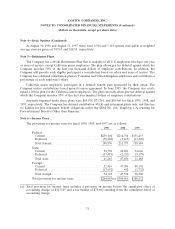

Note 8—Segment Reporting (Continued)

The Company and its subsidiaries are principally engaged in the operation of membership warehouses

in the United States, Canada, Japan and through majority-owned subsidiaries in the United Kingdom,

Taiwan and Korea and through a 50%-owned joint venture in Mexico. The Company’s reportable segments

are based on management responsibility.

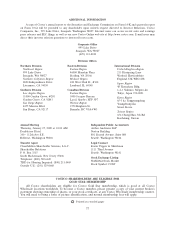

Other

United States Canadian International

Operations Operations Operations Total

Year Ended August 29, 1999

Total revenue ........................ $22,404,026 $4,104,662 $947,343 $27,456,031

Operating income (loss) ................. 723,375 146,839 (10,087) 860,127

Depreciation and amortization ............ 177,661 32,559 14,591 224,811

Capital expenditures ................... 655,924 79,583 52,428 787,935

Total assets .......................... 5,984,537 992,943 527,521 7,505,001

Year Ended August 30, 1998

Total revenue ........................ $19,620,552 $4,030,766 $618,559 $24,269,877

Operating income (loss) ................. 648,429 142,807 (3,960) 787,276

Depreciation and amortization ............ 154,680 32,113 9,522 196,315

Capital expenditures ................... 448,173 55,373 68,358 571,904

Total assets .......................... 4,984,571 847,430 427,879 6,259,820

Year Ended August 31, 1997

Total revenue ........................ $17,544,247 $3,907,185 $422,972 $21,874,404

Operating income (loss) ................. 458,600 124,761 (2,649) 580,712

Depreciation and amortization ............ 144,506 30,874 6,379 181,759

Capital expenditures ................... 454,267 34,803 64,304 553,374

Total assets .......................... 4,224,668 851,103 400,543 5,476,314

33

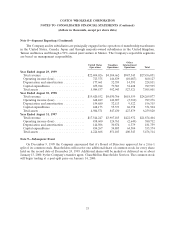

Note 9—Subsequent Event

On December 9, 1999 the Company announced that it’s Board of Directors approved for a 2-for-1

split of its common stock. Shareholders will receive one additional share of common stock for every share

held on the record date of December 24, 1999. Additional shares will be mailed or delivered on or about

January 13, 2000, by the Company’s transfer agent, ChaseMellon Shareholder Services. The common stock

will begin trading at a post-split price on January 14, 2000.