Costco 1999 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 1999 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COSTCO WHOLESALE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(dollars in thousands, except per share data)

Note 6—Income Taxes (Continued)

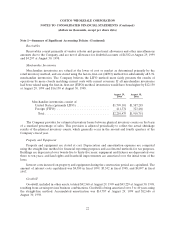

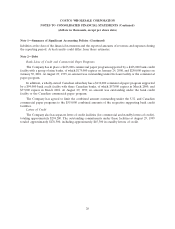

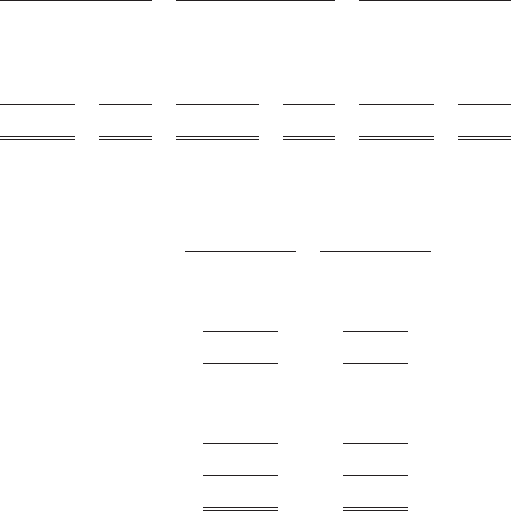

Reconciliation between the statutory tax rate and the effective rate for fiscal 1999, 1998, and 1997 is as

follows:

1999 1998 1997

Federal taxes at statutory rate ........ $231,756 35.00% $ 268,241 35.00% $182,115 35.00%

State taxes, net ................... 28,870 4.36 33,722 4.40 22,374 4.30

Foreign taxes, net ................. 10,532 1.59 8,543 1.11 5,452 1.05

Other ......................... (6,295) (0.95) (3,945) (0.51) (1,809) (.35)

Provision at effective tax rate ........ $264,863 40.00% $ 306,561 40.00% $208,132 40.00%

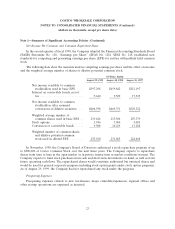

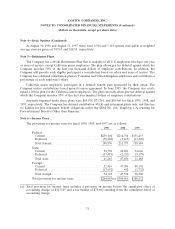

The components of the deferred tax assets and liabilities are as follows:

August 29, August 30,

1999 1998

Accrued liabilities ........................... $118,912 $93,158

Deferred membership fees ..................... 78,151 —

Other .................................... 15,589 14,010

Total deferred tax assets ..................... 212,652 107,168

Property and equipment ...................... 52,795 67,293

Merchandise inventories ...................... 42,551 33,589

Other .................................... 10,684 1,022

Total deferred tax liabilities .................. 106,030 101,904

Net deferred tax assets ....................... $106,622 $ 5,264

The deferred tax accounts at August 29, 1999 and August 30, 1998 include current deferred income

tax assets of $164,839 and $59,667, respectively, and non-current deferred income tax liabilities of $58,217

and $54,403, respectively. Current deferred income tax assets are included in other current assets.

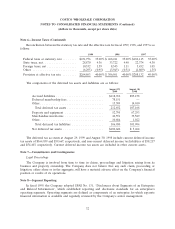

Note 7—Commitments and Contingencies

Legal Proceedings

The Company is involved from time to time in claims, proceedings and litigation arising from its

business and property ownership. The Company does not believe that any such claim, proceeding or

litigation, either alone or in the aggregate, will have a material adverse effect on the Company’s financial

position or results of its operations.

Note 8—Segment Reporting

In fiscal 1999, the Company adopted SFAS No. 131, ‘‘Disclosures about Segments of an Enterprise

and Related Information’’, which established reporting and disclosure standards for an enterprise’s

operating segments. Operating segments are defined as components of an enterprise for which separate

financial information is available and regularly reviewed by the Company’s senior management.

32