Costco 1999 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 1999 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COSTCO COMPANIES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(dollars in thousands, except per share data)

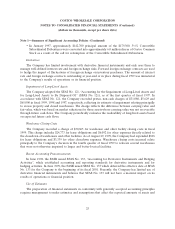

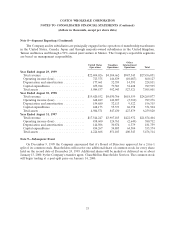

Note 3—Leases (Continued)

Company to either renew for a series of one-year terms or to purchase the equipment at the then fair

market value.

Aggregate rental expense for fiscal 1999, 1998, and 1997, was $59,263, $55,375, and $54,019, respec-

tively. Future minimum payments during the next five fiscal years and thereafter under non-cancelable

leases with terms in excess of one year, at August 29, 1999, were as follows:

2000 ................................................... $ 64,406

2001 ................................................... 62,508

2002 ................................................... 62,153

2003 ................................................... 60,645

2004 ................................................... 59,160

Thereafter ............................................... 619,690

Total minimum payments .................................. $928,562

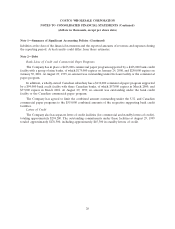

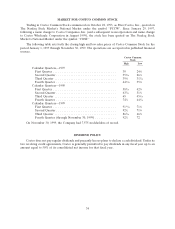

Note 4—Stock Options

The Costco Companies, Inc. 1993 Combined Stock Grant and Stock Option Plan (the New Stock

Option Plan) provides for the issuance of up to 30 million shares of the Company’s common stock upon

the exercise of stock options or up to 1,666,666 shares through stock grants. Prior to the merger of The

Price Company and Costco Wholesale Corporation, various incentive and non-qualified stock option plans

existed which allowed certain key employees and directors to purchase or be granted common stock of The

Price Company and Costco Wholesale Corporation (collectively the Old Stock Option Plans). Options

were granted for a maximum term of ten years, and were exercisable upon vesting. Options granted under

these plans generally vest ratably over five to nine years. Subsequent to the merger, new grants of options

have not been made under the Old Stock Option Plans.

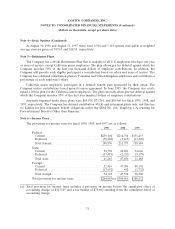

The Company applies Accounting Principles Board Opinion (APB) No. 25 and related Interpretations

in accounting for stock options. Accordingly, no compensation cost has been recognized for the plans. Had

compensation cost for the Company’s stock-based compensation plans been determined based on the fair

value at the grant dates for awards under those plans consistent with Statement of Financial Accounting

Standards No. 123 (SFAS No.123), ‘‘Accounting for Stock-Based Compensation’’, the Company’s net

income and net income per share would have been reduced to the pro forma amounts indicated below:

1999 1998 1997

Net income:

As reported ........................... $397,298 $459,842 $312,197

Pro forma ............................. $352,660 $438,053 $301,947

Net income per share (diluted):

As reported ........................... $ 1.73 $ 2.03 $ 1.47

Pro forma ............................. $ 1.54 $ 1.93 $ 1.42

29