Costco 1999 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 1999 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.COSTCO WHOLESALE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(dollars in thousands, except per share data)

Note 1—Summary of Significant Accounting Policies (Continued)

25

• In January 1997, approximately $142,700 principal amount of the $179,300, 51⁄2% Convertible

Subordinated Debentures were converted into approximately 6.0 million shares of Costco Common

Stock as a result of the call for redemption of the Convertible Subordinated Debentures.

Derivatives

The Company has limited involvement with derivative financial instruments and only uses them to

manage well-defined interest rate and foreign exchange risks. Forward foreign exchange contracts are used

to hedge the impact of fluctuations of foreign exchange on inventory purchases. The amount of interest

rate and foreign exchange contracts outstanding at year-end or in place during fiscal 1999 was immaterial

to the Company’s results of operations or its financial position.

Impairment of Long-Lived Assets

The Company adopted the SFAS No. 121, ‘‘Accounting for the Impairment of Long-Lived Assets and

for Long-Lived Assets to Be Disposed Of’’ (SFAS No. 121), as of the first quarter of fiscal 1997. In

accordance with SFAS No. 121, the Company recorded pretax, non-cash charges of $31,080, $5,629 and

$65,000 in fiscal 1999, 1998 and 1997, respectively, reflecting its estimate of impairment relating principally

to excess property and closed warehouses. The charge reflects the difference between carrying value and

fair value, which was based on market valuations for those assets whose carrying value was not recoverable

through future cash flows. The Company periodically evaluates the realizability of long-lived assets based

on expected future cash flows.

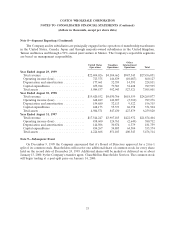

Warehouse Closing Costs

The Company recorded a charge of $30,865 for warehouse and other facility closing costs in fiscal

1999. This charge includes $24,773 for lease obligations and $6,092 for other expenses directly related to

the closedown of warehouses and other facilities. As of August 29, 1999, the Company had expended $828

for lease obligations and $3,339 for other closedown expenses. Warehouse closing costs incurred relate

principally to the Company’s decision in the fourth quarter of fiscal 1999 to relocate several warehouses

that were not otherwise impaired to larger and better-located facilities.

Recent Accounting Pronouncements

In June 1998, the FASB issued SFAS No. 133, ‘‘Accounting for Derivative Instruments and Hedging

Activities’’, which established accounting and reporting standards for derivative instruments and for

hedging activities. In June 1999, the FASB issued SFAS No. 137 which deferred the effective date of SFAS

No. 133 for the Company to the beginning of its fiscal 2001. Presently, the Company has limited use of

derivative financial instruments and believes that SFAS No. 133 will not have a material impact on its

results of operations or financial position.

Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles

requires management to make estimates and assumptions that affect the reported amounts of assets and