Cincinnati Bell 2015 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2015 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

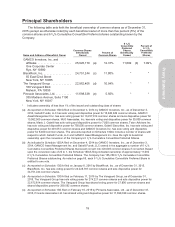

Principal Shareholders

The following table sets forth the beneficial ownership of common shares as of December 31,

2015 (except as otherwise noted) by each beneficial owner of more than five percent (5%) of the

common shares and 6 3/4% Cumulative Convertible Preferred shares outstanding known by the

Company.

Name and Address of Beneficial Owner

Common Shares

Beneficially

Owned

Percent of

Common Shares

63/4%

Convertible

Preferred

Shares

Beneficially

Owned

Percent of

63/4%

Convertible

Preferred

Shares

GAMCO Investors, Inc. and

affiliates ...................... 25,926,170 (a) 12.37% 11,002 (b) 7.09%

One Corporate Center

Rye, NY 10580

BlackRock, Inc. .................. 24,751,244 (c) 11.80% * *

55 East 52nd Street

New York, NY 10055

The Vanguard Group ............. 22,962,406 (d) 10.94% * *

100 Vanguard Blvd.

Malvern, PA 19355

Pinnacle Associates, Ltd. .......... 11,698,338 (e) 5.50% * *

335 Madison Avenue, Suite 1100

New York, NY 10017

* Indicates ownership of less than 1% of the issued and outstanding class of shares

(a) As reported on Schedule 13D/A filed on December 4, 2014 by GAMCO Investors, Inc., as of December 3,

2014, Gabelli Funds, LLC has sole voting and dispositive power for 10,846,849 common shares, GAMCO

Asset Management Inc. has sole voting power for 13,227,914 common shares and sole dispositive power for

13,982,365 common shares, MJG Associates, Inc. has sole voting and dispositive power for 30,000 common

shares, Mario J. Gabelli has sole voting and dispositive power for 7,000 common shares, Teton Advisors Inc.

has sole voting and dispositive power for 750,005 common shares, Gabelli Securities, Inc. has sole voting and

dispositive power for 301,551 common shares and GAMCO Investors Inc. has sole voting and dispositive

power for 8,400 common shares. The amounts reported on Schedule 13D/A include a number of shares with

respect to which Gabelli Funds, LLC and GAMCO Asset Management Inc. have the right to beneficial

ownership upon the conversion of the Company’s 6 3/4% Cumulative Convertible Preferred Shares.

(b) As indicated in Schedule 13D/A filed on December 4, 2014 by GAMCO Investors, Inc., as of December 3,

2014, GAMCO Asset Management Inc. and Gabelli Funds, LLC owned in the aggregate a number of 6 3/4%

Cumulative Convertible Preferred Shares that would convert into 220,049 common shares if converted. Based

upon the conversion rate of 20 to 1, the Schedule 13D/A filing indicated ownership of approximately 11,002

63/4% Cumulative Convertible Preferred Shares. The Company has 155,250 6 3/4% Cumulative Convertible

Preferred Shares outstanding. As noted on page 65, each 6 3/4% Cumulative Convertible Preferred Share is

entitled to one vote.

(c) As reported on Schedule 13G/A filed on January 8, 2016 by BlackRock, Inc., as of December 31, 2015,

BlackRock, Inc. has sole voting power for 24,228,787 common shares and sole dispositive power for

24,751,244 common shares.

(d) As reported on Schedule 13G/A filed on February 11, 2016 by The Vanguard Group, as of December 31,

2015, The Vanguard Group has sole voting power for 274,221 common shares and sole dispositive power for

22,672,814 common shares. The Vanguard Group has shared voting power for 27,800 common shares and

shared dispositive power for 289,592 common shares.

(e) As reported on Schedule 13G filed on February 10, 2016 by Pinnacle Associates, Ltd., as of December 31,

2015, Pinnacle Associates Ltd. has shared voting and dispositive power for 11,698,338 common shares.

19

Proxy Statement