Cincinnati Bell 2015 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2015 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Form 10-K Part II Cincinnati Bell Inc.

discussed below, and to comply with applicable laws and regulations, will not exceed the amounts reflected in

our consolidated financial statements. As such, costs, if any, that may be incurred in excess of those amounts

provided as of December 31, 2015, cannot be reasonably determined.

Based on information currently available, consultation with counsel, available insurance coverage and

established reserves, management believes that the eventual outcome of all outstanding claims will not,

individually or in the aggregate, have a material effect on the Company’s financial position, results of operations

or cash flows.

Off-Balance Sheet Arrangements

Indemnifications

During the normal course of business, the Company makes certain indemnities, commitments, and

guarantees under which it may be required to make payments in relation to certain transactions. These include:

(a) intellectual property indemnities to customers in connection with the use, sale, and/or license of products and

services, (b) indemnities to customers in connection with losses incurred while performing services on their

premises, (c) indemnities to vendors and service providers pertaining to claims based on negligence or willful

misconduct, (d) indemnities involving the representations and warranties in certain contracts, and (e) outstanding

letters of credit which totaled $6.3 million as of December 31, 2015. In addition, the Company has made

contractual commitments to several employees providing for payments upon the occurrence of certain prescribed

events. The majority of these indemnities, commitments, and guarantees do not provide for any limitation on the

maximum potential for future payments.

Critical Accounting Policies and Estimates

Our consolidated financial statements are prepared in accordance with generally accepted accounting

principles in the United States. Application of these principles requires management to make estimates or

judgments that affect the amounts reported in the financial statements and accompanying notes. These estimates

are based on information available as of the date of the financial statements; accordingly, as this information

changes, the financial statements could reflect different estimates or judgments. Certain accounting policies

inherently have a greater reliance on the use of estimates, and, as such, have a greater possibility of producing

results that could be materially different than originally reported.

Our most significant accounting policies are presented in Note 1 to the consolidated financial statements.

Management views critical accounting policies to be those policies that are highly dependent on subjective or

complex judgments, estimates or assumptions, and where changes in those estimates and assumptions could have

a significant impact on the consolidated financial statements. We have discussed our most critical accounting

policies, judgments and estimates with our Audit and Finance Committee.

The discussion below addresses major judgments used in:

•revenue recognition;

•accounting for allowances for uncollectible accounts receivable;

•reviewing the carrying value of goodwill;

•reviewing the carrying values of long-lived assets;

•accounting for discontinued operations;

•accounting for income taxes; and

•accounting for pension and postretirement expenses.

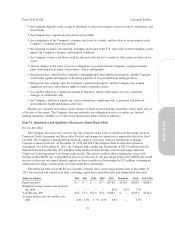

45

Form 10-K