Cincinnati Bell 2015 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2015 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Form 10-K Part I Cincinnati Bell Inc.

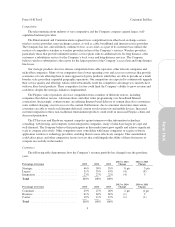

The Entertainment and Communications segment faces competition from other local exchange carriers,

wireless service providers, inter-exchange carriers, and cable, broadband and internet service providers. Wireless

providers, particularly those that provide unlimited wireless service plans with no additional fees for long

distance, offer customers a substitution service for the Company’s access lines and long distance lines. The

Company believes wireless substitution accounts for the largest portion of its access line losses. Also, cable

competitors that have existing service relationships with CBT’s customers also offer substitution services, such

as VoIP and long distance voice services in the Company’s operating areas. Partially as a result of wireless

substitution and increased competition, CBT’s legacy voice lines decreased by 14% and long distance subscribers

decreased by 6% in 2015 compared to 2014.

Our strategic products also face intense competition from cable operators, other telecom companies and

niche fiber companies. Many of our competitors have lower operating costs and access to resources that provide

economies of scale allowing them to more aggressively price products, which they are able to provide on a much

broader scale given their expanded geographic operations. Our competitors are expected to continuously upgrade

their service quality and offerings, which could substantially erode the competitive advantage we currently have

with our fiber-based products. These competitive factors could limit the Company’s ability to grow revenue and

cash flows despite the strategic initiatives implemented.

The Fioptics suite of products also faces competition from a number of different sources, including

companies that deliver movies, television shows and other video programming over broadband Internet

connections. Increasingly, content owners are utilizing Internet-based delivery of content directly to consumers,

some without charging a fee for access to the content. Furthermore, due to consumer electronics innovations,

consumers are able to watch such Internet-delivered content on television sets and mobile devices. Increased

customer migration to these non-traditional entertainment products could result in increased Fioptics churn and

decreased penetration. If the Company is unable to effectively implement strategies to attract and retain Fioptics

video and high-speed internet subscribers, retain access lines and long distance subscribers, or replace such

customers with other sources of revenue, the Company’s Entertainment and Communications business will be

adversely affected.

The IT Services and Hardware segment competes against numerous other information technology

consulting, web-hosting, and computer system integration companies, many of which are large in scope and well-

financed. This market is rapidly evolving and highly competitive. Other competitors may consolidate with larger

companies or acquire software application vendors or technology providers, which may provide competitive

advantages. The Company believes that many of the participants in this market must grow rapidly and achieve

significant scale to compete effectively. This consolidation could affect prices and other competitive factors in

ways that could impede our ability to compete successfully in the market.

The competitive forces described above could have a material adverse impact on the Company’s business,

financial condition, results of operations and cash flows.

Accelerating the pace of investment in our Fioptics suite of products could have a negative impact on our

financial results.

In 2014, we began accelerating the pace of investment in our Fioptics suite of products due to a progressive

change in customer expectations for increased internet speeds. We intend to continue such accelerated

investments through 2016. There are several factors that could result in a negative effect on our revenue,

operating income and cash flows, such as:

•our costs could significantly exceed expectations;

•the acceleration may not generate the expected increase in subscribers;

•it may be inefficient to build out the additional fiber at an accelerated rate;

•there may be a lack of workforce to achieve our construction, sales and installation targets; and

•access to the fiber required for our construction plans may be limited.

11

Form 10-K