Cincinnati Bell 2015 Annual Report Download - page 182

Download and view the complete annual report

Please find page 182 of the 2015 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Form 10-K Part II Cincinnati Bell Inc.

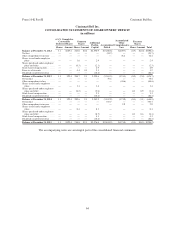

Cincinnati Bell Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. Description of Business and Accounting Policies

Description of Business — Cincinnati Bell Inc. and its consolidated subsidiaries (“Cincinnati Bell”, “we”,

“our”, “us” or the “Company”) provides diversified telecommunications and technology services. The Company

generates a large portion of its revenue by serving customers in the Greater Cincinnati and Dayton, Ohio areas.

An economic downturn or natural disaster occurring in this, or a portion of this, limited operating territory could

have a disproportionate effect on our business, financial condition, results of operations and cash flows compared

to similar companies of a national scope and similar companies operating in different geographic areas.

As of December 31, 2015, we operate our business through the following segments: Entertainment and

Communications (formerly known as “Wireline”) and IT Services and Hardware.

The company has 3,250 employees as of December 31, 2015, and approximately 30% of its employees are

covered by a collective bargaining agreement with Communications Workers of America (“CWA”) that will be

in effect through May 12, 2018.

Basis of Presentation — The consolidated financial statements of the Company have been prepared

pursuant to the rules and regulations of the U.S. Securities and Exchange Commission (“SEC”) and, in the

opinion of management, include all adjustments necessary for a fair presentation of the results of operations,

comprehensive income, financial position and cash flows for each period presented.

Basis of Consolidation — The consolidated financial statements include the consolidated accounts of

Cincinnati Bell Inc. and its majority-owned subsidiaries over which it exercises control. Intercompany accounts

and transactions have been eliminated in the consolidated financial statements. Investments over which the

Company exercises significant influence are recorded under the equity method. Investments in which we own

less than 20% of the ownership interests and cannot exercise significant influence over the investee’s operations

are recorded at cost.

Recast of Financial Information for Discontinued Operations — In the second quarter of 2014, we

entered into agreements to sell our wireless spectrum licenses and certain other assets related to our wireless

business. The agreement to sell our wireless spectrum licenses closed on September 30, 2014, for cash proceeds

of $194.4 million. Simultaneously, we entered into a separate agreement to use certain spectrum licenses for

$8.00 until we no longer provided wireless service. Effective March 31, 2015, all wireless subscribers were

migrated off our network and we ceased providing wireless services and operations. Certain wireless tower lease

obligations and other assets were transferred to the acquiring company on April 1, 2015.

The closing of our wireless operations represents a strategic shift in our business. Therefore, certain wireless

assets, liabilities and results of operations are reported as discontinued operations in our financial statements.

Accordingly, the Company recast its prior period results to be comparable with the current discontinued

operations presentation with the exception of the Consolidated Statements of Comprehensive Income,

Consolidated Statements of Shareowners’ Deficit and Consolidated Statements of Cash Flows. See Note 3 for all

required disclosures.

Use of Estimates — The preparation of financial statements in conformity with generally accepted

accounting principles (“GAAP”) requires management to make estimates and assumptions that affect the

amounts reported. Actual results could differ from those estimates. Significant items subject to such estimates

and judgments include: the carrying value of property, plant and equipment; the valuation of insurance and

claims liabilities; the valuation of allowances for receivables and deferred income taxes; reserves recorded for

income tax exposures; the valuation of asset retirement obligations; assets and liabilities related to employee

benefits; and the valuation of goodwill. In the normal course of business, the Company is also subject to various

regulatory and tax proceedings, lawsuits, claims and other matters. The Company believes adequate provision

has been made for all such asserted and unasserted claims in accordance with GAAP. Such matters are subject to

many uncertainties and outcomes that are not predictable with assurance.

66