Cincinnati Bell 2015 Annual Report Download - page 207

Download and view the complete annual report

Please find page 207 of the 2015 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Form 10-K Part II Cincinnati Bell Inc.

Other charges in 2015 represent project related expenses as we continue to identify opportunities to

integrate the business markets within our Entertainment and Communications and IT Services & Hardware

segments. For 2013, contract terminations consisted of amounts due to a distributor to terminate a contractual

agreement.

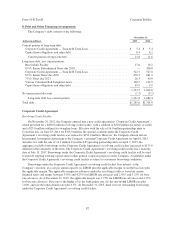

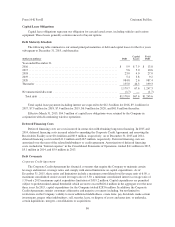

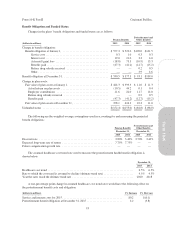

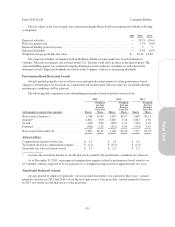

A summary of restructuring activity by business segment is presented below:

(dollars in millions)

Entertainment

and

Communications

IT Services

and Hardware Corporate Total

Balance as of December 31, 2012 ...................... $ 8.6 $0.5 $2.8 $11.9

Charges .......................................... 9.1 0.7 3.7 13.5

Utilizations ....................................... (7.2) (0.4) (3.5) (11.1)

Balance as of December 31, 2013 ...................... 10.5 0.8 3.0 14.3

Charges/(Reversals) ................................. (0.5) — 0.1 (0.4)

Utilizations ....................................... (6.1) (0.5) (2.4) (9.0)

Balance as of December 31, 2014 ...................... 3.9 0.3 0.7 4.9

Charges .......................................... 1.6 2.8 1.6 6.0

Utilizations ....................................... (4.7) (2.8) (2.3) (9.8)

Balance as of December 31, 2015 ...................... $ 0.8 $0.3 $ — $ 1.1

At December 31, 2015 and 2014, $0.9 million and $4.9 million, respectively, of the restructuring liabilities

were included in “Other current liabilities.” At December 31, 2015, $0.2 million was included in “Other

noncurrent liabilities.”

12. Pension and Postretirement Plans

Savings Plans

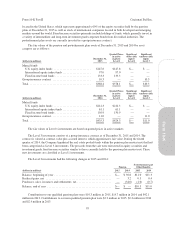

The Company sponsors several defined contribution plans covering substantially all employees. The

Company’s contributions to the plans are based on matching a portion of the employee contributions. Both

employer and employee contributions are invested in various investment funds at the direction of the employee.

Employer contributions to the defined contribution plans were $7.0 million, $6.4 million, and $6.2 million in

2015, 2014, and 2013, respectively.

Pension and Postretirement Plans

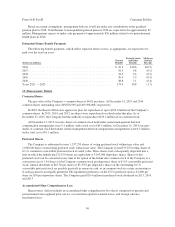

The Company sponsors three noncontributory defined benefit pension plans: one for eligible management

employees, one for non-management employees, and one supplemental, nonqualified, unfunded plan for certain

former senior executives. The management pension plan is a cash balance plan in which the pension benefit is

determined by a combination of compensation-based credits and annual guaranteed interest credits. Pension plan

amendments were approved in May 2013 and the Company remeasured the associated pension obligations. As a

result of the pension plan amendment, the Company recorded a curtailment gain of $0.6 million and a $10.3

million reduction to the associated pension obligations during the second quarter of 2013. The non-management

pension plan is also a cash balance plan in which the combination of service and job-classification-based credits

and annual interest credits determine the pension benefit. During the second quarter of 2015, the non-

management pension plan was amended to eliminate all future pension credits and transition benefits. As a result,

we recognized a curtailment loss of $0.3 million and a $1.7 million reduction to the associated pension

obligations. Benefits for the supplemental plan are based on eligible pay, adjusted for age and service upon

retirement. We fund both the management and non-management plans in an irrevocable trust through

contributions, which are determined using the traditional unit credit cost method. We also use the traditional unit

credit cost method for determining pension cost for financial reporting purposes.

91

Form 10-K