Cincinnati Bell 2015 Annual Report Download - page 214

Download and view the complete annual report

Please find page 214 of the 2015 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Form 10-K Part II Cincinnati Bell Inc.

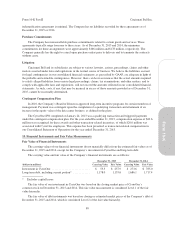

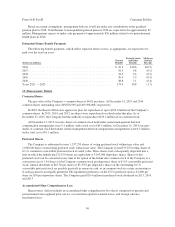

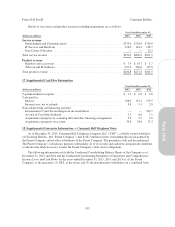

The following is a reconciliation of the statutory federal income tax rate with the effective tax rate for each

year:

Year Ended December 31,

2015 2014 2013

U.S. federal statutory rate .................................................. 35.0% 35.0% 35.0%

State and local income taxes, net of federal income tax .......................... 0.7 0.8 1.5

Change in valuation allowance, net of federal income tax ......................... (0.8) (2.0) (12.4)

State net operating loss adjustments .......................................... 0.3 1.9 2.1

Nondeductible interest expense ............................................. — 2.7 (8.9)

Unrecognized tax benefit changes ........................................... 0.2 1.4 (1.7)

Nondeductible compensation ............................................... 0.1 0.7 (2.0)

Foreign ................................................................ — — (0.5)

Other differences, net ..................................................... — 0.4 (1.7)

Effective tax rate ........................................................ 35.5% 40.9% 11.4%

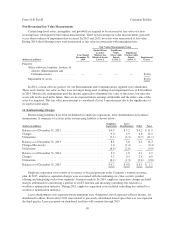

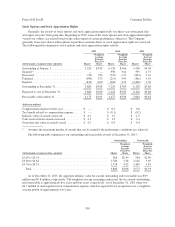

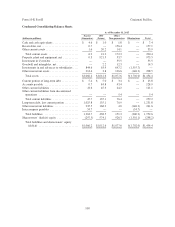

The income tax (benefit) provision was charged to continuing operations, discontinued operations,

accumulated other comprehensive income or additional paid-in capital as follows:

Year Ended December 31,

(dollars in millions) 2015 2014 2013

Income tax (benefit) provision related to:

Continuing operations .................................................... $159.8 $ 81.4 $ (8.3)

Discontinued operations .................................................. 34.8 (24.0) 5.8

Accumulated other comprehensive income (loss) .............................. 2.0 (22.4) 42.1

Excess tax benefits on stock option exercises ................................. (0.1) (0.1) (0.5)

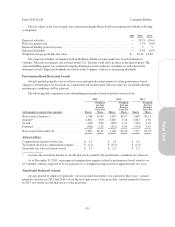

The components of our deferred tax assets and liabilities were as follows:

December 31,

(dollars in millions) 2015 2014

Deferred tax assets:

Net operating loss carryforwards ............................................... $142.0 $286.5

Pension and postretirement benefits ............................................. 89.1 95.5

Investment in CyrusOne ...................................................... 68.9 64.5

Deferred gain on sale of wireless spectrum licenses ................................. — 42.2

AMT Credit Carryforward .................................................... 32.7 24.7

Other ..................................................................... 43.8 47.4

Total deferred tax assets ...................................................... 376.5 560.8

Valuation allowance ....................................................... (58.4) (64.4)

Total deferred tax assets, net of valuation allowance ................................ $318.1 $496.4

Deferred tax liabilities:

Property, plant and equipment ................................................. $134.9 $121.9

Other ..................................................................... 0.3 4.9

Total deferred tax liabilities ................................................... 135.2 126.8

Net deferred tax assets .................................................... $182.9 $369.6

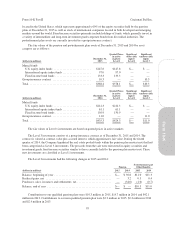

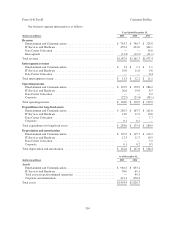

As of December 31, 2015, the Company had $258.6 million of federal tax operating loss carryforwards with

a deferred tax asset value of $90.5 million, alternative minimum tax credit carryforwards of $32.7 million, state

98