CVS 2004 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2004 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

program in the U.S. Now former Eckerd customers in the South are enjoying

advertised discounts without the hassle of clipping coupons. They are also

reaping the benefits of the ExtraBucks™cash rewards that come with their sales

receipts each quarter. These are just a few examples of “CVS easy” in action,

and we continue to look for ways to further improve our customer experience.

Robust pipeline and new generics to help drive future growth

We are seeing a temporary slowdown in industry prescription growth, which is

due to a number of factors. They include the slow pace of new drug approvals,

higher co-pays and growing co-insurance arrangements, Rx to over-the-counter

switches, and the growth in mandatory mail order plans. However, ours is still

agrowth industry. Pharmaceutical and biotech companies are hard at work

discovering new drugs, and $40–$50 billion worth of branded drug sales will

come off patent by 2008. Generic equivalents will make these medications less

expensive and more accessible to a larger population. Furthermore, prescription

drugs often remain the most cost-effective form of healthcare delivery,reducing

the need for hospitalization and surgery and getting people back to work sooner.

The Medicare Prescription Drug, Improvement and Modernization Act of 2003

will go into effect in January 2006, and we expect to be significant participants in

delivering this new benefit through our retail stores as well as our PBM.

Although we expect it to put some pressure on margins, this program should

prove to be a net positive for CVS. By making prescription drugs more affordable

to millions of senior citizens, this new benefit should increase their utilization.

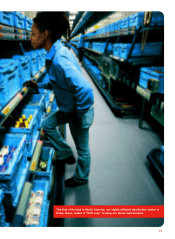

Before signing off, I want to thank the more than 145,000 colleagues who focus

on our “CVS easy” mission every day they come to work. Some have been with

CVS for many years. Others—like the experienced and valued former Eckerd

employees—are relatively new to our company. Together their efforts made this

company stronger in 2004. I also want to acknowledge the work of our talented

and engaged board of directors, in particular the late Terry Lautenbach. Everyone

at CVS held Terry in high regard for his keen intellect. I valued the wise counsel

he gave our company and me personally during his tenure on our board, and his

sudden death has been a great loss. On a happier note, Hasbro President and

CEO Alfred Verrecchia joined our board in September, and we’ve quickly put the

financial and operational skills of this seasoned executive to work on your behalf.

With 2005 well underway, we have good reason to feel confident. Our core

business is thriving and the integration of the acquired Eckerd businesses is

proceeding smoothly.Our focus on new markets provides a valuable engine for

growth. In unlocking the value of the former Eckerd stores, we have a great

opportunity to improve their profitability and gain market share. Our retail and

PBM strengths also leave us uniquely positioned in our industry. Although we

15

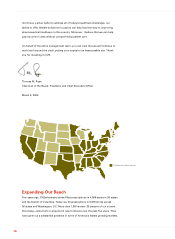

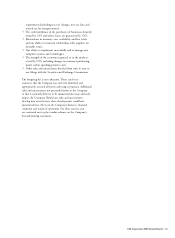

’02 ’03 ’04

804

1675

3074

24-and Extended-

Hour Stores

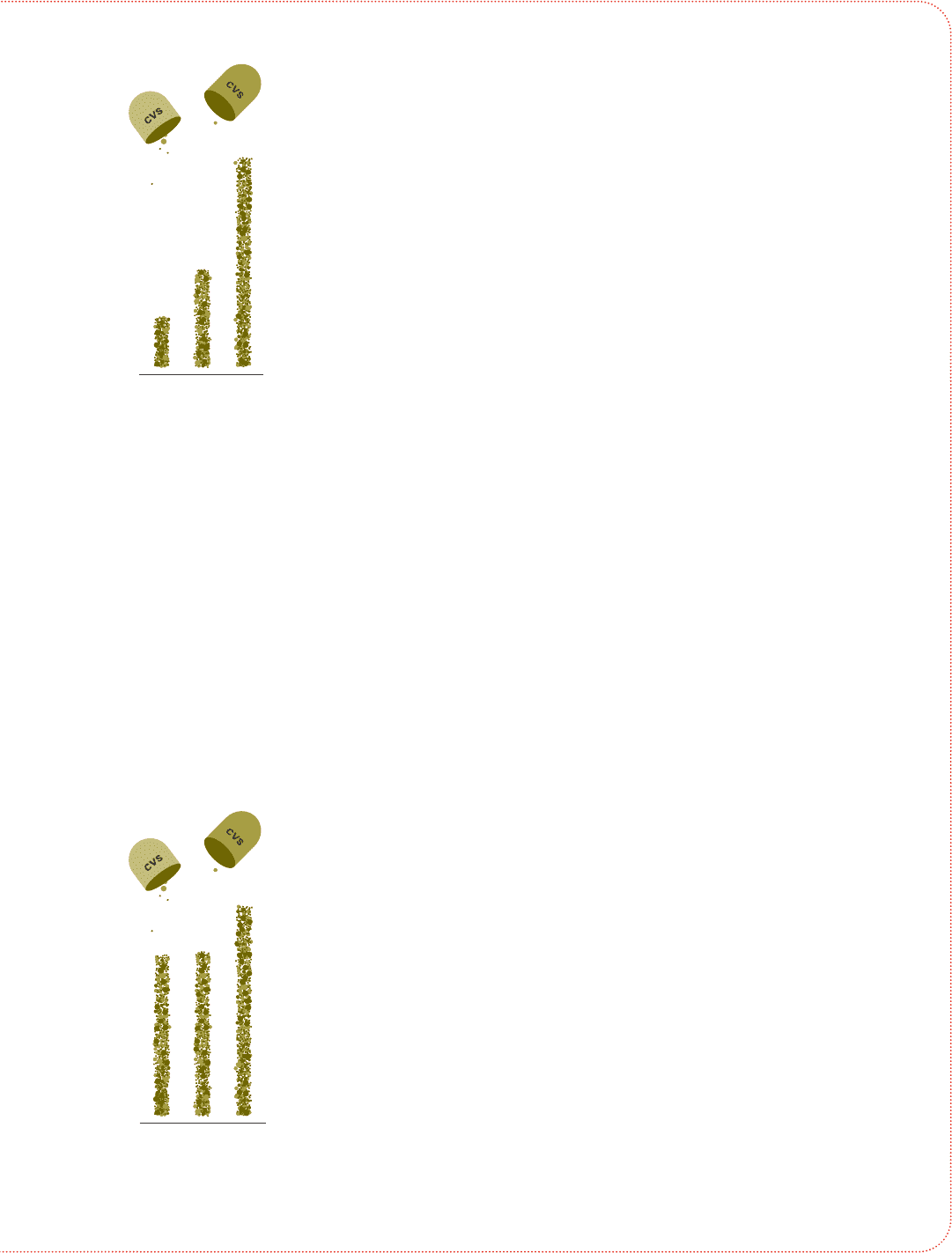

’02 ’03 ’04

4087 4179

5375

Store Count