CVS 2004 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2004 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

To Our Shareholders:

The past year has been a rewarding one at CVS. While continuing to build on

our solid core business, we made a significant purchase that positions us for

even stronger performance in the years ahead. Our acquisition of 1,268 Eckerd

stores gives us a substantial presence in the high-growth Florida and Texas

markets. Moreover,the addition of Eckerd Health Services (EHS) to our

PharmaCare subsidiary makes us the fourth-largest full-service pharmacy

benefits manager (PBM) in the United States, significantly broadening the

diversity of our client base and enhancing our competitive position.

We knew that executing our organic growth strategy while integrating the

Eckerd acquisition would seem to be an ambitious undertaking to many outside

CVS. However, as the opening pages of this report reveal, challenges like these

are really all in a day’s work for our experienced management team and CVS

colleagues across the country. We know what it takes to implement “CVS easy,”

improve customer satisfaction, open new stores, and drive productivity, and we

aim to excel at doing all of them virtually every hour of every day in every store.

Enjoying strong sales and earnings growth

Before discussing our activities in more detail, let me review the good news

regarding our 2004 results. Driven by the strength of our existing business and

the addition of the former Eckerd assets, sales rose 15.1 percent to a record

$30.59 billion. Diluted earnings per share were $2.20, including a one-time,

non-cash tax benefit of 14.5 cents as well as a one-time, non-cash negative

adjustment of 10 cents relating to a change in accounting practices for leases.

The acquisition diluted per-share earnings by 16 cents, and we also had one less

week included in our 2004 results compared to 2003.

12

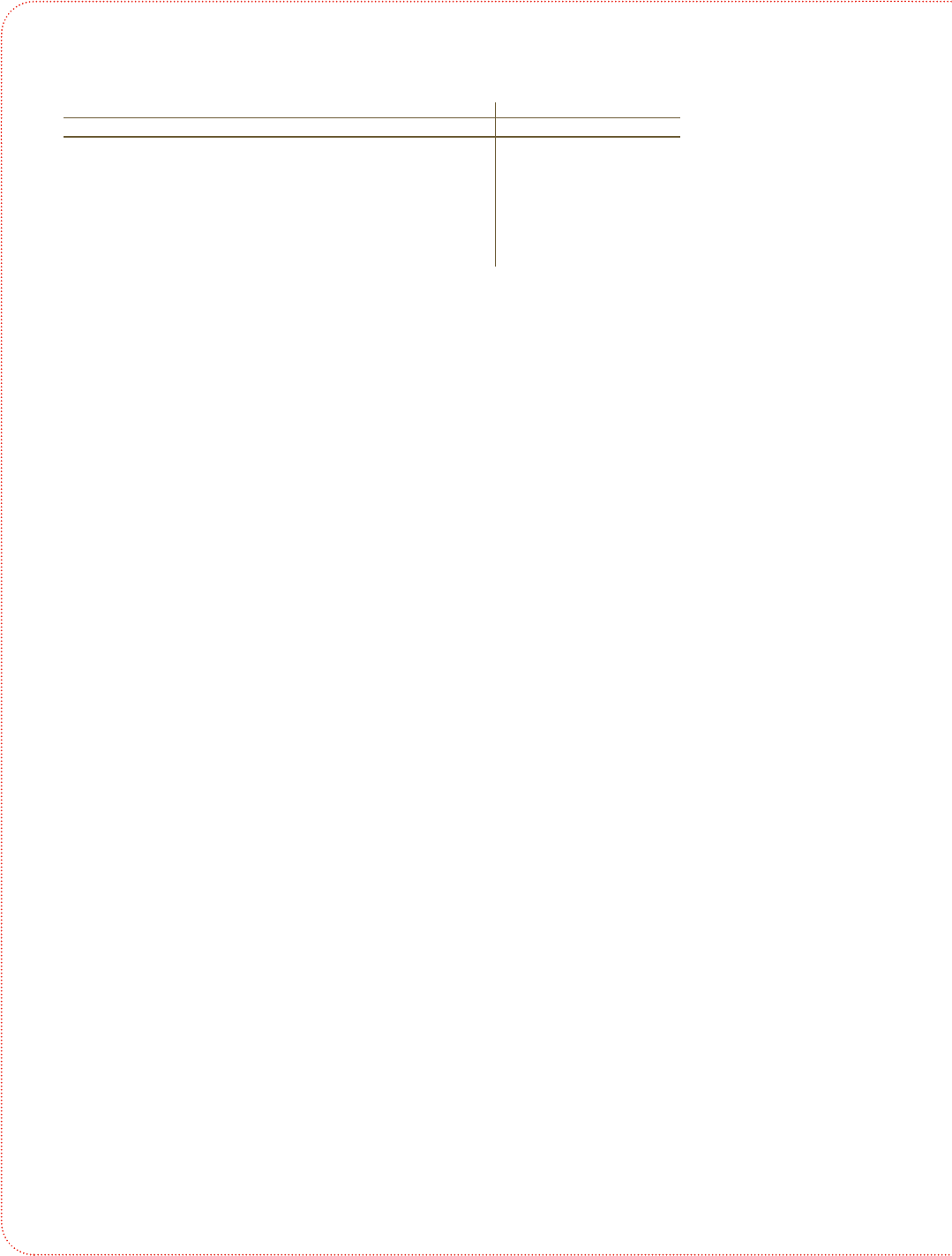

Financial Highlights

2004 2003

In millions, except per share 52 weeks 53 weeks % Change

Sales $30,594.3 $26,588.0 15.1

Operating profit 1,454.7 1,423.6 2.2

Net earnings 918.8 847.3 8.4

Diluted earnings per common share 2.20 2.06 6.8

Stock price at calendar year end 45.07 36.12 24.8

Market capitalization at calendar year end 18,071 14,281 26.5