CVS 2004 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2004 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

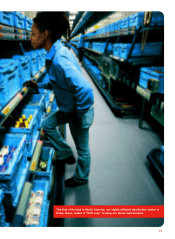

Another productivity gain goes live.

“A penny saved is a penny earned,” wrote Ben Franklin. CVS has taken

that credo to heart as we look for new and innovative ways to improve

our cost structure. That, in turn, allows us to sell our products at

attractive retail prices. Take our new, state-of-the-art distribution center

in Ennis, Texas. The first facility of its kind in North America, it

requires half the space of a conventional distribution center and needs

one-third fewer people to run it. Yet, its storage and retrieval systems

are capable of servicing the same volume and number of stores as a

conventional facility twice its size. The Ennis facility even boosts in-

store productivity because it selects and ships products customized to

the layout of each destination store. That can significantly reduce the

time it takes to get products from the delivery truck to store shelves.

When our new Central Florida distribution center opens in late 2006,

it will incorporate the same technology.

At the store level, the EPIC system has improved pharmacy workflow

and cut costs, while our Assisted Inventory Management (AIM)system

has taken the guesswork out of inventory tracking. AIM has helped

improve our in-stock position and steadily increase our inventory

productivity. Since 2001, we’ve used a combination of technologies to

reduce shrink levels by more than 50 percent. For example, our VIPER

software provides tools for analyzing front-store and pharmacy

transactions. Sorting through 3 million transactions a day, it can quickly

identify risk trends. We’ve brought VIPER and all our systems to the

newly acquired Eckerd stores. With the acquired stores’ initially higher

shrink levels and cost structure, we see a significant opportunity for

operating margin improvement.

10:00pm

10