CVS 2004 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2004 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Wehad to close only 160 former Eckerd stores in 2004, fewer than anticipated,

and our infrastructure is now supporting the remaining 1,100-plus stores. We

have re-merchandised every location to the CVS product mix and planogram and

have significantly lowered everyday prices on over 5,000 items. More than 300

locations now look like CVS stores inside and out. We have ramped up our

remodeling effort and expect to complete the entire conversion by July 2005. As

we complete remodeling by market, we will hold special events to re-introduce

the stores to customers. Once completed, we should be well positioned to

reap the benefits of a sales turnaround. Furthermore, we see tremendous

opportunities for margin improvement as we bring our operating capabilities

and technology to bear. In fact, we expect the acquisition to add 15–20 cents to

earnings per share in 2005 based largely on productivity gains.

The addition of EHS was also a key factor in the acquisition. It gives us the

unmatched combination of a PBM covering 30 million lives, the industry’s

leading retail presence, and a specialty pharmacy offering. As a result, we are

strategically positioned to provide all payors—patients, insurers, managed care

companies, and employers alike—with a complete and flexible pharmacy

solution. Our core PharmaCare business is growing, with the EHS integration

progressing well as we focus on retaining clients and gaining new ones. (Read

more about our PharmaCare opportunity on page 6.)

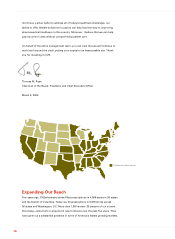

Even as we were busy integrating Eckerd assets, CVS maintained a brisk pace

of new store openings in 2004. We opened 225, with net unit growth of 88

stores factoring in relocations and closings. As a result, square footage grew

3.4 percent. With the acquired stores, retail square footage increased 33 percent.

Virtually all our net growth took place in newer CVS markets such as Texas,

Florida, Phoenix, Las Vegas, and Chicago. We opened our first stores in Los

Angeles and Orange County, California, as well as Minneapolis. All these markets

boast faster-than-average growth among the 55 and over population, a demo-

graphic that uses three times as many prescription drugs as people under 55.

Leveraging our “CVS easy” efforts

As with any CVS location, the success of the converted Eckerd stores will be

driven in part by our ability to make the customer shopping experience “CVS

easy.” Former Eckerd customers are providing us with very positive feedback

on this front. They appreciate the ease with which they get into and out of our

stores, the extended hours we’ve added at 80 percent of the acquired stores,

and the addition of 180 24-hour locations. As for location, the overwhelming

majority of the acquired Eckerd properties were already well situated.

We’ve completed our ExtraCare®rollout at the acquired stores. With more than

50 million cardholders, ExtraCare is the largest and most successful retail loyalty

14

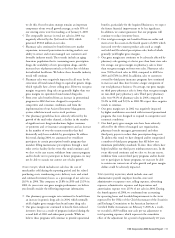

Pharmacy Sales

In billions of dollars

’02 ’03 ’04

16.4

18.3

21.5

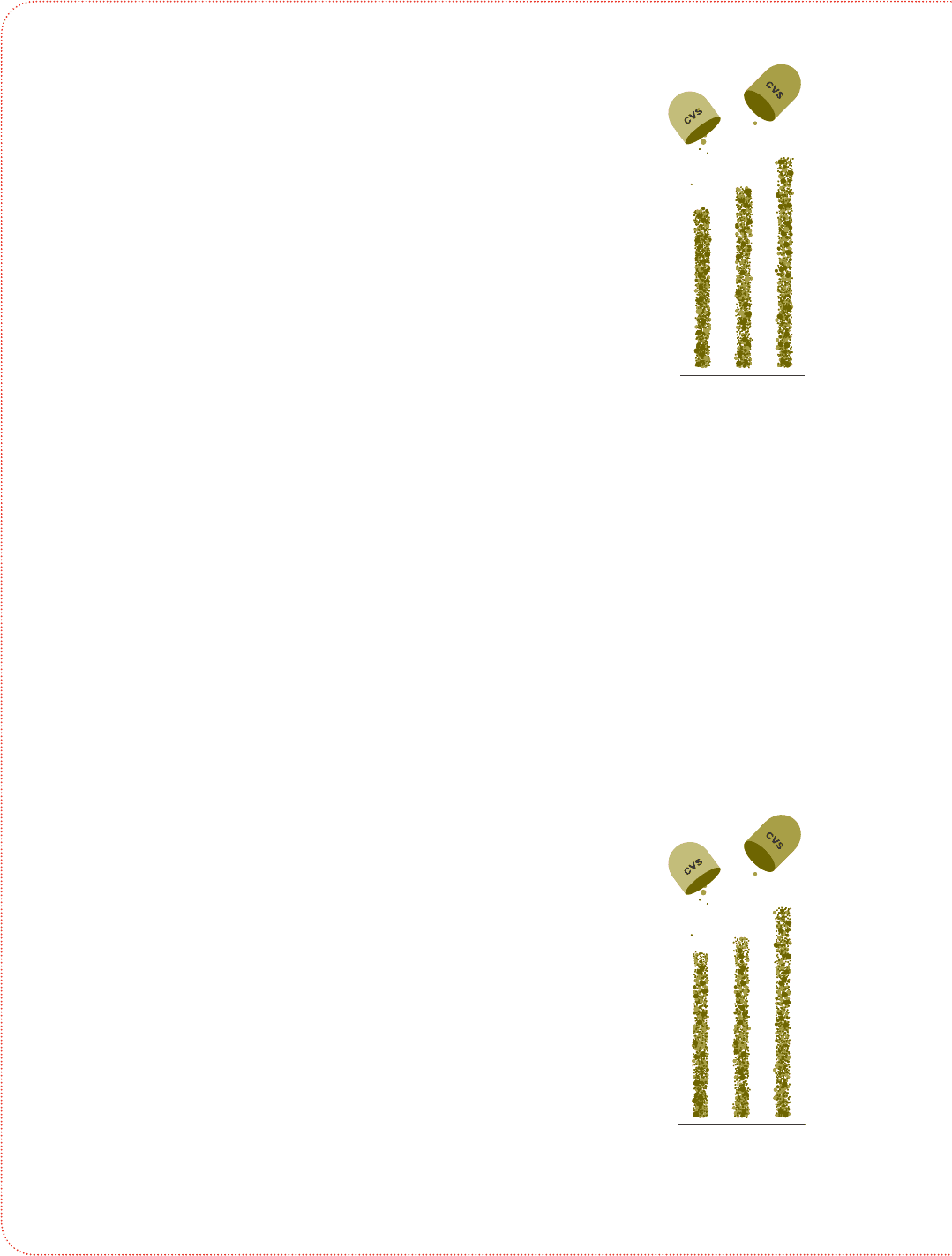

’02 ’03 ’04

24.2

26.6

30.6

Total Sales

In billions of dollars