CVS 2004 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2004 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

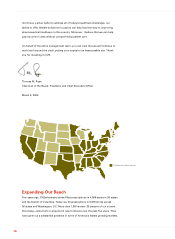

Investors have responded enthusiastically to our ongoing success and to our

prospects following the acquisition. CVS stock produced a 25.5 percent total

return to shareholders in 2004. That number far exceeded the returns of the

S&P 500 Index, the S&P Retail Index, and the chain drug industry.Our balance

sheet remains among the strongest in the industry,as evidenced by our A–

debt rating from Standard & Poor’sand our A3 rating from Moody’s Investor

Services. Our continued financial strength allowed us to announce a 9 percent

dividend increase in the first quarter of 2005.

Same-store sales grew 5.5 percent, excluding the acquired stores, with pharmacy

same-store sales up 7.0 percent. Our pharmacy business continues to gain share

and now has 13.5 percent of the U.S. retail pharmacy market. Meanwhile, front-

end same-store sales climbed 2.3 percent. We gained significant retail share in all

our key front-end categories, especially photo, cosmetics, skin care, candy, and

healthcare. With CVS proprietary products such as Nuprin healthcare products,

the first disposable digital camera with color preview, and other new CVS private

label and exclusive brands, we continued to differentiate our offerings.

Rapidly integrating our new businesses; expanding in high-growth markets

I’m happy to report that the Eckerd integration is proceeding faster than any

large-scale integration in our industry’s history. Thanks to the talents of our

management team, their experience with prior acquisitions, and our state-of-the-

art technology,we’ve already put the greatest risks associated with the integra-

tion behind us. We completed the migration of all financial and store systems

by Thanksgiving, less than four months after closing the deal and ahead of our

end-of-year target.

13

Chairman, President, and CEO Tom Ryan