Brother International 2008 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2008 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35Brother Annual Report 2008

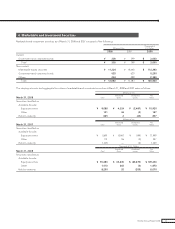

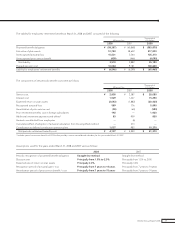

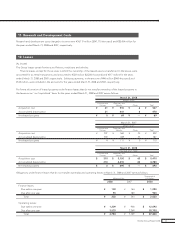

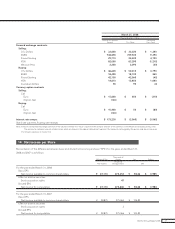

Sublease revenues included in the above table at March 31, 2008 and 2007 were as follows:

Thousands of

Millions of Yen U.S. Dollars

2008 2007 2008

Finance leases:

Due within one year ¥ 70 ¥ 106 $ 700

Due after one year 76 146 760

Total ¥ 146 ¥ 252 $ 1,460

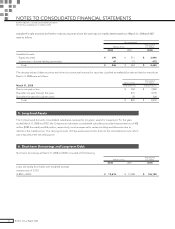

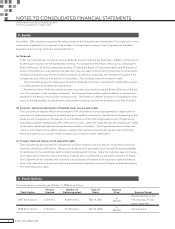

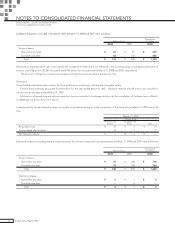

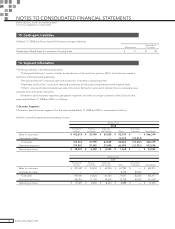

13. Derivatives

The Group enters into foreign currency forward contracts and currency option contracts to hedge foreign exchange risk

associated with certain assets and liabilities denominated in foreign currencies. The Group also enters into interest rate

swap contracts to manage its interest rate exposures on certain liabilities.

All derivative transactions are entered into to hedge interest and foreign currency exposures incorporated within

the Group’s business. Accordingly, market risk in these derivatives is basically offset by opposite movements in the

value of hedged assets or liabilities. The Group does not hold or issue derivatives for trading purposes.

Because the counterparties to these derivatives are limited to major international financial institutions with high

credit rating, the Group does not anticipate any losses arising from credit risk.

Derivative transactions entered into by the Group have been made in accordance with internal policies which regu-

late the authorization and credit limit amount.

The contract or notional amounts of derivatives which are shown in the following table do not represent the

amounts exchanged by the parties and do not measure the Group's exposure to credit or market risk.