Brother International 2008 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2008 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

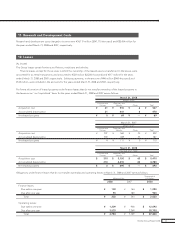

24 Brother Annual Report 2008

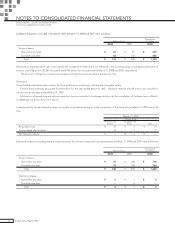

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Brother Industries, Ltd. and Consolidated Subsidiaries

For the Years ended March 31, 2008 and 2007

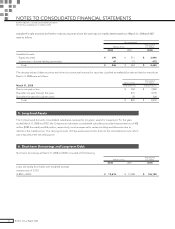

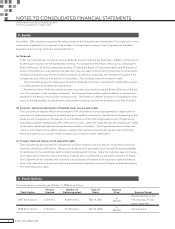

in accordance with generally accepted accounting principles in their respective jurisdictions for its consolidation process

unless they are clearly unreasonable. On May 17, 2006, the ASBJ issued ASBJ Practical Issues Task Force (PITF) No.18,

“Practical Solution on Unification of Accounting Policies Applied to Foreign Subsidiaries for the Consolidated Financial

Statements”. The new task force prescribes: 1) the accounting policies and procedures applied to a parent company

and its subsidiaries for similar transactions and events under similar circumstances should in principle be unified for the

preparation of the consolidated financial statements, 2) financial statements prepared by foreign subsidiaries in accor-

dance with either International Financial Reporting Standards or the generally accepted accounting principles in the

United States tentatively may be used for the consolidation process, 3) however, the following items should be adjusted

in the consolidation process so that net income is accounted for in accordance with Japanese GAAP unless they are not

material;

(1) Amortization of goodwill

(2) Actuarial gains and losses of defined benefit plans recognized outside profit or loss

(3) Capitalization of intangible assets arising from development phases

(4) Fair value measurement of investment properties, and the revaluation model for property, plant and equipment,

and intangible assets

(5) Retrospective application when accounting policies are changed

(6) Accounting for net income attributable to a minority interest

The new task force is effective for fiscal years beginning on or after April 1, 2008 with early adoption permitted.

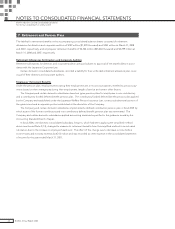

3. Business Combination

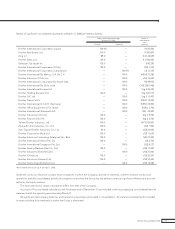

On July 1, 2006, the Group acquired 100% of shares of JAX Inc. (“JAX”). JAX engaged in network karaoke business

which was carved out from Taito Corporation. This acquisition was made to expand market share by strengthening

competitiveness through reinforcement of marketing and product lines. The results of operations of JAX were included

in the accompanying consolidated financial statements of income for fiscal 2006 from the date of the acquisition.

In fiscal 2006, the Company accounted for this business combination by the purchase method of accounting. The

acquisition cost was ¥4,645 million which was all paid in cash. The total cost of acquisition had been allocated to the

assets acquired and the liabilities assumed based on their respective fair values. The fair values of assets acquired and

liabilities assumed at the acquisition date were disclosed as additional information in the accompanying consolidated

statements of cash flows.