Brother International 2008 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2008 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

Brother Industries, Ltd. and Consolidated Subsidiaries

9Brother Annual Report 2008

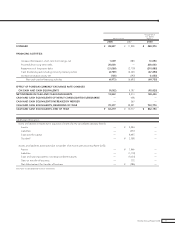

Income Statement Analysis

To review the economic situation surrounding our group (the company and its consolidated sub-

sidiaries) in the current consolidated fiscal year, the United States saw an increasing slowdown as the

end of the year approached due to subprime loan problems and soaring oil prices. In Europe and

Japan, the economy moved solidly on the whole, but is recently showing a heightened sense of uncer-

tainty due to the influence of the U.S. economy.

In such surroundings, our group’s consolidated business performance resulted in sales of ¥566,379

million, an increase of 0.7% year on year. Although we had some sales-decreasing factors such as busi-

ness transfers, we could keep the result at this level due to steady sales of communications and printing

equipment and machine tools, as well as the positive impact of the foreign exchange rate, mainly

against Euro.

In spite of the increase in selling, general and administrative expenses, including R&D expenses, the

positive impact of the foreign exchange rate, and other factors helped us to achieve an operating

income of ¥53,503 million, an increase of 4.4% year on year. Although non-operating exchange losses

mainly increased, the ordinary income was ¥46,535 million, an increase of 2.3 % year on year. Due to an

increase in the income taxes-deferred for tax effect accounting, the net income for the current period

was ¥27,110 million, down 6.1% from the same period in the previous year.

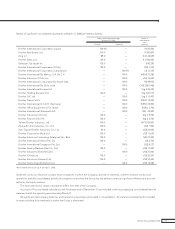

Performance by Business Segment (excluding inter-segment sales)

1) Printing & Solutions (P&S)

Net sales: ¥412,614 million (+3.8% YoY)

Communications and printing equipment: ¥367,640 million (+3.9% YoY)

Although sales decreased in the U.S., business in Europe and Asia moved steadily, and the positive

impact of the foreign exchange rate also helped to mark increases in sales, improving overall perfor-

mance.

Electronic stationery: ¥44,974 million (+3.0% YoY)

Steady business performance in Europe and Asia and the positive impact of the foreign exchange rate

helped to achieve an overall sales increase.

Operating income: ¥38,807 million (+3.7% YoY)

In spite of the increase in R&D and other expenses, the resulting profit increase was due to factors such

as improvement of sales composition and the positive impact of the foreign exchange rate.

2) Personal & Home (P&H)

Net sales: ¥33,790 million (-1.3% YoY)

While sales declined mainly in Japan, overall sales remained at the same level as in the same period in

the previous year.

Operating income: ¥3,398 million (+37.8% YoY)

We marked an increase in profits due to reformation of sales composition by increasing middle- and

high-end models, and by taking advantage of the foreign exchange rate.

3) Machinery & Solution (M&S)

Net sales: ¥67,825 million (+7.6% YoY)

Industrial sewing machines: ¥35,239 million (+2.3% YoY)

Sales moved steadily, mainly for shipments to Turkey, and the overall performance also turned out to

include an increase in sales.

Machine tools: ¥32,586 million (+14.1% YoY)

Sales moved strongly, mainly for shipments to China, resulting in an increase in sales.

Operating Income

Operating Income to Sales

(¥ billion)

Operating Income

(%)

Operating Income to Sales

2006 2007 2008

45.0

51.3 53.5

Fiscal years ended March 31

0

10

20

30

40

50

60

0.0

1.5

3.0

4.5

6.0

7.5

9.0

7.8 9.1 9.4

Net Income

Net Income to Sales

(¥ billion)

Net Income

(%)

Net Income to Sales

2006 2007 2008

Fiscal years ended March 31

0

5

10

15

20

25

30

0

1.0

2.0

3.0

4.0

5.0

6.0

24.6

4.3

5.1 4.8

28.9

27.1

ROA*

ROE**

(%)

ROA ROE

2006 2007 2008

Fiscal years ended March 31

*

ROA=Net Income/Average total assets X 100

**

ROE=Net Income/Average owner's equity X 100

0

5

10

15

20

7.1

14.9

7.7

14.8

6.9

12.7