Brother International 2008 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2008 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29Brother Annual Report 2008

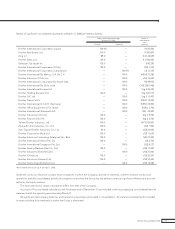

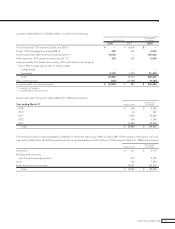

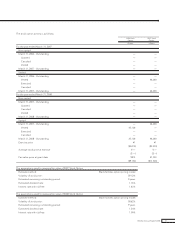

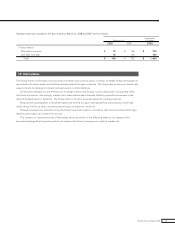

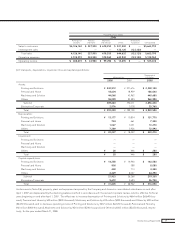

The liability for employees’ retirement benefits at March 31, 2008 and 2007 consisted of the following:

Thousands of

Millions of Yen U.S. Dollars

2008 2007 2008

Projected benefit obligation ¥ (58,387) ¥ (60,868) $ (583,870)

Fair value of plan assets 51,783 58,652 517,830

Unrecognized actuarial loss 10,531 5,564 105,310

Unrecognized prior service benefit (409) (466) (4,090)

Net liability 3,518 2,882 35,180

Prepaid pension cost 10,064 9,181 100,640

Liability for employees’ retirement benefits ¥ (6,546) ¥ (6,299) $ (65,460)

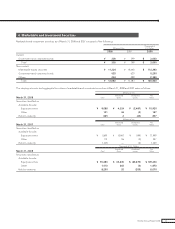

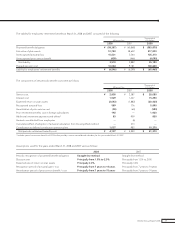

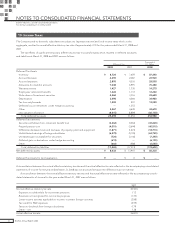

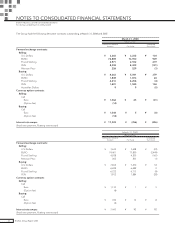

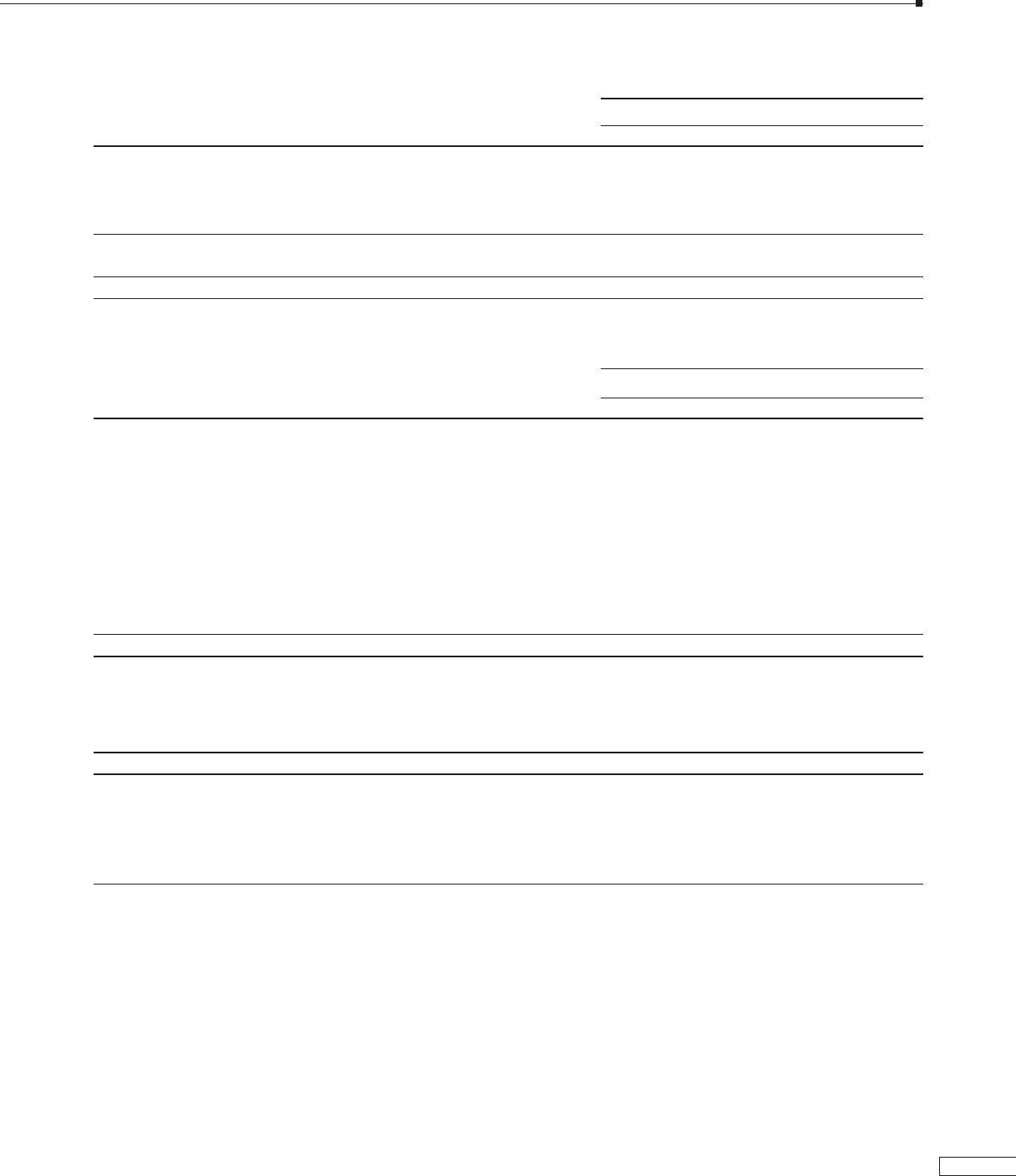

The components of net periodic benefit costs were as follows:

Thousands of

Millions of Yen U.S. Dollars

2008 2007 2008

Service cost ¥ 2,808 ¥ 2,587 $ 28,080

Interest cost 1,529 1,427 15,290

Expected return on plan assets (2,043) (1,882) (20,430)

Recognized actuarial loss 589 776 5,890

Amortization of prior service cost (58) (60) (580)

Prior retirement benefits cost in foreign subsidiaries 192 —1,920

Additional retirement payments and others* 83 900 830

Amounts contributed from employees — (6) —

Cumulative effect of adoption of actuarial calculation from the simplified method — 213 —

Contribution to defined contribution pension plans 1,037 985 10,370

Net periodic retirement benefits cost ¥ 4,137 ¥ 4,940 $ 41,370

* Includes special termination benefits of ¥725 million paid by a certain consolidated subsidiary for the year ended March 31, 2007.

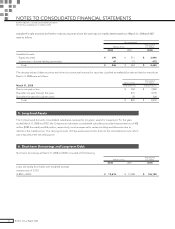

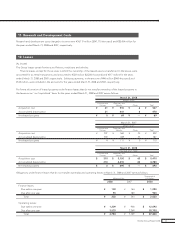

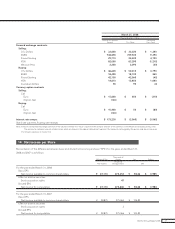

Assumptions used for the years ended March 31, 2008 and 2007 were as follows:

2008 2007

Periodic recognition of projected benefit obligation Straight-line method Straight-line method

Discount rate Principally from 1.5% to 2.0% Principally from 1.5% to 2.0%

Expected rate of return on plan assets Principally 3.0% Principally 3.0%

Recognition period of actuarial gain / loss Principally from 7 years to 14 years Principally from 7 years to 14 years

Amortization period of prior service benefit / cost Principally from 7 years to 15 years Principally from 7 years to 14 years