Brother International 2008 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2008 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

11Brother Annual Report 2008

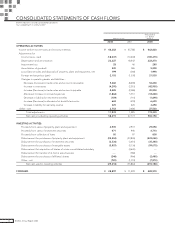

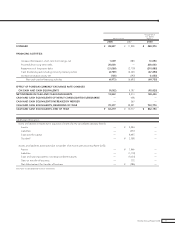

Cash Flow Statement

We obtained ¥58,215 million in cash and cash equivalents (funds) from operating activities in the current

consolidated fiscal year. On the other hand, we spent ¥29,318 million on investing activities and ¥6,973

million on financing activities. As a result, our fund balance at the end of the current consolidated fiscal

year totaled ¥83,219 million, a net increase of ¥12,842 million compared with the balance at the end of

the previous consolidated fiscal year.

A summary of cash flows and their major factors for the current consolidated fiscal year are present-

ed as follows.

1) Cash Flow from Operating Activities

Net income before income taxes and minority interests was ¥46,282 million. In addition to adjustment

for nonfund gains and losses, including ¥22,227 million of depreciation and amortization, there were

changes in the funds due to a ¥5,360 million decrease in trade notes and accounts receivable, and a

¥4,295 million increase in inventory. After deducting ¥18,037 million for income taxes paid, the cash

flow from operating activities resulted in a fund increase of ¥58,215 million.

2) Cash Flow from Investing Activities

Due to ¥22,304 million of disbursement for acquisition of tangible fixed assets and ¥5,907 million of dis-

bursement for acquisition of intangible fixed assets, the cash flow from investing activities resulted in a

fund decrease of ¥29,318 million.

3) Cash Flow from Financing Activities

Due to ¥6,789 million in payments of dividends including minority interest portion and other factors, the

cash flow from financing activities resulted in a fund decrease of ¥6,973 million.

Outlook for Fiscal Year ending March 2009

As for the economic circumstances for the next period, we currently see decelerating trends mainly in

the U.S., and an increasing sense of uncertainty for economic prospects.

In the full-year forecast for the fiscal year ending March 2009, under such an economic environment,

we expect to increase net sales compared with the fiscal year ended March 2008, mainly due to sales

increases in the laser and inkjet business of communications and printing equipment, in spite of the

negative impact of the foreign exchange rate. As to profits, both operating income and ordinary

income are anticipated to decrease due to the negative impact of the foreign exchange rate and the

increase in depreciation and selling, general and administrative expenses including R&D. We anticipate

that net income will increase because exchange losses for non-operating profits will decrease and there

will no longer be an influence from an increase in the income taxes-deferred for tax effect accounting

which affected the accounting for the fiscal year ended March 2008.

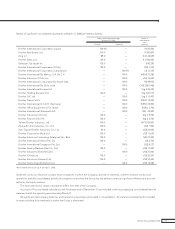

Total Assets

(¥ billion)

2006 2007 2008

Fiscal years ended March 31

0

100

200

300

400

500

348.2

399.1 392.3

Owners' Equity

Owners' Equity Ratio

(¥ billion)

Owners' Equity

(%)

Owners' Equity Ratio

2006 2007 2008

Fiscal years ended March 31

0

50

100

150

200

250

300

181.1

210.4 216.2

52.0 52.7 55.1

0

10

20

30

40

50

60