Brother International 2008 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2008 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

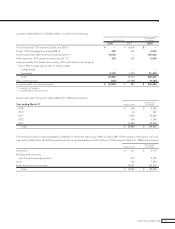

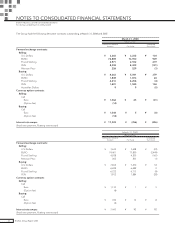

34 Brother Annual Report 2008

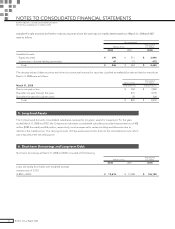

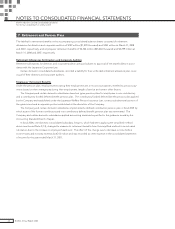

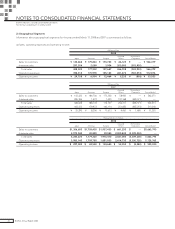

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Brother Industries, Ltd. and Consolidated Subsidiaries

For the Years ended March 31, 2008 and 2007

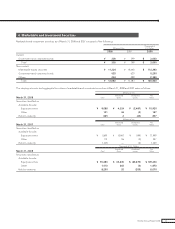

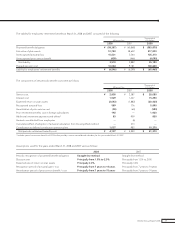

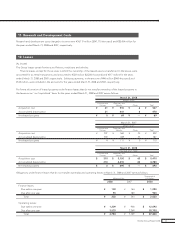

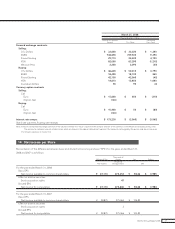

Sublease obligations included in the above table at March 31, 2008 and 2007 were as follows:

Thousands of

Millions of Yen U.S. Dollars

2008 2007 2008

Finance leases:

Due within one year ¥ 65 ¥ 97 $ 650

Due after one year 68 132 680

Total ¥ 133 ¥ 229 $ 1,330

Depreciation expense, which was computed by the straight-line method and not reflected in the accompanying consolidated statements of

income, was ¥126 million ($1,260 thousand) and ¥191 million for the years ended March 31, 2008 and 2007, respectively.

The amount of obligations under finance leases includes the imputed interest expense portion.

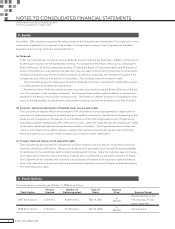

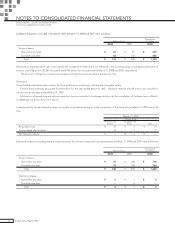

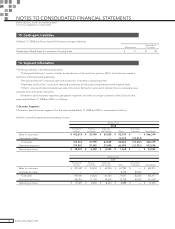

(As lessor)

Consolidated subsidiaries lease certain furniture and fixtures, machinery, vehicles and intangible assets.

Finance lease revenues amounted to ¥139 million for the year ended March 31, 2007. Sublease revenue of ¥139 million was included in

the amount for the year ended March 31, 2007.

Information of leased property whose ownership does not transfer to the lessee during or at the completion of the lease term at March

31, 2008 was not disclosed since it was nil.

Leased property whose ownership does not transfer to the lessee during or at the completion of the lease term at March 31, 2007 was as fol-

lows:

March 31, 2007

Millions of Yen

Machinery and Intangible Fixed

Vehicles Assets Total

Acquisition cost ¥ 70 ¥ 1 ¥ 71

Accumulated depreciation 70 1 71

Net leased property ¥ — ¥ — ¥ —

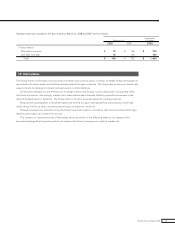

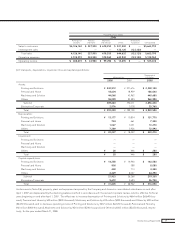

Expected revenues including interest revenue portion from finance leases and operating leases at March 31, 2008 and 2007 were as follows:

Thousands of

Millions of Yen U.S. Dollars

2008 2007 2008

Finance leases:

Due within one year ¥ 70 ¥ 106 $ 700

Due after one year 76 146 760

Total ¥ 146 ¥ 252 $ 1,460

Operating leases:

Due within one year ¥ 0 ¥ 1 $ 0

Due after one year — 0 —

Total ¥ 0 ¥ 1 $ 0