Brother International 2008 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2008 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10 Brother Annual Report 2008

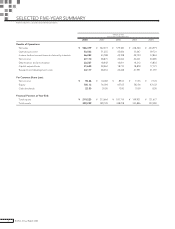

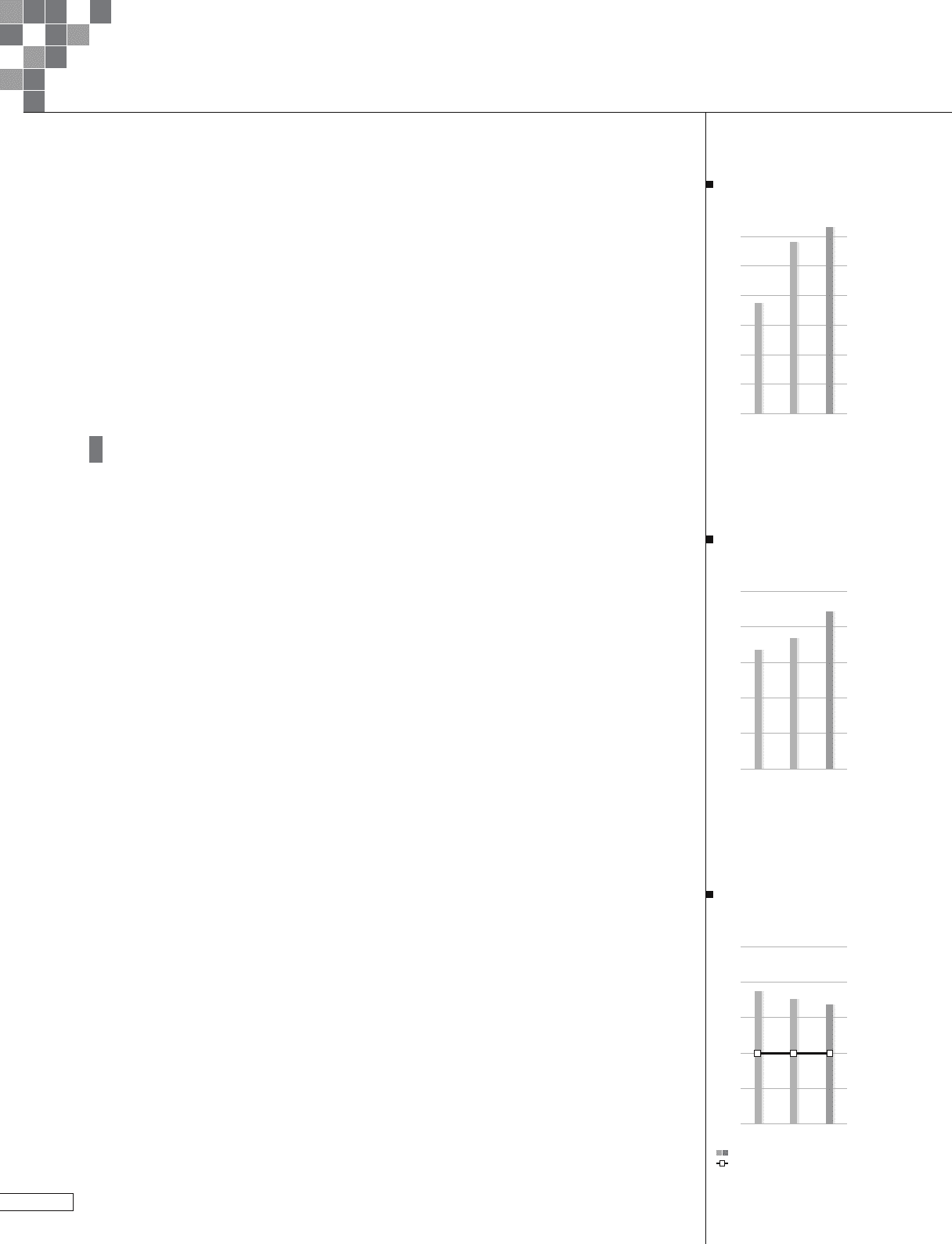

Capital Expenditures

(¥ billion)

2006 2007 2008

Fiscal years ended March 31

0

5

10

15

20

25

30

18.7

29.0

31.6

Depreciation &

Amortization

(¥ billion)

2006 2007 2008

Fiscal years ended March 31

0

5

10

15

20

25

16.8

18.4

22.2

Interest-bearing Debt

Debt Equity Ratio

(¥ billion)

Interest-bearing Debt

(%)

Debt Equity Ratio

2006 2007 2008

37.5 35.3 33.6

Fiscal years ended March 31

0

10

20

30

40

50

0.2 0.2 0.2

0.0

0.1

0.2

0.3

0.4

0.5

Operating income: ¥9,929 million (+17.2% YoY)

Operating income increased mainly due to the effect of sales increase and improvement of sales com-

position.

4) Others

Net sales: ¥52,150 million (-22.6% YoY)

Sales decreased due to factors such as a transfer of a door-to-door sales business and a sales subsidiary

of PCs.

Operating income: ¥1,369 million (-52.6% YoY)

Operating income decreased, mainly due to the income decrease in the network karaoke and content

business, as well as the effect of business transfers.

Performance by Area (including inter-segment sales)

1) Japan

Net sales: ¥428,022 million (-0.1% YoY)

While we had a sales increase in communications and printing equipment, mainly for shipments to

Europe, net sales remained almost at the same level as in the same period in the previous year because

of sales decrease for business transfers, etc.

Operating income: ¥29,708 million (+17.4% YoY)

In spite of the increase in selling, general and administrative expenses, including R&D expenses, the

positive impact of the foreign exchange rate, and other factors enabled us to achieve an increase in

profits.

2) The Americas

Net sales: ¥177,932 million (-5.4% YoY)

In addition to the negative impact of the foreign exchange rate, sales decreases, particularly of commu-

nications and printing equipment, resulted in a decrease in net sales.

Operating income: ¥6,954 million (-15.3% YoY)

Operating income decreased mainly due to an increase in selling, general and administrative expenses.

3) Europe

Net sales: ¥197,647 million (+13.1% YoY)

Sales moved well mainly for communications and printing equipment, and there was a positive impact

from the foreign exchange rate against Euro, which together contributed to the increase in net sales.

Operating income: ¥12,464 million (+7.3% YoY)

Operating income increased mainly due to the effect of sales increases, particularly of communications

and printing equipment.

4) Asia and Other Areas

Net sales: ¥266,708 million (+4.1% YoY)

Net sales increased mainly due to the positive impact of the foreign exchange rate.

Operating income: ¥5,235 million (+17.3% YoY)

Operating income increased due to cost reductions, mainly at production plants.

MANAGEMENT’S DISCUSSION AND ANALYSIS

Brother Industries, Ltd. and Consolidated Subsidiaries