Brother International 2007 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2007 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32 Brother Annual Report 2007

Notes to Consolidated Financial Statements

Brother Industries, Ltd. and Consolidated Subsidiaries

For the Years ended March 31, 2007 and 2006

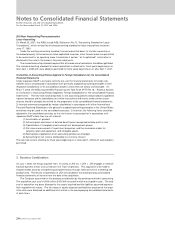

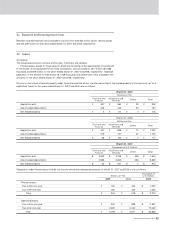

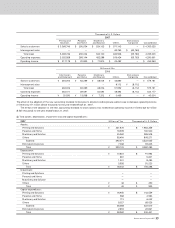

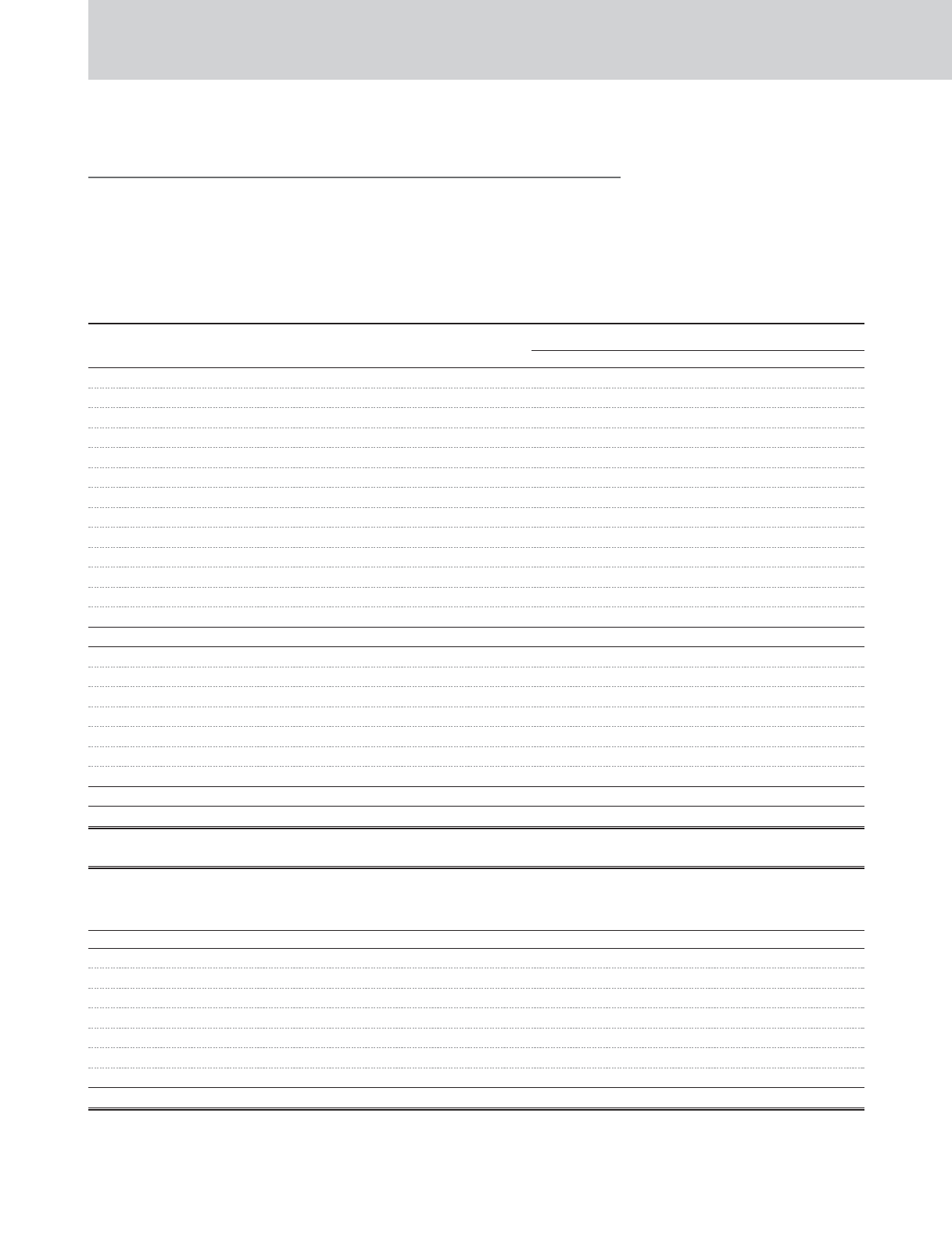

10. Income Taxes

The Company and its domestic subsidiaries are subject to Japanese national and local income

taxes which, in the aggregate, resulted in normal effective statutory tax rate of approximately

41% for the years ended M arch 31, 2007 and 2006.

The tax effects of significant temporary differences and tax loss carryforwards w hich resulted in

deferred tax assets and liabilities at M arch 31, 2007 and 2006 w ere as follow s:

64,907

17,686

38,780

59,280

14,661

9,602

28,102

33,932

7,975

10,618

39,398

(58,382)

266,559

(27,644)

(30,881)

(14,186)

(43,263)

(26,610)

(5,831)

(148,415)

118,144

0

7,996

1,944

-

7,113

2,076

1,554

2,619

4,383

767

-

6,345

(6,627)

28,170

(3,262)

(3,320)

(1,801)

(4,683)

(3,837)

(717)

(17,620)

10,550

30

7,659

2,087

4,576

6,995

1,730

1,133

3,316

4,004

941

1,253

4,649

(6,889)

31,454

(3,262)

(3,644)

(1,674)

(5,105)

(3,140)

(688)

(17,513)

13,941

0

Deferred Tax Assets:

Inventory

Accrued bonuses

Accrued expenses

Allow ance for doubtful accounts

Warranty reserve

Employees' retirement benefits

Write-down of investment securities

Depreciation

Tax loss carryforw ards

Deferred loss under hedge accounting

Other

Less valuation allowance

Total deferred tax assets

Deferred Tax Liabilities:

Securities w ithdraw n from retirement benefit trust

Prepaid pension cost

Differences betw een book and tax bases of property, plant and equipment

Undistributed earnings of foreign subsidiaries

Unrealized gain on available-for-securities

Other

Total deferred tax liabilities

Net deferred tax assets

Deferred Tax Assets for land revaluation

Thousands of

U.S. Dollars

200720062007

Millions of Yen

¥

¥

¥

¥

¥

¥

$

$

$

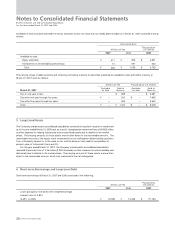

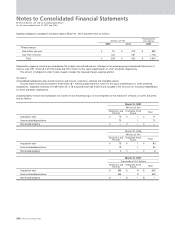

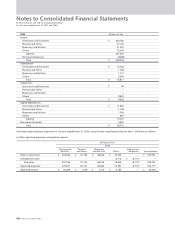

A reconciliation betw een the normal effective statutory tax rate and the actual effective tax rate reflected in the accompanying consolidated

statements of income for the year ended M arch 31, 2007 w as as follow s:

A reconciliation betw een the normal effective statutory tax rate and the actual effective tax rate reflected in the accompanying consolidated

statements of income for the year ended M arch 31, 2006 w as not disclosed because the difference w as not material.

40.50%

1.12

(1.35)

(2.98)

(2.59)

0.79

1.38

36.87%

Normal effective statutory tax rate

Expenses not deductible for income tax purposes

Revenues not recognized for income tax purposes

Low er income tax rates applicable to income in certain foreign countries

Tax credit for R&D expenses

Taxes on dividends from foreign subsidiaries

Other - net

Actual effective tax rate

2007