Brother International 2007 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2007 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

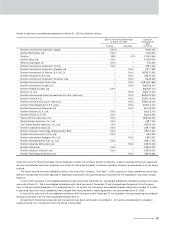

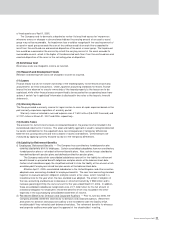

4,765,025

2,838,356

1,926,669

1,492,305

434,364

19,814

(10,407)

(25,559)

3,271

(36,415)

(390)

-

-

-

-

4,644

2,644

(7,949)

4,017

(46,330)

388,034

150,475

(7,390)

143,085

246

244,703

0.888

0.888

0.169

579,181

362,534

216,647

171,643

45,004

2,073

(1,668)

(2,926)

239

(472)

(9,932)

9,572

1,973

(71)

(1,636)

182

-

-

(10)

(2,676)

42,328

11,433

5,811

17,244

440

24,644

89.03

-

13.00

562,273

334,926

227,347

176,092

51,255

2,338

(1,228)

(3,016)

386

(4,297)

(46)

-

-

-

-

548

312

(938)

474

(5,467)

45,788

17,756

(872)

16,884

29

28,875

104.82

104.82

20.00

14 Brother Annual Report 2007

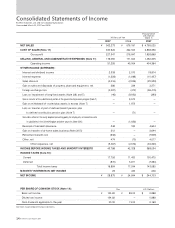

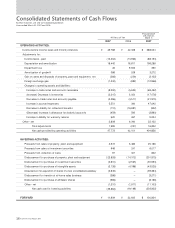

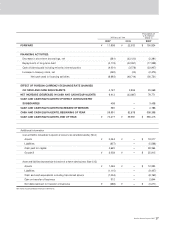

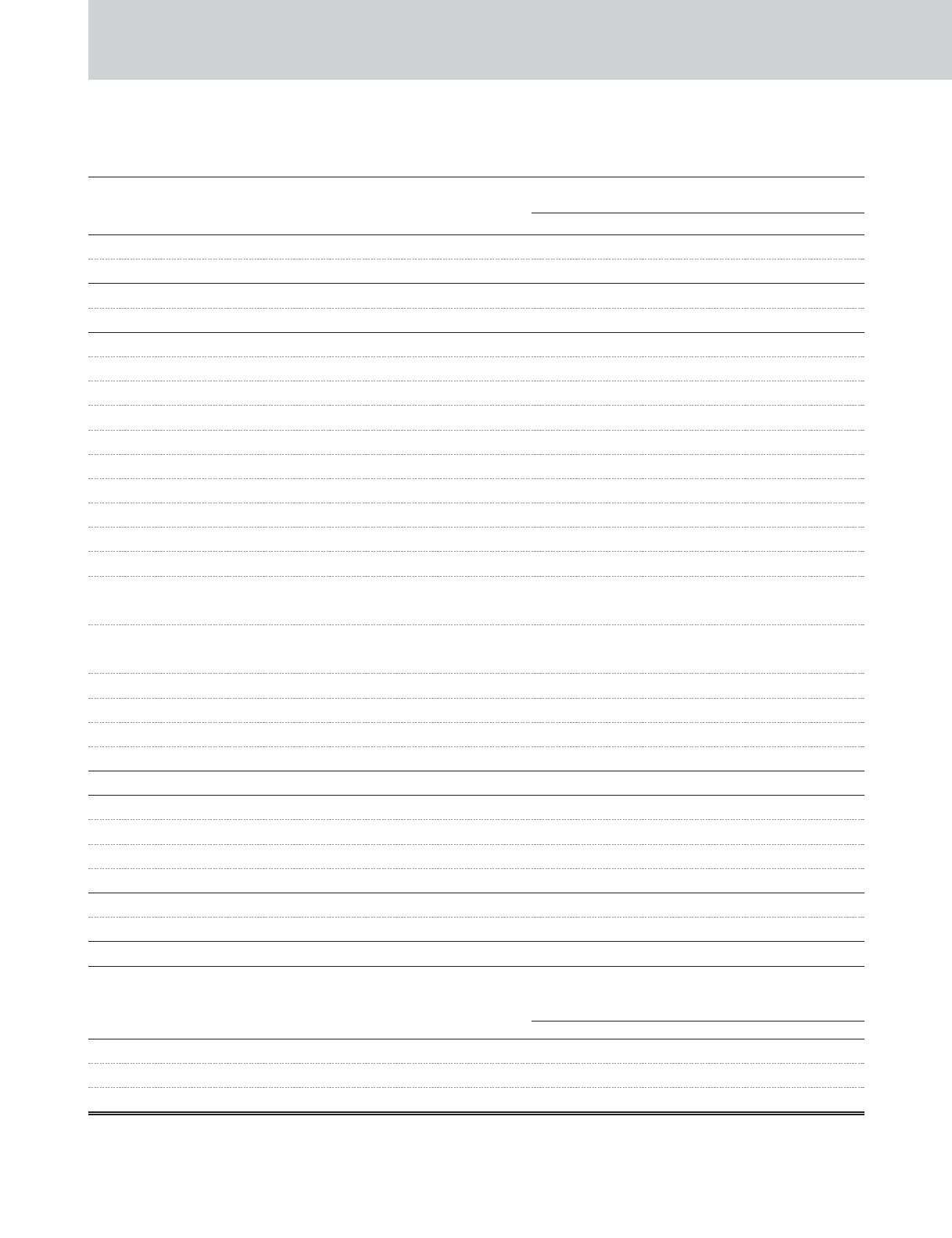

Consolidated Statements of Income

Brother Industries, Ltd. and Consolidated Subsidiaries

Years ended March 31, 2007 and 2006

NET SALES

COST OF SALES (Note 11)

Gross profit

SELLING, GENERAL AND ADMINISTRATIVE EXPENSES (Note 11)

Operating income

OTHER INCOME (EXPENSES):

Interest and dividend income

Interest expense

Sales discount

Gain on sales and disposals of property, plant and equipment, net

Foreign exchange loss

Loss on impairment of long-lived assets (Note 2(8) and 5)

Gain on transfer of the substitutional portion of the governmental pension program (Note 7)

Gain on withdraw al of trusted plan assets in excess (Note 7)

Loss on transfer of part of defined benefit pension plan

to defined contribution pension plan (Note 7)

Cumulative effect of the new ly adopted accounting policy for employee's retirement benefits

in subsidiaries in the United Kingdom and other countries (Note 2(14))

Reversal of bad debt allowance

Gain on transfer of at-home sales business (Note 2(15))

Retirement benefit cost

Other, net

Other expenses, net

INCOME BEFORE INCOME TAXES AND MINORITY INTERESTS

INCOME TAXES (Note 10):

Current

Deferred

Total income taxes

MINORITY INTERESTS IN NET INCOME

NET INCOME

PER SHARE OF COMMON STOCK (Note 14):

Basic net income

Diluted net income

Cash dividends applicable to the year

Thousands of

U.S. Dollars

(Note 1)

200720062007

Millions of Yen

Yen

¥

¥

¥

¥

¥

¥

$

$

$

See notes to consolidated financial statements.

U.S. Dollars