Brother International 2007 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2007 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

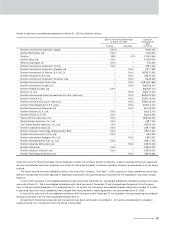

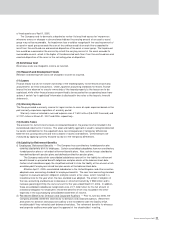

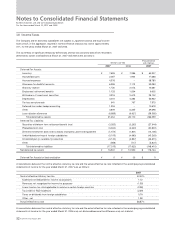

Available-for-sale securities and held-to-maturity securities w hose fair value was not readily determinable as of M arch 31, 2007 and 2006 w ere as

follows:

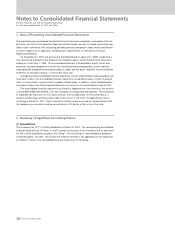

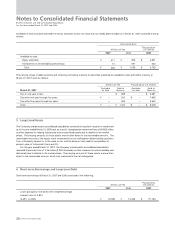

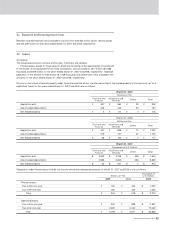

The carrying values of debt securities and others by contractual maturity for securities classified as available-for-sale and held-to-maturity at

March 31, 2007 w ere as follows:

26 Brother Annual Report 2007

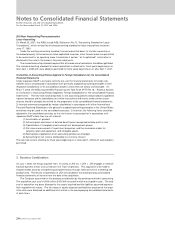

Notes to Consolidated Financial Statements

Brother Industries, Ltd. and Consolidated Subsidiaries

For the Years ended March 31, 2007 and 2006

-

-

-

March 31, 2007

Due in one year or less

Due after one year through five years

Due after five years through ten years

Total

Available

for Sale

Held to

Maturity

Available

for Sale

Held to

Maturity

Millions of Yen Thousands of U.S. Dollars

¥

¥

399

200

425

1,024

$

¥

-

-

-

$

$

3,381

1,695

3,602

8,678

$

$

Available-for-sale:

Equity securities

Investments in limited liability partnerships

Total

Thousands of

U.S. Dollars

Carrying am ount

4,331

432

4,763

$

$

Millions of Yen

505

551

1,056

¥

¥

511

51

562

¥

¥

200720062007

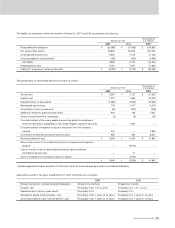

Loans principally from banks with w eighted average

interest rates of 4.80%

(4.35% in 2006)

Thousands of

U.S. Dollars

111,763$

Millions of Yen

13,333¥13,188¥

200720062007

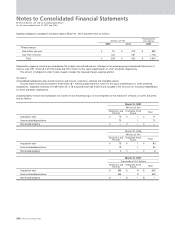

5. Long-Lived Assets

The Company and domestic consolidated subsidiaries review ed its long-term assets for impairment

as of the year ended March 31, 2006 and, as a result, recognized an impairment loss of ¥9,932 million

as other expense for leasing fixed assets and unused fixed assets due to decline in the market

prices. The carrying amounts of these assets were written dow n to the recoverable amounts. The

recoverable amounts of the assets w ere measured at the net selling price determined by quotation

from a third-party vendors or at the value in use, and the discount rate used for computation of

present value of future cash flow s w as 5% .

For the year ended M arch 31, 2007, the Company and domestic consolidated subsidiaries

recorded impairment loss of ¥ 46 million ($ 390 thousand) as other expense for certain building and

idle assets due to decline in the market prices. The carrying amounts of these assets w ere w ritten

dow n to the recoverable amount, w hich was measured at the net selling price.

6. Short-term Borrowings and Long-term Debt

Short-term borrow ings at M arch 31, 2007 and 2006 consisted of the follow ing: