Brother International 2007 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2007 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management's Discussion and Analysis

Brother Industries, Ltd. and Consolidated Subsidiaries

09

Brother Annual Report 2007

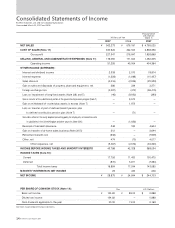

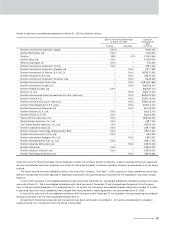

Net Income

Net Income to Sales

Operating Income

Operating Income to Sales

Operating Income

Operating Income to Sales

Fiscal years ended March 31

(¥ billion) (%)

60

50

40

30

20

10

0

9.0

7.5

6.0

4.5

3.0

1.5

0

2006 20072005

33.4

7.6 7.8

45.0

51.3

9.1

Net Income

Net Income to Sales

Fiscal years ended March 31

(¥ billion) (%)

30

25

20

15

10

5

0

6.0

5.0

4.0

3.0

2.0

1.0

0

2006 20072005

20.4

4.7

4.3

24.6

28.9

5.1

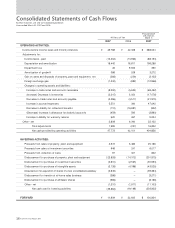

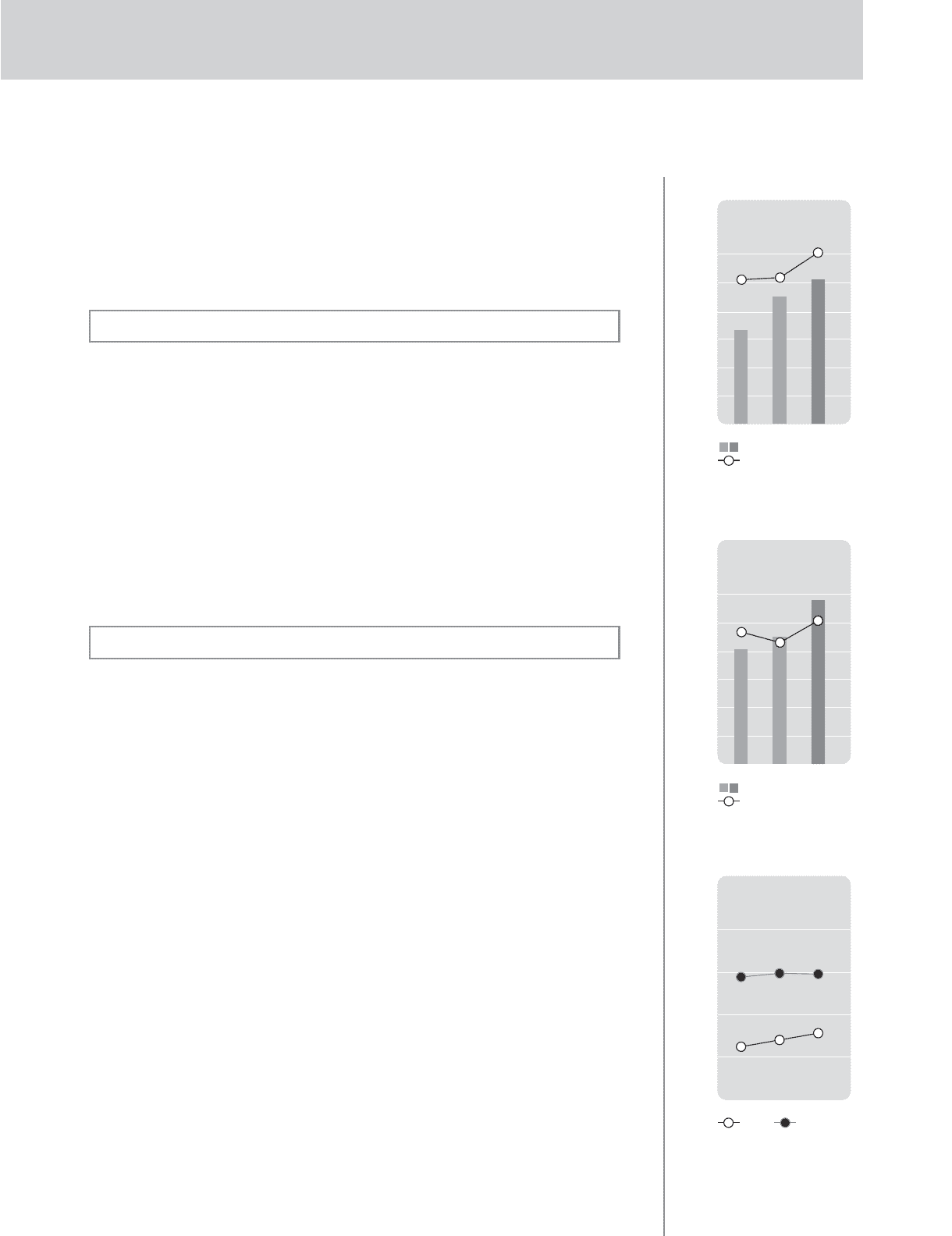

ROA

ROE

Fiscal years ended March 31

(%)

20

15

10

5

02006 20072005

14.9

14.5

*

**

7.1

6.1

ROA ROE

*ROA=Net Income/Average total assetsX100

**ROE=Net Income/Average owner's equity X100

7.7

14.8

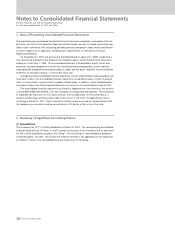

In fiscal 2006, some consolidated subsidiaries changed their fiscal years from the year ending

December 31 to the year ending March 31, the same as the fiscal year of Brother Industries, Ltd.

This change better facilitates the management of global business operations. Since the fiscal 2006

consolidated financial statements include a transitional three-month period for these subsidiaries,

there are no comparisons w ith fiscal 2006 performance in this section.

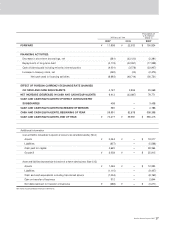

Income Statement Analysis

In fiscal 2007, the U.S. economy began to show signs of w eakening, but economic grow th contin-

ued at a moderate pace in Europe and Asia. In Japan, the economy continued to recover as compa-

nies reported strong earnings.

In this environment, the Brother Group (Brother Industries, Ltd. and its consolidated subsidiaries)

posted strong sales of communications and printing equipment and machine tools in all regions.

Sales also benefited from the w eakness of the yen relative to the U.S. dollar and euro. The result

was consolidated sales of ¥562,273 million.

Operating income w as ¥51,255 million because of higher sales, primarily from communications

and printing equipment, and favorable foreign exchange rates. Ordinary income w as ¥45,479 million.

The higher ordinary income and a decline in income taxes, the result of a charge for the impairment

of fixed assets in fiscal 2007, resulted in net income of ¥28,875 million.

Performance by Business Segment (excluding inter-segment sales)

1) Printing & Solutions (P&S)

Sales of communications and printing equipment totaled ¥353,968 million due to strong sales of

laser and inkjet products, along with supplies, in all regions. For electronic stationery products,

sales of ¥43,662 million reflected solid sales of these products in the Americas and Europe. The

result w as segment sales of ¥397,630 million. Operating income was ¥37,427 million. Selling, general

and administrative expenses, w hich include research and development expenses, were higher,

but this w as offset by grow th in sales of communications and printing equipment and the yen's

depreciation.

2) Personal & Home (P&H)

Brisk sales of domestic sewing machines in the Americas resulted in segment sales of ¥34,224

million. Due to an improvement in profitability because of a better product mix and a contribution from

foreign exchange rates, operating income w as ¥2,465 million.

3) Machinery & Solution (M&S)

Industrial sewing machines sales totaled ¥34,459 million as sales in Asia and Turkey declined.

Machine tools sales totaled ¥28,565 million mainly because of strong sales to customers in Asia.

The result w as segment sales of ¥63,024 million. Operating income w as ¥8,474 million due to the

higher machine tools sales and favorable foreign exchange rates.

4) Others

The acquisition of a karaoke business in the netw ork karaoke and content category resulted in seg-

ment sales of ¥67,395 million. Operating income was ¥2,889 million because of a decline in earn-

ings in the netw ork karaoke and content business.