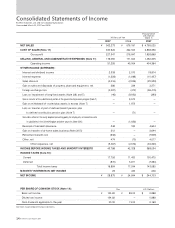

Brother International 2007 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2007 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10 Brother Annual Report 2007

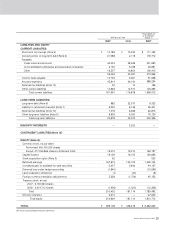

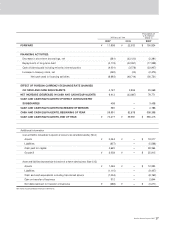

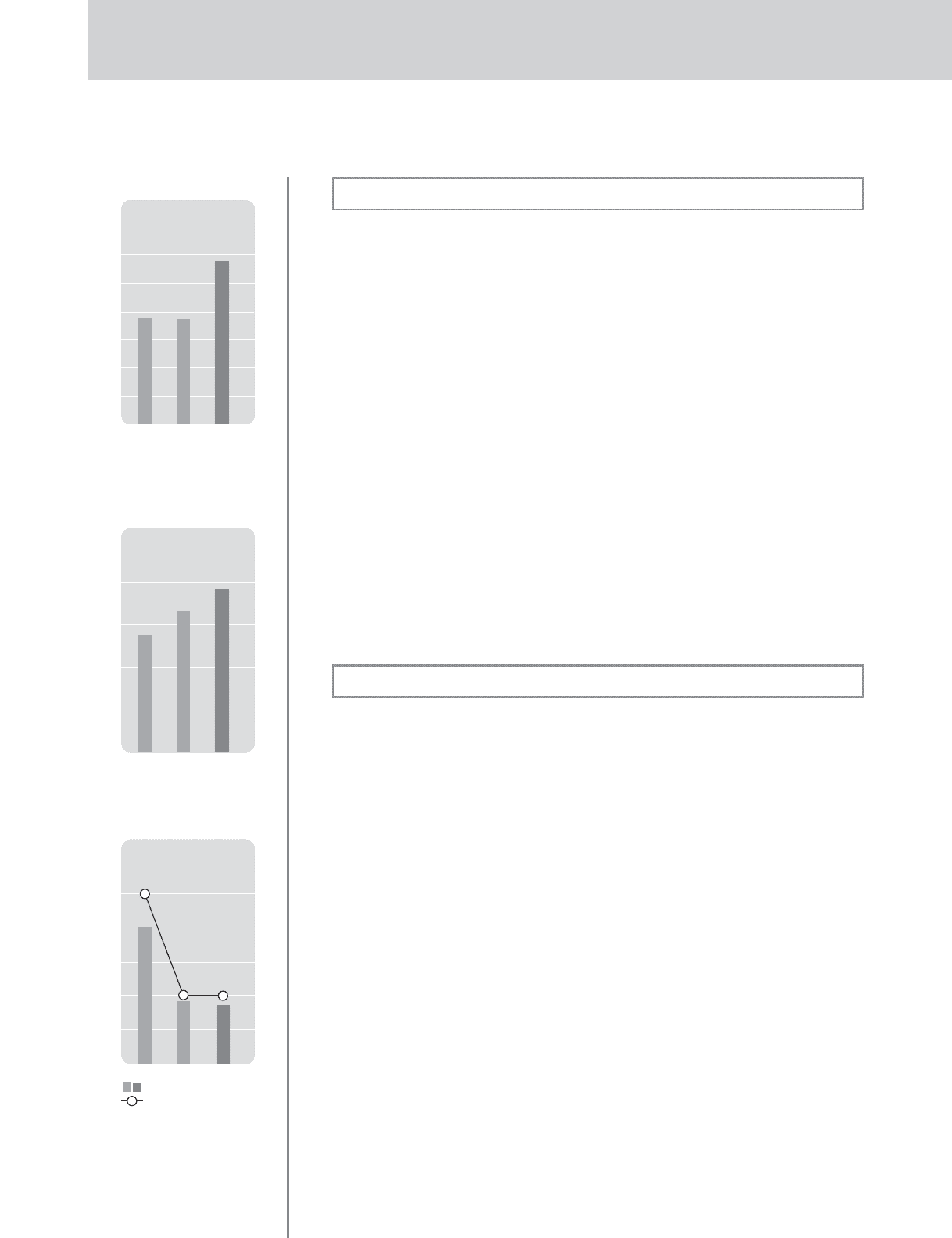

Capital Expenditures

Fiscal years ended March 31

(¥ billion)

30

25

20

15

10

5

02006 20072005

18.8 18.7

29.0

Depreciation &

Amortization

Fiscal years ended March 31

(¥ billion)

20

15

10

5

02006 20072005

14.2

16.8

18.4

Interest-bearing Debt

Debt Equity Ratio

Fiscal years ended March 31

100

80

60

40

20

02006 20072005

37.5

80.7

(¥ billion)

Interest-bearing Debt

Debt Equity Ratio

(%)

0.5

0.4

0.3

0.2

0.1

0

0.5

0.2

0.2

35.3

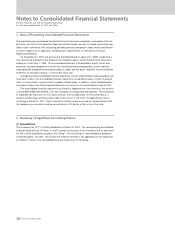

Performance by Area (including inter-segment sales)

1) Japan

Sales in Japan amounted to ¥428,628 million mainly because of strong sales of communications

and printing equipment and machine tools. There w as an increase in selling, general and

administrative expenses, which include research and development expenses. But this w as offset by

the higher sales of communications and printing equipment and machine tools and the w eaker yen,

resulting in operating income of ¥25,295 million.

2) The Americas

Sales totaled ¥188,178 million because of brisk sales of communications and printing equipment

and electronic stationery products. Operating income w as ¥8,206 million, primarily a reflection of

grow th in regional sales, mainly of communications and printing equipment.

3) Europe

Strong sales of communications and printing equipment and electronic stationery products resulted

in sales of ¥174,727 million. Due to grow th in sales, mainly of communications and printing

equipment, operating income w as ¥11,613 million.

4) Asia and Other Areas

Strong sales of communications and printing equipment for sale in Europe w ere mainly responsible

for regional sales of ¥256,311 million. Operating income w as ¥4,461 million primarily because of a

decline in industrial sew ing machines earnings.

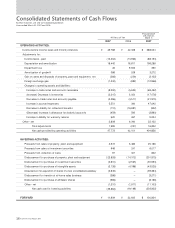

Fund Procurement, Liquidity and Cash Flows

1) Fund Procurement and Liquidity

The Brother Group's main financial policy is to maintain an appropriate level of liquidity and to

ensure a flexible and efficient source of funds for its current and future business activities. Based

on this policy, the group has a cash management system for the efficient use of cash and cash

equivalents at group companies. In addition, credit facilities with several financial institutions have

been established to supplement liquidity. As a result, the Brother Group is able to hold loans to the

absolute minimum by preventing the uneven distribution of liquidity among group companies.

Liquidity is defined as the sum of cash and cash equivalents and the unused portion of credit

facilities. As of M arch 31, 2007, cash and cash equivalents totaled ¥70,377 million and the entire

¥30,000 million of credit facilities with financial institutions w as unused. This resulted in total liquidity

of ¥100,377 million. M anagement believes this provides adequate liquidity for the entire fiscal year

with regard to seasonal fluctuations in the demand for funds, loans that are due w ithin one year

and risks involving the operating environment.

For fund procurement activities, the basic policy is to use short-term loans of not more than

one year that are denominated in local currencies to meet w orking capital requirements. For long-term

funding used to acquire production facilities and other equipment, the basic policy is to use internal

resources along with fixed-rate, long-term loans and bonds. As of M arch 31, 2007, short-term loans

totaled ¥13,188 million, most of w hich are denominated in yen and U.S. dollars. Long-term loans

(including the current portion) totaled ¥5,220 million, most of w hich are fixed-rate loans denominated

in yen. Bonds (including the current portion) totaled ¥16,850 million, all of which are denominated

in yen.

The Brother Group has acquired credit ratings from Rating and Investment Information, Inc. In

June 2007, the long-term debt and issuance rating was raised from A- to A. The commercial paper

rating is a-1. Management believes that it should maintain credit ratings at an adequate level to

ensure access to financial and capital markets.