Brother International 2007 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2007 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

20 Brother Annual Report 2007

Notes to Consolidated Financial Statements

Brother Industries, Ltd. and Consolidated Subsidiaries

For the Years ended March 31, 2007 and 2006

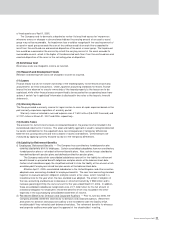

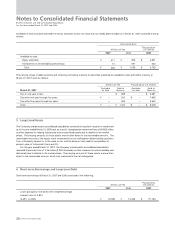

(2) Investments in Unconsolidated Subsidiaries and Associated Companies

Investments in 2 unconsolidated subsidiaries (3 in 2006) and 6 associated companies (6 in 2006)

are accounted for by the equity method.

Investments in the remaining unconsolidated subsidiaries and associated companies are stated

at cost. If these companies had been consolidated or accounted for by the equity method, the

effect on the consolidated financial statements w ould not have been material.

Accordingly, income from the unconsolidated subsidiaries and associated companies is

recognized w hen the Group receives dividends. Unrealized inter-company profits, if any, have not

been eliminated in the consolidated financial statements.

(3) Cash Equivalents

Cash equivalents are short-term investments that are readily convertible into cash and that are

exposed to insignificant risk of changes in value.

Cash equivalents include time deposits, money management funds and securities under

repurchase agreements that represent short-term investments, all of w hich mature or become

due w ithin three months of the date of acquisition.

(4) Inventories

Inventories are stated at the low er of cost or market. Cost is determined by the average method

by the Company and consolidated manufacturing subsidiaries. The consolidated sales subsidiaries

determine cost by using the average method or the first-in, first-out method.

(5) Marketable and Investment Securities

Marketable and investment securities are classified and accounted for, depending on management's

intent, as follows:

i) trading securities, w hich are held for the purpose of earning capital gains in the near term are

reported at fair value, and the related unrealized gains and losses are included in earnings,

ii) held-to-maturity debt securities, which management has the positive intent and ability to hold to

maturity, are reported at amortized cost, and

iii) available-for-sale securities with market values, w hich are not classified as either of the

aforementioned securities, are reported at fair value, w ith unrealized gains and losses, net of

applicable taxes, reported as a separate component of equity. Non-marketable available-for-sale

securities are stated at cost determined by the moving average method.

For other than temporary declines in fair value, marketable and investment securities are reduced

to net realizable value by a charge to income.

(6) Property, Plant and Equipment

Property, plant and equipment are stated at cost. Depreciation is computed primarily by the

declining-balance method at rates based on the estimated useful lives of the assets. The range of

useful lives is principally from 3 to 50 years for buildings and structures, from 4 to 15 years for

machinery and vehicles and from 2 to 20 years for furniture and fixtures.

(7) Land Revaluation

Under the "Law of Land Revaluation", promulgated on M arch 31, 1998 and revised on M arch 31,

1999 and 2001, one of the Company's subsidiaries, Xing Inc., elected a one-time revaluation of its

ow n-use land to a value based on real estate appraisal information as of M arch 31, 2002. The

resulting land revaluation difference represents an unrealized devaluation of land and is stated, net

of income taxes, as a component of equity. There was no effect on the consolidated statements

of income. Continuous readjustment is not permitted unless the land value subsequently declines

significantly such that the amount of the decline in value should be removed from the land revalu-

ation difference account and related deferred tax assets. As at March 31, 2007, the carrying

amount of the land after the above one-time revaluation exceeded the market value by ¥ 0 million

($ 0 thousand).

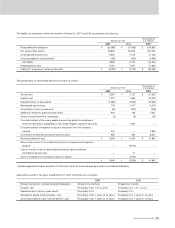

(8) Long-lived Assets

In August 2002, the Business Accounting Council (BAC) issued a Statement of Opinion,

"Accounting for Impairment of Fixed Assets," and in October 2003 the ASBJ issued ASBJ

Guidance No. 6, "Guidance for Accounting Standard for Impairment of Fixed Assets." These new

pronouncements w ere required to be adopted for fiscal years beginning on or after April 1, 2005.

The Company and its domestic subsidiaries adopted the new accounting standard for impairment