Brother International 2007 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2007 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

19

Brother Annual Report 2007

¥ 630,000

¥ 300,000

¥ 1,621,564

¥ 3,500,000

¥ 90,250

US$ 7,034

C$ 11,592

MEX$ 75,260

US$ 14,000

R$ 49,645

CH$ 2,801,966

Stg.£ 26,500

Stg.£ 87,013

Stg.£ 17,400

EURO 25,000

EURO 12,000

EURO 16,000

EURO 3,700

DKr. 32,000

Stg.£ 9,700

Stg.£ 2,500

NT$ 242,000

US$ 7,000

US$ 20,000

US$ 11,630

MR 21,000

A$ 2,500

US$ 9,527

US$ 11,000

US$ 27,000

US$ 20,500

US$ 40,000

US$ 12,482

-

-

0.2%

-

-

-

100.0

100.0

100.0

100.0

100.0

100.0

-

100.0

100.0

100.0

100.0

100.0

100.0

-

-

-

-

-

-

-

-

100.0

-

100.0

-

-

100.0

100.0%

100.0

88.0

100.0

100.0

100.0

-

-

-

-

-

-

100.0

-

-

-

-

-

-

100.0

100.0

100.0

100.0

60.0

100.0

100.0

100.0

-

100.0

-

100.0

100.0

-

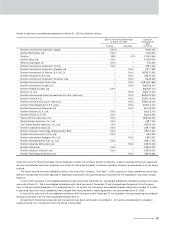

Brother International Corporation (Japan)

Brother Real Estate, Ltd.

Xing Inc.

Brother Sales, Ltd.

Bellezza Club Japan Inc.

Brother International Corporation (U.S.A.)

Brother International Corporation (Canada) Ltd.

Brother International De M exico, S.A. De C.V.

Brother Industries (U.S.A.) Inc.

Brother International Corporation Do Brazil, Ltda.

Brother International De Chile, Ltda.

Brother International Europe Ltd.

Brother Holding (Europe) Ltd.

Brother U.K. Ltd.

Brother Internationale Industriemaschinen G.m.b.H. (Germany)

Brother France S.A.S.

Brother International G.m.b.H. (Germany)

Brother Office Equipment S.P.A. (Italy)

Brother International (Denmark) A/S

Brother Industries (U.K.) Ltd.

Brother Finance (U.K.) Plc

Taiwan Brother Industries, Ltd.

Zhuhai Brother Industries, Co., Ltd.

Xian Typical Brother Industries, Co., Ltd.

Brother Corporation (Asia) Ltd.

Brother Industries Technology (M alaysia) Sdn. Bhd.

Brother International (Aust.) Pty. Ltd.

Brother International Singapore Pte. Ltd.

Brother Sewing M achine Xian Co., Ltd.

Brother Industries (Shenzhen) Ltd.

Brother (China) Ltd.

Brother Industries (Vietnam) Ltd.

Brother Technology (Shenzhen) Ltd.

Capital in

thousands of

local

currency

IndirectlyDirectly

Equity ow nership percentage

at M arch 31, 2007

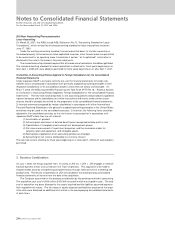

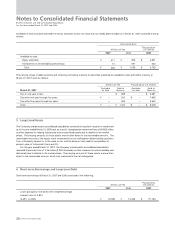

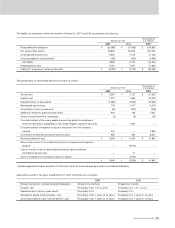

Details of significant consolidated subsidiaries at M arch 31, 2007 are listed as follows:

Under the control or influence concept, those companies in w hich the Company, directly or indirectly, is able to exercise control over operations

are fully consolidated, and those companies over which the Group has the ability to exercise significant influence are accounted for by the equity

method.

The fiscal year-end of certain subsidiaries differs from that of the Company. Prior April 1, 2005, accounts of those subsidiaries w hich have

different fiscal periods have been adjusted for significant transactions that occurred during the period from the subsidiaries' year-ends through

March 31.

In fiscal 2005, Company's consolidated subsidiaries w ith year-end of December 31, excluding 9 subsidiaries, decided to change their fiscal

year-end to M arch 31. The 9 consolidated subsidiaries w ith fiscal year-end of December 31 also changed reporting period to the Company

from for the year ending December 31 to ending M arch 31. As a result, the Company's consolidated financial statements included 15 months

of operating results for those subsidiaries that changed their fiscal year-end or reporting period in the year ended M arch 31, 2006.

In fiscal 2006, accounts of 9 consolidated subsidiaries with fiscal year-end of December 31 are included in the accompanying consolidated

financial statements w ith the reporting period ending M arch 31.

All significant intercompany balances and transactions have been eliminated in consolidation. All material unrealized profit included in

assets resulting from transactions w ithin the Group is eliminated.