Brother International 2007 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2007 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22 Brother Annual Report 2007

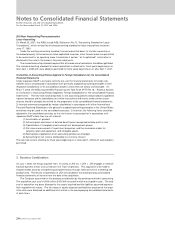

Notes to Consolidated Financial Statements

Brother Industries, Ltd. and Consolidated Subsidiaries

For the Years ended March 31, 2007 and 2006

According to the approval at the Company's annual shareholders' meeting on June 23,

2006, the Company terminated the policy relating to retirement benefits to directors and corporate

auditors. Effective June 23, 2006, the Company ceased the accrual of the retirement benefits

to directors and corporate auditors and reclassified its balance amounting to ¥712 million

($ 6,034 thousand) to other long-term liabilities. Certain domestic companies still have such

policies and provided for retirement allowances to directors and corporate auditors in the same

manner.

(15) Business Combination

In October 2003, BAC issued a Statement of Opinion, "Accounting for Business Combinations",

and on December 27, 2005 ASBJ issued ASBJ Statement No.7, "Accounting Standard for

Business Separations", and ASBJ Guidance No.10, "Guidance for Accounting Standard for

Business Combinations and Business Separations". These new accounting pronouncements

were effective for fiscal years beginning on or after April 1,2006.

The accounting standard for business combinations allows companies to apply the pooling of

interests method of accounting only when certain specific criteria are met such that the business

combinations is essentially regarded as a uniting-of-interests.

For business combinations that do not meet the uniting-of-interests criteria, the business combi-

nation is considered to be an acquisition and the purchase method of accounting is required. This

standard also prescribes the accounting for combinations for entities under common control and

for joint ventures.

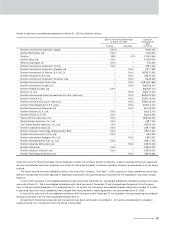

The Group acquired 100% of share of JAX Inc. w hich engaged in netw ork karaoke business

on July 1, 2006 and accounted for it by purchase method of accounting. The related goodw ill is

systematically amortized over 7 years.

The Group transferred 100% of its at-home sales business to Yamano Holdings Corporation

on January 1, 2007. Transferred at-home sales business included related net assets such as

goodw ill, inventories, leasing assets, equipments, deposits, customer / vender business relationships

and shares of the w holly ow ned subsidiary w hich engaged in at-home sales business.

(16) Stock Options

On December 27, 2005, the ASBJ issued ASBJ Statement No.8, "Accounting Standard for Stock

Options" and related guidance. The new standard and guidance are applicable to stock options

new ly granted on and after M ay 1, 2006. This standard requires companies to recognize compen-

sation expense for employee stock options based on the fair value at the date of grant and over

the vesting period as consideration for receiving goods or services. The standard also requires

companies to account for stock options granted to non-employees based on the fair value of

either the stock option or the goods or services received. In the consolidated balance sheet, the

stock option is presented as a stock acquisition right as a separate component of equity until exercised.

The standard covers equity-settled, share-based payment transactions, but does not cover

cash-settled, share-based payment transactions. In addition, the standard allows unlisted companies

to measure options at their intrinsic value if they cannot reliably estimate fair value.

The Company applied the new accounting standard for stock options to those granted on and

after M ay 1, 2006. The effect of adoption of this accounting standard for the year ended M arch

31, 2007 w as to decrease income before income taxes and minority interests by ¥ 62 million

($ 525 thousand).

(17) Presentation of Equity

On December 9, 2005, the ASBJ published a new accounting standard for presentation of equity.

Under this accounting standard, certain items w hich were previously presented as liabilities are

now presented as components of equity. Such items include stock acquisition rights, minority

interests, and any deferred gain or loss on derivatives accounted for under hedge accounting.

This standard is effective for fiscal years ended on or after May 1, 2006. The consolidated balance

sheet as of M arch 31, 2007 is presented in line with this new accounting standard.

(18) Bonuses to Directors and Corporate Auditors

Prior to the fiscal year ended M arch 31, 2005, bonuses to directors and corporate auditors were

accounted for as a reduction of retained earnings in the fiscal year following approval at the general

shareholders meeting. The ASBJ issued ASBJ Practical Issues Task Force (PITF) No.13,

“ Accounting Treatment for Bonuses to Directors and Corporate Auditors,” which encouraged

companies to record bonuses to directors and corporate auditors on the accrual basis with a related

charge to income, but still permitted the direct reduction of such bonuses from retained earnings