Brother International 2007 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2007 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28 Brother Annual Report 2007

Notes to Consolidated Financial Statements

Brother Industries, Ltd. and Consolidated Subsidiaries

For the Years ended March 31, 2007 and 2006

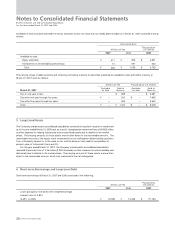

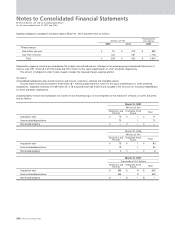

7. Retirement and Pension Plans

The liability for retirement benefits in the accompanying consolidated balance sheets consisted of

retirement allow ances for directors and corporate auditors of ¥243 million ($ 2,060 thousand) and

¥976 million at M arch 31, 2007 and 2006, respectively, and employees' retirement benefits of

¥ 6,299 million ($ 53,381 thousand) and ¥5,170 million at M arch 31, 2007 and 2006, respectively.

Retirement allowances for Directors and Corporate Auditors

Retirement allowances for directors and corporate auditors are paid subject to approval of the

shareholders in accordance w ith the Japanese Corporate Law.

As disclosed in Note 2 (14), the Company ceased to accrue retirement benefits for directors

and corporate auditors. Certain domestic consolidated subsidiaries recorded a liability for their

unfunded retirement allow ance plan covering all of their directors and corporate auditors.

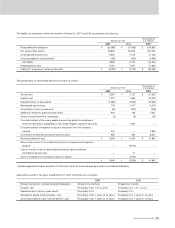

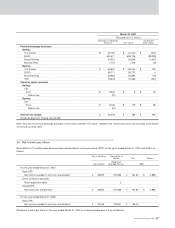

Employees' Retirement Benefits

Under the pension plan, employees terminating their employment are, in most circumstances,

entitled to pension payments based on their average pay during their employment, length of service

and certain other factors.

The Company and certain domestic subsidiaries have tw o types pension plans for employees:

a non-contributory and a contributory funded defined benefit pension plan. The contributory funded

defined benefit pension plan applied by the Company and established under the Japanese

Welfare Pension Insurance Law, covers a substitutional portion of government and a corporate

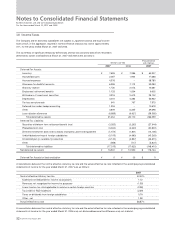

portion established at the discretion of the Company. In accordance w ith the Defined Benefit

Pension Plan Law enacted in April 2002, the Company applied for an exemption from obligation to

pay benefits for future employee services related to the substitutional portion w hich w ould result

in the transfer of the pension obligations upon the government's approval. The Company

obtained approval for exemption from the future obligation by the Ministry of Health, Labor and

Welfare on October 1, 2004. In fiscal 2005, the Company applied for transfer of the substitutional

portion of past pension obligations to the government and obtained approval by the Ministry of

Health, Labor and Welfare on September 30, 2005. Based on the approval at September 30,

2005, the Company recognized a gain on transfer of the substitutional portion of the governmental

pension program in the amount of ¥9,572 million for the year ended M arch 31, 2006.

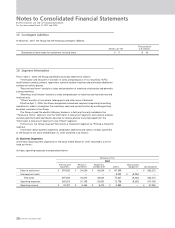

The Company and certain domestic subsidiaries implemented a defined contribution pension

plan in fiscal 2005 by w hich a part of the former contributory and non-contributory defined benefit

pension plan was terminated. The Company and certain domestic subsidiaries applied accounting

treatments specified in the guidance issued by the Accounting Standard Board of Japan. The

effect of this transfer w as to decrease income before income taxes and minority interests by ¥71

million and was recorded as other expenses in the statement of income for the year ended M arch

31, 2006.

The Company has contributed its investment equity securities to the employee benefit trust

for the Company's contributory defined benefit pension plan. In February 2006, the Company

withdrew the part of the trust assets because the fund status has been in excess of assets. The

effect of this w ithdraw al w as to increase income before income taxes and minority interests by

¥1,973 million and was recorded as other income in the statement of income for the year ended

March 31, 2006.

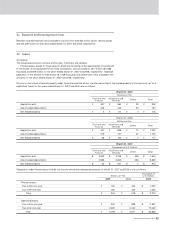

In fiscal 2006, one of the domestic consolidated subsidiary, Xing Inc, w hich had been applying

the simplified method above mentioned Note 2 (14), changed to measure its retirement benefits

from the simplified method to actuarial calculation due to increase of employee headcount. The

effect of this change w as to decrease income before income taxes and minority interests by ¥213

million ($ 1,805 thousand) and was recorded as other expense in the statement of income for the

year ended M arch 31, 2007.