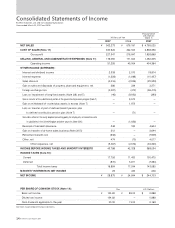

Brother International 2007 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2007 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

11

Brother Annual Report 2007

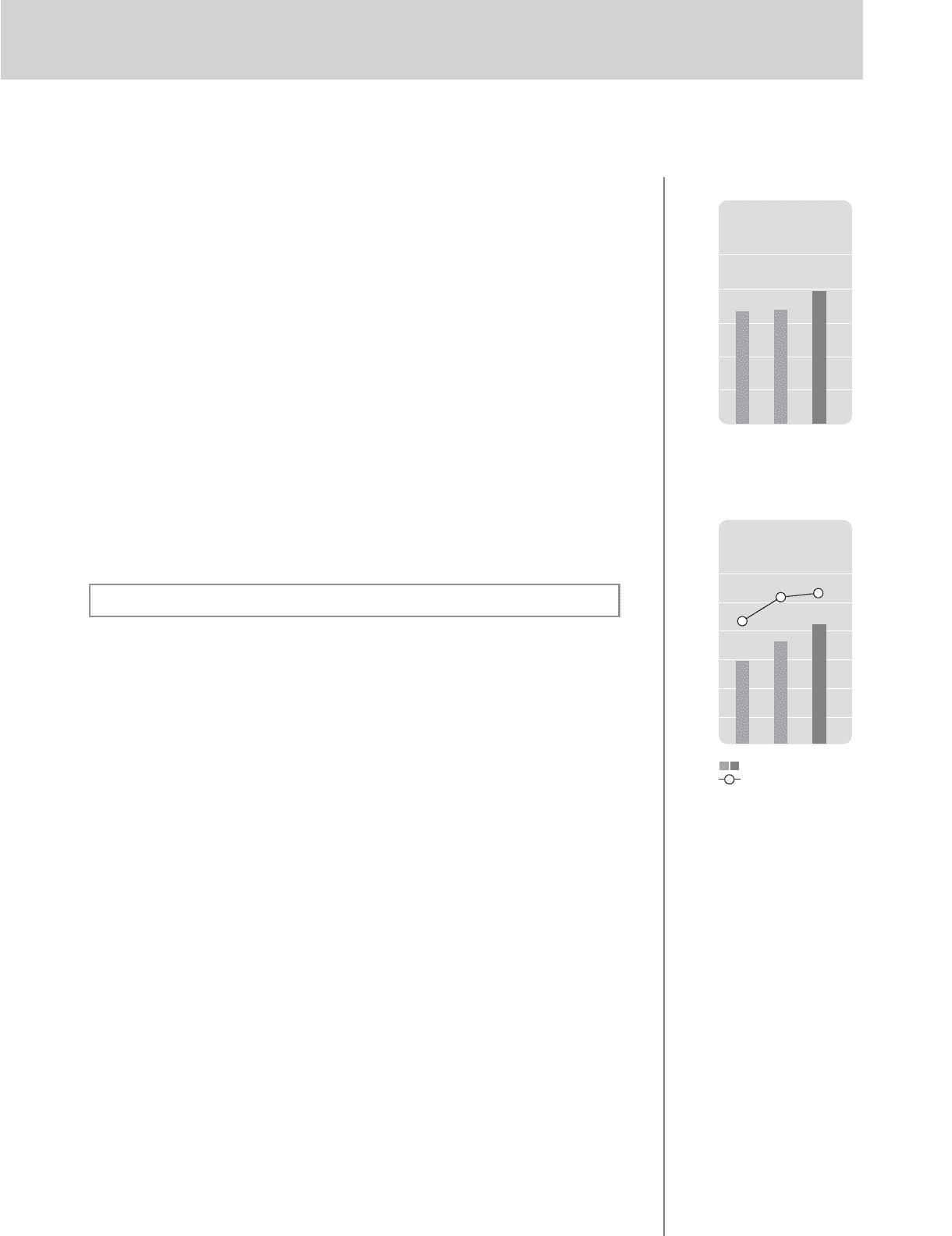

Total Assets

Fiscal years ended March 31

(¥ billion)

500

400

300

200

100

02006 20072005

343.8 348.2

399.1

Owners' Equity

Owners' Equity Ratio

Fiscal years ended March 31

(¥ billion)

300

250

200

150

100

50

02006 20072005

149.9

181.1

210.4

52.7

52.0

Owners' Equity

Owners' Equity Ratio

(%)

60

50

40

30

20

10

0

43.6

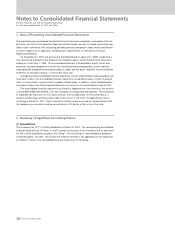

The Brother Group believes that its operating cash flow s, internal liquidity, including credit

facilities, and sound balance sheet can provide the necessary funds for w orking capital, capital

expenditures and R&D activities in order to sustain the group's grow th.

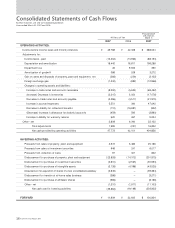

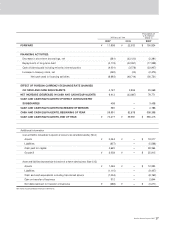

2) Cash Flow

Cash Flow from Operating Activities

Net cash provided by operating activities w as ¥47,773 million. Income before income taxes and

minority interests w as ¥45,788 million and depreciation and amortization w as ¥18,442 million. M ain

uses of cash were a ¥8,200 million increase in trade notes and accounts receivable, a ¥2,586 million

decrease in trade notes and accounts payable and income taxes paid of ¥10,402 million.

Cash Flow from Investing Activities

Net cash used in investing activities w as ¥35,864 million. This w as mainly attributable to payments

of ¥23,826 million for the purchase of property, plant and equipment, ¥5,136 million for the purchase

in intangible assets, and payments of ¥4,645 million for the purchase of stock in affiliated companies

due to a change in the scope of consolidation.

Cash Flow from Financing Activities

Net cash used in financing activities was ¥6,693 million. This includes debt repayments of ¥2,400

million for short-term and long-term loans and bonds and dividend payments of ¥3,870 million.

Outlook for Fiscal 2008

In the fiscal year ending in M arch 2008, the outlook for the U.S. economy is becoming increasingly

uncertain and economic grow th is expected to slow in Europe and Asia. In Japan, a slow pace of

grow th in the corporate sector is foreseen despite the outlook for healthy consumer spending.

The Brother Group expects higher sales in fiscal 2008 because of a continuation in strong sales

of communications and printing equipment. How ever, the group is forecasting declines in operat-

ing income and ordinary income. Substantial research and development expenses in the printing

business and new businesses aimed at supporting future grow th and higher depreciation expenses

resulting from grow th in capital expenditures are expected to hold dow n earnings. The Brother

Group is also forecasting low er net income as the application of tax-effect accounting results in

higher income taxes.

This outlook is based on yen exchange rates of ¥115 to the U.S. dollar and ¥150 to the euro.