Airtran 2008 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2008 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

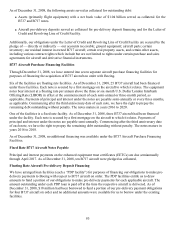

Note 9 – Income Taxes

We are subject to taxation in the United States and various state jurisdictions. Our tax years for 1997 through

2008 are subject to examination by the Internal Revenue Service. The total amount of unrecognized tax benefits

and related penalties and interest was not material as of December 31, 2008 or 2007. We do not anticipate any

material change in the total amount of unrecognized tax benefits to occur within the next twelve months.

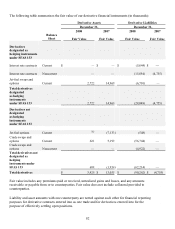

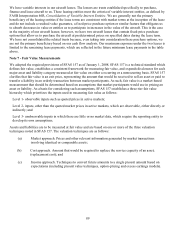

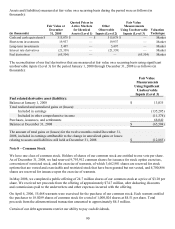

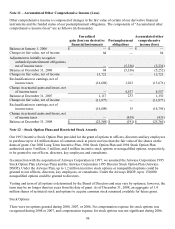

The components of the provision (benefit) for income taxes are as follows (in thousands):

Year ended December 31,

2008 2007 2006

Current provision (benefit):

Federal $ (198) $ 205 $

—

State

—

—

—

Total current provision (benefit) (198) 205

—

Deferred provision (benefit):

Federal (14,938) 31,771 9,805

State (2,927) 2,693 138

Total deferred provision (benefit) (17,865) 34,464 9,943

Income tax expense (benefit) $ (18,063) $ 34,669 $ 9,943

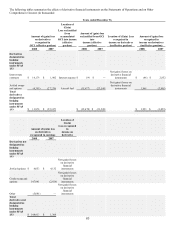

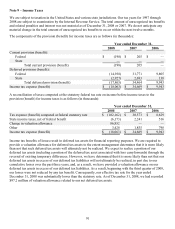

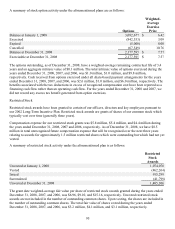

A reconciliation of taxes computed at the statutory federal tax rate on income before income taxes to the

provision (benefit) for income taxes is as follows (in thousands):

Year ended December 31,

2008 2007 2006

Tax expense (benefit) computed at federal statutory rate $ (102,162) $ 30,573 $ 8,629

State income taxes, net of federal benefit (6,173) 2,241 516

Change in valuation allowance 86,852

—

—

Other 3,420 1,855 798

Income tax expense (benefit) $ (18,063) $ 34,669 $ 9,943

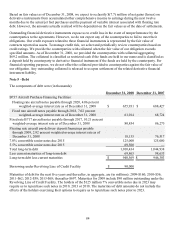

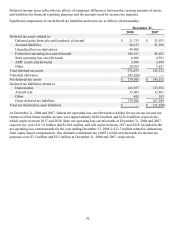

Income tax benefits of losses result in deferred tax assets for financial reporting purposes. We are required to

provide a valuation allowance for deferred tax assets to the extent management determines that it is more likely

than not that such deferred tax assets will ultimately not be realized. We expect to realize a portion of our

deferred tax assets (including a portion of the deferred tax asset associated with loss carryforwards) through the

reversal of existing temporary differences. However, we have determined that it is more likely than not that our

deferred tax assets in excess of our deferred tax liabilities will not ultimately be realized, in part due to our

cumulative losses over the past three years, and, as a result, we have provided a valuation allowance on our

deferred tax assets in excess of our deferred tax liabilities. As a result, beginning with the third quarter of 2008,

our losses were not reduced by any tax benefit. Consequently, our effective tax rate for the year ended

December 31, 2008 was substantially lower than the statutory rate. As of December 31, 2008, we had recorded

$97.2 million of valuation allowance related to our net deferred tax assets.

91