Airtran 2008 Annual Report Download - page 56

Download and view the complete annual report

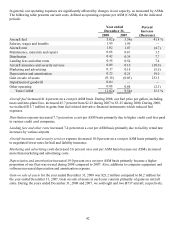

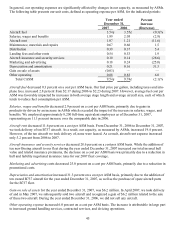

Please find page 56 of the 2008 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Financing activities used $40.6 million of cash during 2008 compared to using cash of $51.5 million in 2007.

During 2008, we received cash from the issuance of debt financing for aircraft pre-delivery deposits of $32.7

million and repaid $91.1 million of pre-delivery deposit debt financing. During 2008, we repaid $229.4 million

of aircraft purchase debt financing. Also, during 2008, we borrowed $178.6 million in non-cash transactions to

finance the purchase of six B737 aircraft. During 2007, we received cash from the issuance of debt financing for

aircraft pre-delivery deposits of $67.7 million and repaid $61.4 million of pre-delivery deposit debt financing.

During 2007, we repaid $53.7 million of aircraft purchase debt financing. Also, during 2007, we borrowed

$293.7 million in non-cash transactions to finance the purchase of ten B737 aircraft. See ITEM 8.

“FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA, Note 5 – “Debt” for additional information

regarding our outstanding debt.

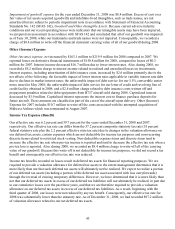

During the second quarter 2008, we completed two additional financings. The proceeds were used to improve

our overall liquidity and for general corporate purposes. On April 30, 2008, we completed a public offering of

$74.8 million in convertible senior notes due in 2015. Such notes bear interest at 5.5% payable semi-annually,

in arrears, on April 15 and October 15. The 5.5% notes are senior unsecured obligations of Holdings and rank

equally with all existing and future senior unsecured obligations of Holdings. We placed approximately $12.2

million of the proceeds of the offering in an escrow account with the trustee. Funds in the escrow account are

invested in government securities and are being used to make the first six scheduled semi-annual interest

payments on the notes, and these payments are secured by a pledge of the assets in escrow. On May 1, 2008, we

completed a public offering of 24.7 million shares of our common stock at a price of $3.20 per share, receiving

net proceeds of approximately $74.7 million, after deducting discounts and commissions paid to the

underwriters and other expenses incurred with the offering.

In August 2008, we entered into an amendment to our agreement with a co-branded credit card issuer to sell a

specified number of pre-award frequent flyer credits. In 2008, we received $20 million related to an early

purchase of frequent flyer credits.

During 2008 and 2007, we received $3.9 million and $2.4 million, respectively, from the issuance of common

stock related to the exercise of options and the employee stock purchase plan.

Year 2009 Cash Requirements and Potential Sources of Liquidity

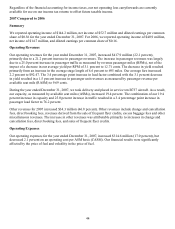

Our 2009 cash flows will be impacted by a variety of factors including our operating results, scheduled debt

maturities, and capital expenditure requirements. In addition, we may need cash resources to fund increases in

collateral provided to counterparties to our derivative financial instrument arrangements and our cash flows may

be adversely impacted in the event that one or more credit card processors withholds amounts that would

otherwise be remitted to us.

During 2009, we will need cash for capital expenditures and debt maturities. We anticipate that during 2009:

expenditures for acquisition of property and equipment other than aircraft and aircraft parts will be

approximately $10 million to $15 million. Payments of current maturities of existing debt and capital lease

obligations will aggregate $160.7 million in 2009, including $90 million previously borrowed under the

Revolving Line of Credit Facility.

Our 2009 aircraft purchase commitments aggregate $135.0 million, including our obligation to make pre-

delivery deposit payments to Boeing. No additional pre-delivery deposits are due for the 2009 scheduled

deliveries. Although we typically have financed a significant portion of our pre-delivery deposit requirements

with debt from financial institutions, we currently have no such financing in place for our deliveries in 2011 and

beyond and we have no assurance that, given the current status of the financial markets, satisfactory financing

will be available to us when we are obligated to make pre-delivery deposit payments of $16.2 million in

2009. We have four B737 aircraft scheduled for delivery in 2009, two of which we have agreed to sell to a

foreign air carrier to whom we previously sold two B737 aircraft in 2008. We have received deposits of $5.0

48