Airtran 2008 Annual Report Download - page 57

Download and view the complete annual report

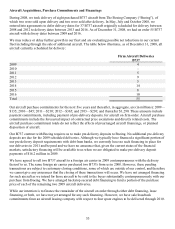

Please find page 57 of the 2008 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.million from the foreign carrier. However, these pending sales are subject to customary closing conditions,

some of which are outside of our control, and therefore we cannot give assurances that the closing of these

transactions will occur. We have not arranged permanent financing for such aircraft because we intend for those

aircraft to be sold to the buyer substantially contemporaneously with our purchase from Boeing. However, we

have arranged backstop secured debt financing to fund a portion of the purchase price of each of the other two

B737 aircraft deliveries scheduled for 2009.

We may need cash resources to fund increases in collateral provided to counterparties to our derivative financial

arrangements and our cash flows may be adversely impacted in the event that one or more credit card

processors withholds amounts that would otherwise be remitted to us. We provide counterparties to our

derivative financial instrument arrangements with collateral when the fair value of our obligation exceeds

specified amounts. Our obligation to provide collateral pursuant to fuel related derivative financial instrument

arrangements tends to be inversely related to fuel prices; consequently, to the extent fuel prices decrease we will

experience lower fuel expense and higher collateral requirements. Because we hedge significantly less than 100

percent of our fuel requirements, over time a sustained decrease in fuel prices tends to produce a net cash

benefit even though a significant decrease in fuel prices tends to cause a net use of cash in the period when

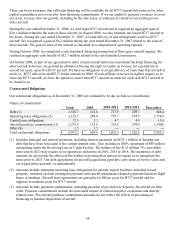

prices decrease. As of December 31, 2008 and February 2, 2009, we provided counterparties with collateral

aggregating $69.2 million and $32.2 million, respectively.

Each of our agreements with our credit card processors allows, under specified conditions, the processor to

retain cash related to future travel that such processor otherwise would remit to us (i.e., a “holdback”). As of

December 31, 2008, we were in compliance with our processing agreements and each of our two largest

processors was entitled to withhold amounts that would otherwise be remitted to us. The largest processor was

holding back no remittances because we had obtained a letter of credit for the benefit of the processor. In the

event that, among other things, our aggregate unrestricted cash and investments (as defined) falls below agreed

upon levels, or a processor reasonably determines that there has been a material adverse occurrence or certain

other events occur, the processor would be entitled to withhold additional cash remittances from us; our

potential cash exposure to additional holdbacks by our largest two credit card processors based on advanced

ticket sales as of December 31, 2008, after considering the $125 million letter of credit issued in favor of our

largest credit card processor, was up to a maximum of $84.0 million.

We believe we have options available to meet our debt repayments, capital expenditures and operating

commitments which may include internally generated funds and various financing or leasing options, including

the sale, lease, or sublease of our aircraft. Additionally, we have arranged for a $90 million Revolving Line of

Credit Facility, under which $90 million and $0 was outstanding as of December 31, 2008 and February 2,

2009, respectively. However, our owned aircraft and our pre-delivery deposits are pledged as collateral for

outstanding debt, and we have pledged—directly or indirectly—a variety of our assets to collateralize our

obligations under our Letter of Credit and Revolving Line of Credit Facility. The counterparty to the Revolving

Line of Credit Facility has agreed to release its lien on certain of the collateral securing that Facility for certain

purposes, which may include securing a new financing.

We believe that our existing liquidity and projected 2009 cash flows will be sufficient to fund our operations

and other financial obligations through December 2009. While we believe our 2009 plan is reasonable, a

combination of one or more material and significant adverse events, most of which are outside of our direct

control, could, depending on severity and duration, have an unfavorable impact on our ability to generate

sufficient cash from operations to maintain adequate liquidity through December 31, 2009. Such adverse events

could include: significant increases in fuel prices for an extended period of time; significant sustained declines

in unit revenues as a consequence of unfavorable macroeconomic or other conditions; or, the increase in the

percentage of advance ticket sales that are being held back by our credit card processors. If one or more of such

events were to occur, we would likely undertake a variety of actions to mitigate the impact of such events

including seeking to obtain additional secured debt, unsecured debt or equity financing. However, our current

49