Airtran 2008 Annual Report Download - page 93

Download and view the complete annual report

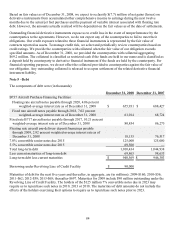

Please find page 93 of the 2008 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.As of December 31, 2008, the following assets served as collateral for outstanding debt:

• Assets (primarily flight equipment) with a net book value of $1.04 billion served as collateral for the

B737 and B717 notes.

• Aircraft pre-delivery deposits served as collateral for pre-delivery deposit financing and for the Letter o

f

Credit and Revolving Line of Credit Facility.

Additionally, our obligations under the Letter of Credit and Revolving Line of Credit Facility are secured by the

pledge of — directly or indirectly — our accounts receivable; ground equipment; aircraft parts; certain

inventory; our residual interest in owned B717 aircraft; certain real property assets, and certain other assets,

including various contract rights which include but are not limited to rights under certain purchase and sales

agreements for aircraft and derivative financial instruments.

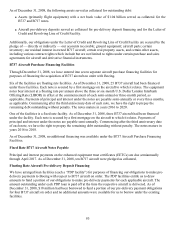

B737 Aircraft Purchase Financing Facilities

Through December 31, 2008, we have entered into seven separate aircraft purchase financing facilities for

purposes of financing the acquisition of B737 aircraft on order with Boeing.

Six of the facilities are floating rate facilities. As of December 31, 2008, 25 B737 aircraft had been financed

under these facilities. Each note is secured by a first mortgage on the aircraft to which it relates. The equipment

notes bear interest at a floating rate per annum above the three or six-month U.S. Dollar London Interbank

Offering Rate (LIBOR) in effect at the commencement of each semi-annual or three-month period, as

applicable. Payments of principal and interest under the notes are payable semi-annually or every three months,

as applicable. Commencing after the third anniversary date of each note, we have the right to prepay the

remaining debt outstanding without penalty. The notes mature in years 2016 to 2020.

One of the facilities is a fixed rate facility. As of December 31, 2008, three B737 aircraft had been financed

under the facility. Each note is secured by a first mortgage on the aircraft to which it relates. Payments of

principal and interest under the notes are payable semi-annually. Commencing after the third anniversary date

of each note, we have the right to prepay the remaining debt outstanding without penalty. The notes mature in

years 2016 to 2018.

As of December 31, 2008, no additional financing was available under the B737 Aircraft Purchase Financing

Facilities.

Fixed Rate B717 Aircraft Notes Payable

Principal and interest payments on the enhanced equipment trust certificates (EETCs) are due semiannually

through April 2017. As of December 31, 2008, ten B717 aircraft were pledged as collateral.

Floating Rate Aircraft Pre-delivery Deposit Financing

We have arranged loan facilities (each a “PDP facility”) for purposes of financing our obligations to make pre-

delivery payments to Boeing with respect to B737 aircraft on order. The PDP facilities entitle us to draw

amounts to fund a portion of our obligations to make pre-delivery payments for each applicable aircraft. The

amount outstanding under each PDP loan is paid off at the time the respective aircraft is delivered. As of

December 31, 2008, $18 million had been borrowed to fund a portion of our pre-delivery payment obligations

for four B737 aircraft on order and no additional amounts were available for us to borrow under the existing

facilities.

85