Airtran 2008 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2008 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

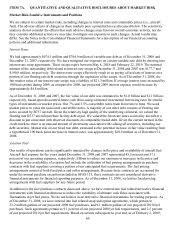

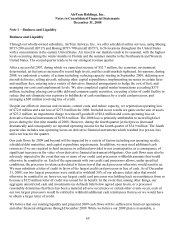

we have entered into fuel related swap and option agreements, which has increased our gallons under contract to

116.0 million gallons of our projected 2009 fuel purchases, and 17.3 million gallons of our projected 2010 fuel

purchases. Such agreements pertain to 32.5 percent of our projected 2009 jet fuel requirements, and 4.9 percent

of our projected 2010 jet fuel requirements. Under jet fuel swap arrangements, we pay a fixed rate per gallon

and receive the monthly average price of Gulf Coast jet fuel. The fuel related option arrangements include

collars, purchased call options, and sold call options. Depending on market conditions at the time a derivative

contract is entered into, we generally use jet fuel, heating oil, or crude oil as the underlying commodity. Since

September 30, 2008, we have revised the composition of our portfolio of fuel related derivative financial

instruments in part to reduce our obligation to provide collateral to counterparties in the event of a decrease in

the price of the underlying commodity. More specifically, as of February 2, 2009, our portfolio contained

relatively fewer collars and relatively more purchased calls.

For every dollar increase per barrel in crude oil or refining costs, our fuel expense (including taxes and into-

plane fees) for 2009, before the impact of our derivative financial instruments, would increase approximately

$9.0 million based on projected operations.

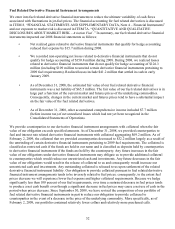

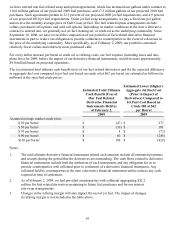

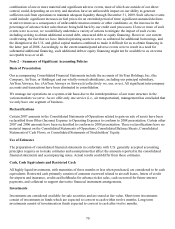

The (a) estimated total ultimate cash benefit (use) of our fuel related derivatives and (b) the expected difference

in aggregate fuel cost compared to jet fuel cost based on crude oil at $62 per barrel are estimated as follows (in

millions) at the specified crude prices:

Estimated Total Ultimate

Cash Benefit (Use) of

Our Fuel Related

Derivative Financial

Instruments Held as

of February 2,

Estimated Lower (Higher)

Aggregate Jet Fuel Cost

(Prior to Impact of

Derivatives) Compared to

Jet Fuel Cost Based on

Crude Oil at $62

per Barrel

2009 2009

Assumed average market crude price:

$ 30 per barrel $ (47) $ 275

$ 50 per barrel $ (30) $ 101

$ 70 per barrel $ 8 $ (72)

$ 90 per barrel $ 60 $ (246)

$110 per barrel $ 106 $ (420)

Notes:

1. The total ultimate derivative financial instrument related cash amounts include all estimated payments

and receipts during the period that the derivatives are outstanding. The cash flows related to derivative

financial instruments include both the settlement of such instruments and any obligation for us to

provide counterparties with collateral prior to settlement of a derivative financial instrument. Any

collateral held by counterparties at the time a derivative financial instrument settles reduces any cash

required at time of settlement.

2. As of February 2, 2009, we had provided counterparties with collateral aggregating $32.2

million for fuel related derivatives pertaining to future fuel purchases and for our interest

rate swap arrangements.

3. Changes in the refining margin will also impact the cost of jet fuel. The impact of changes

in refining margin is not included in the table above.

61